Written by: Steven Vannelli, CFA | Knowledge Leaders Capital

This the name of a recent research piece from the San Francisco Federal Reserve written by Adam Shapiro. The paper attempts to separate supply and demand factors to evaluate which is causing the elevated rate of inflation.

The paper concludes that supply factors are responsible for more than half of the current elevated level of the PCE deflator. It reflects supply constraints due to labor shortages, supply chain disruptions, the pandemic, and war in Ukraine.

Supply-related issues are contributing 2.5% more than the pre-pandemic average, while demand drive factors are 1.4% higher than the pre-pandemic average. So, supply-driven inflation explains a bit more than half of the 4.8% gap between the current level of the PCE deflator and its pre-pandemic average.

Looking at recent monthly PCE deflator measures, we can see how supply and demand factors have contributed to elevated inflation.

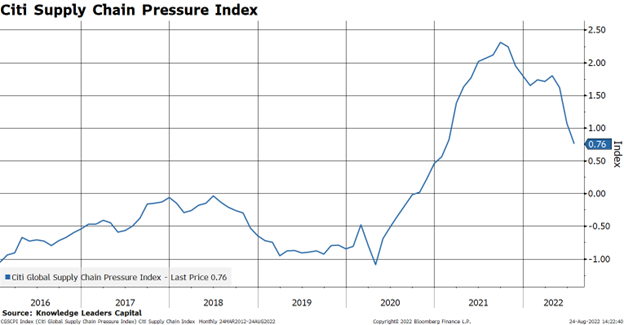

Fortunately, it appears that supply-related factors are improving. For this we look to two indicators of supply chain pressures, one from the New York Fed and one from Citigroup. They both paint the same picture of supply chain pressures easing.

As Fed Chair Powell stated in a recent interview, “What [the Fed] can control is demand, we can’t really affect supply with our policies…so the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.”

Does Chairman Powell acknowledge this supply-side improvement in his speech on Friday? It surely would be an incomplete assessment of inflation not to take research like this into consideration. The Fed can obviously impact demand, but the data suggests on balance, demand isn’t the main issue.

Related: Is the Japanese Yen’s Decline Over?