Here’s what I’m thinking…

1. Investing in companies that solve “little things” can make you the most money.

This weekend, I got invisible braces to straighten my teeth.

I had metal braces as a kid. Painful. The orthodontist would grip his pliers, clamp down on the metal wire cemented to my teeth, and crank.

Then I failed to wear my retainer, and my teeth moved back. Oops.

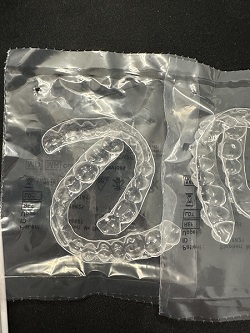

My new invisible braces are a technological marvel. The orthodontist scanned my mouth with a high-tech camera, then gave me 10 sets of plastic retainers like this:

I put a new pair on every two weeks… upload a few pictures through an app on my iPhone so he can check my progress… and that’s it.

No appointments. No metal in my mouth. No slurping soup because I can’t chew with the pain.

It may seem like a little thing… but this is why I’m an optimist and invest like one.

We can piggyback on the entrepreneurs making the world better with technology.

Align (ALGN) created invisible braces about 20 years ago, and its stock took off like a rocket—surging 5,000%+.

But the opportunity in Align has come and gone. My dentist confirmed Align no longer makes the best retainers.

This comes back to the lifecycle of disruptive businesses. Eventually, all ground-breaking technologies become easy to replicate. That’s why we buy companies in the early and profitable stages of their megatrends, which often last 10 years or so.

From the time of its IPO in 2001 until 2021, ALGN surged 5,573%. Wow!

2. The biggest winner of the UAW strike is…

The United Auto Workers (UAW) union—which bargains on behalf of autoworkers—began striking at Ford (F), General Motors (GM), and Stellantis (STLA) plants 11 days ago.

Tesla (TSLA) is the clear-cut winner here.

Detroit’s Big 3 will be forced to raise prices, due to the 40%(!) wage increase unions are demanding.

Meanwhile, Tesla has slashed prices several times in the past year. It doesn’t have to deal with unions. And it isn’t shackled to a dying gas-guzzler business.

Tesla makes better electric vehicles AND they’re cheaper? Elon wins again.

I doubt all the Big 3 will even exist in a decade. While Tesla eats their lunch, unions are making demands like Detroit is still on top of the world.

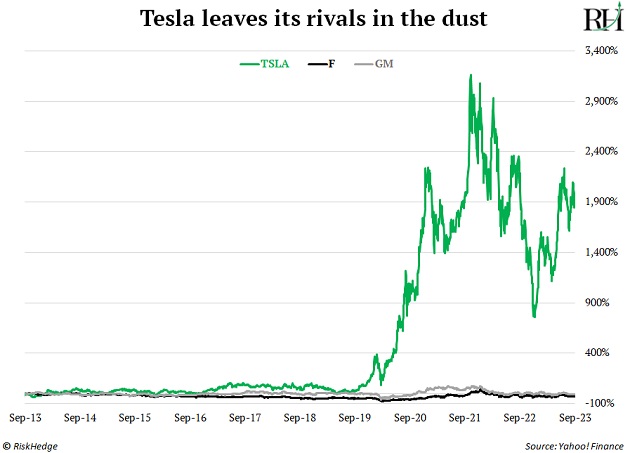

Tesla’s stock surged over 2,400% in the past decade. Meanwhile, Ford and GM have limped along:

Don’t overthink it. This will continue.

3. How fast will AI gut Hollywood?

Another strike just ended in sunny California. The Writers Guild of America has been refusing to work since May, forcing popular shows like The Tonight Show to go dark.

A major sticking point between the two sides was artificial intelligence (AI). Writers wanted studios to ban the use of AI tools that could put them out of jobs.

They got what they wanted… for now.

It’s only a matter of time until someone builds “HollywoodGPT,” an AI bot trained on the transcripts of every film from the past 100 years that can dream up brand-new movie ideas in seconds.

Trying to ignore or ban new innovations never works.

In the early 16th century, the governor of Mecca feared cafés would create spaces for people to come together and criticize him… so he banned coffee.

That didn’t work out too well, as I sip my coffee (with grass-fed butter)…

In 1865, Britain attempted to kill cars before they even got going by passing a law requiring a person to walk in front of every car, waving a red flag. For safety reasons, of course.

A few years from now, Hollywood’s AI embargo will look just as silly.

The best thing you can do is lean into AI and understand how it works. Your future self… your kids… and your portfolio will thank you. I’m here to help you on that journey.

4. While Hollywood boycotts AI, Amazon is moving all-in.

Amazon just signed a deal to invest up to $4 billion in the AI startup Anthropic, creator of ChatGPT competitor Claude.

Remember: We’re early in a multi-year AI boom.

Every day, I’m seeing incredible AI breakthroughs in everything from healthcare to farming to education. The rest of the world will soon be reading about them, too.

AI is the biggest and surest megatrend since the internet. The hardest part of investing in it is losing sight of the big picture and getting shaken out by short-term moves.

AI chip leader Nvidia (NVDA) is the perfect example.

It’s surged 500%+ since I recommended it to RiskHedge readers back in 2018. But to collect those gains, we had to sit through two gut-wrenching 50%+ corrections.

Many investors panicked and sold way too early.

When in doubt, zoom out! There’ll be bumps along the way, but AI will change all our lives and create tons of investing opportunities.

That’s why we’re buying under-the-radar AI companies in Disruption Investor.

5. Today’s dose of optimism…

I had a great birthday weekend with my wife and kids.

We strolled through the forest and fed the ducks in Europe’s largest park here in Dublin. Then my wife and I had a bottle of Brancaia Ilatraia 2006… straight from the Tuscan hills (it was top-notch).

There are lots of ways to waste away your days. Spending time with your family is not one of them. Nobody ever regretted spending too much time with their kids.

Being an engaged dad is a secret superpower. It’s no coincidence many of history’s most successful people had gangs of kids.

As Jay Gould, whom Cornelius Vanderbilt called “the smartest man in America,” once said: “Wife and children are what men fight wars and build castles for.”