Written by: David Lebovitz

Prior to 2022’s sharp increase in bond yields, a significant share of our client conversations focused on where investors could find uncorrelated sources of income. Perhaps unsurprisingly, many of the solutions were alternative investments, and more specifically, core real assets such as real estate, infrastructure and transportation. However, some investors who had previously allocated to this space - and specifically to core real estate - liked what core real assets offered but did not necessarily want to continue increasing existing exposures.

At this point, the conversation would turn to the topic of core infrastructure. In general, core infrastructure assets fall into three buckets - distribution/regulated assets (i.e. water utilities), contracted/power assets (i.e. power plants) and GDP-sensitive assets (i.e. airports and trade terminals). The assets that comprise these categories provide essential services and often operate on a monopolistic basis either by regulatory structure or long-term contract. This provides investors with long-term visibility into the cash flows that these assets generate, allowing for more informed investment decisions to be made.

At the portfolio level, core infrastructure can provide three things - diversification, a hedge against inflation and yield. Starting with diversification, the essential nature of regulated and contracted assets allows them to be fairly resilient in the face of weaker economic activity or volatile capital markets; in fact, less than 3% of total consumption in the U.S. is spent on utilities. Furthermore, many of these assets have structures and/or regulatory frameworks that allow higher costs to be directly passed to the end-consumer, providing a significant hedge against inflation. And finally, strong cash flow generation and long/term visibility into these flows allows for a predictable, income-dominated return stream that still can participate on the upside via capital appreciation. Finding an asset that provides all three of these things - diversification, a hedge against inflation and yield - is challenging even with interest rates at the most attractive levels we have seen in more than a decade.

There are a plethora of questions about the outlook for growth, inflation and monetary policy, and meanwhile, risk asset valuations are looking stretched given our expectation for slower growth and monetary policy that remains tighter for longer. Against this backdrop, core infrastructure continues to represent a way to generate income without taking on more equity risk, while proactively hedging portfolios from the chance that inflation is harder to tame than many currently expect. Furthermore, the search for assets that provide uncorrelated income and diversification is likely to accelerate as bond yields decline and we settle back into a world of slower growth and lower rates.

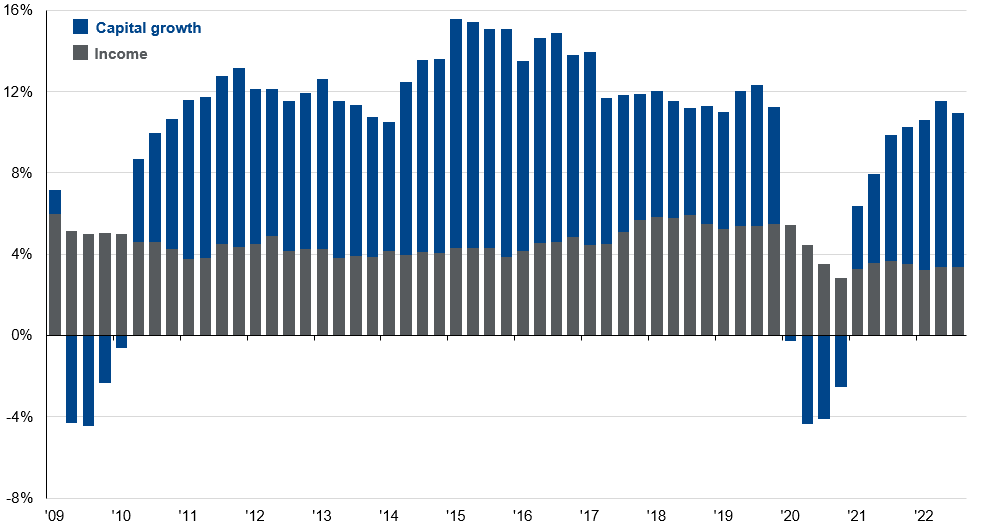

Global core infrastructure returns

Rolling 4-quarter returns from income and capital appreciation

Source: MSCI, J.P. Morgan Asset Management. Infrastructure returns represented by the MSCI Global Quarterly Infrastructure Asset Index. Data show rolling one-year returns from income and capital growth. The chart shows the full index history, beginning in 1Q09, and ending in 4Q22. Past performance is not indicative of future results. Alternative investments carry more risk than traditional investments and are recommended only for long-term investment. Some alternative investments may be highly leveraged and rely on speculative investments that can magnify the potential for loss or gain. Diversification does not guarantee investment returns or eliminate the risk of loss. Data are based on availability as of May 31, 2023.

Related: Will the Debt Ceiling Aftermath Push up Interest Rates?