Written by: David Lebovitz

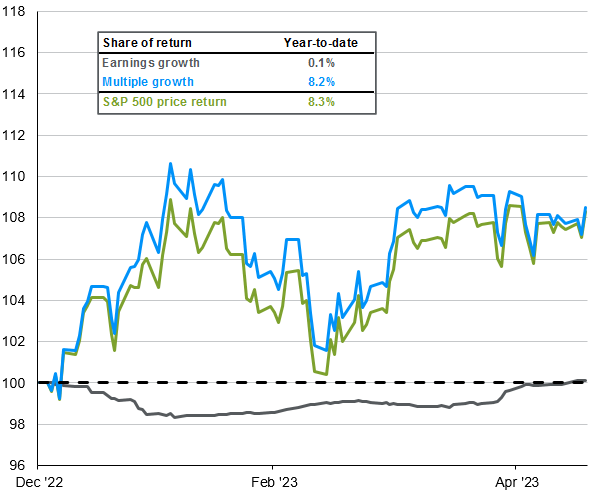

The S&P 500 is up nearly 10% in 2023, as a combination of better-than-expected economic data and earnings reports have coincided with declining interest rates and dovish expectations about the path ahead for monetary policy. As we wrote in our 1Q earnings bulletin, the market’s perception of the path for Federal Reserve (Fed) policy seems a bit misguided, although perhaps the declining probability of a July cut is the first step in a more realistic direction. Regardless, we continue to anticipate a more volatile equity market during the summer months, as market leadership has been extremely narrow and multiple expansion has accounted for the entirety of the S&P 500’s year-to-date return.

Starting with the narrow nature of market leadership, the top 10 names in the S&P 500 have accounted for nearly all the index’s year-to-date return, and the equal-weighted benchmark has meaningfully underperformed the market cap-weighted one. Furthermore, this return has purely been a function of multiple expansion. Given the weight of technology stocks in the index, it is informative to look at how the valuation of that sector has changed: multiples expanded from 20.2x at the start of the year to 24.9x – a +20% increase – while over this same period, the 10 year U.S. Treasury yield fell from 3.88% to 3.50%. This is a story of lower rates and higher valuations.

However, many continue to suggest that earnings are the reason why markets have been so resilient; while we acknowledge that corporate profits have been better than expected – as evidenced by a 5% earnings surprise – S&P 500 operating earnings declined year-over-year in 1Q23. Moreover, the full year 2023 estimate is down nearly 8% from the start of the year but is still tracking positive growth, while 2024 estimates are calling for earnings to rise by nearly 12%. All of this seems a bit aggressive given the focus on slower economic growth and rising recession risk; these estimates make it seem like the market will get its cake and eat it too.

This combination of lower rates, higher equity valuations, and declining earnings – with a potential recession on the horizon – leaves us cautious on the equity market at current levels. If rates really do fall further in the second half of 2023 (i.e. the market is right on Fed pricing) it will be because the recession hit sooner and is deeper than expected, which will not be good for risk assets and these gains will be given back. If the Fed doesn’t cut, that means that mega cap tech valuations – and therefore the valuation of the market – need to come back down to Earth. As a result, we continue to take a defensive approach in equities characterized by a focus on quality and cash flow.

Returns this year have been driven by valuations

Percent change in S&P 500, earnings and valuations, YTD, indexed to 100

Source: Standard & Poor's, FactSet J.P. Morgan Asset Management. Multiple and earnings growth are the year-over-year percent changes in next twelve month estimates.