For the second morning in a row, we received a hotter-than-expected inflation report. Unlike yesterday, when bond yields understandably rose after getting a strong whiff of higher prices for goods and services in the PPI report, this morning, bonds recovered most of the prior day’s losses. It seems perplexing, but stock traders certainly don’t mind. Stocks largely shrugged off the hotter CPI report yesterday, so it should not be a big surprise that they’ll take the bond market’s lead today.

3-Days, 5-Minute Candles, Front-Month (March 2025) 10-Year Treasury Note Futures

Source: Interactive Brokers

Compare the chart above, which shows the price of 10-year Treasury futures (ZN) with that of the Nasdaq 100 (NDX) below. The tech-heavy index moved sideways along with bonds on Tuesday, made a definitive turn higher after a false start once bonds came off their lows, then followed bonds higher. It’s a bit of a ratchet effect – NDX generally follows bonds but is much less likely to sustain declines. Buy-the-dip activity is much more relentless in stocks – particularly tech stocks – than in bonds.

3-Days, 5-Minute Candles, NDX

Source: Interactive Brokers

Quite frankly, it takes a bit of economic gymnastics to explain today’s bond rally since higher-than-expected month-over-month readings in headline PPI (0.4% vs 0.3% expected and 0.2% prior, revised up to 0.5%) and PPI Ex Food, Energy and Trade (0.3% vs 0.2% expected and 0.1% prior, revised up to 0.4%) by no means appear to be bond-friendly. But two explanations exist:

- There was ample discussion that yesterday’s CPI numbers get an abnormal boost in January, and that talk persists for PPI.

- The most troublesome components of PPI are not major factors in the Core PCE Deflator, the Federal Reserve’s preferred inflation measure. Ergo, if the Fed won’t be concerned by the factors that are elevating PPI inflation, neither should the bond market.

While I am a bit skeptical of #1 — it’s not clear why the usual seasonal adjustments fail at the start of the year, though there is a historical tendency for inflation to appear worse at the start of a new year – it is difficult to contest the logic behind #2. It is hard to spin this as an outright positive, but we have indeed seen Fed Funds futures shift the probability for a first cut forward to October. It shifted from September to December yesterday, but like the long end of the curve, that view has moderated a bit.

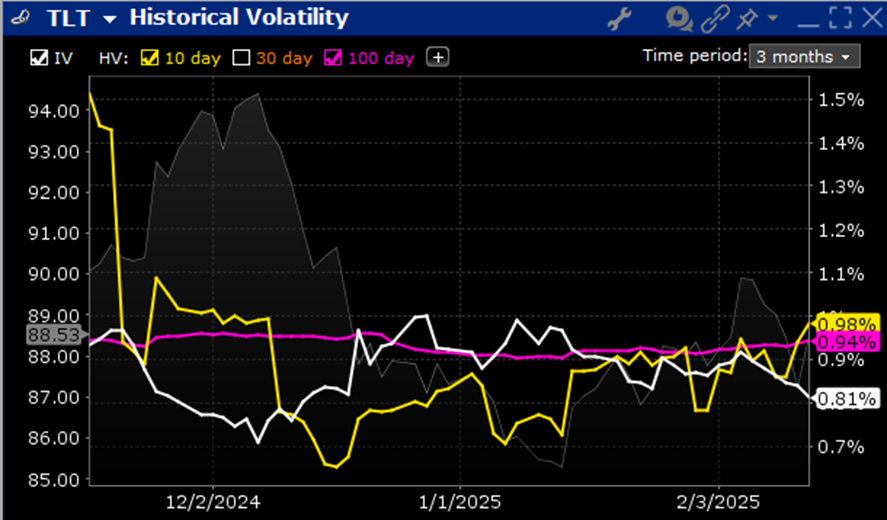

The substantial swings in rates had me wondering whether the recent bond volatility was unusual. Over the short-term it might be, but it is apparently not case on a medium- or longer-term view. The chart below shows the implied and 10- and 100-day historical volatilities for TLT, the iShares 20+ Year Treasury Bond ETF, a good proxy for long-term bonds. Implied vols have dipped, which is not unusual after some events that could induce volatility have passed, but even though the 10-day historical has understandably spiked, it is not far from a longer-term average.

TLT Volatility – Implied (white), 10-Day (yellow) and 100-Day (magenta) Historical Volatilities

Traders might consider whether the current level of TLT implied volatility is a bit low relative to recent movements, but it is by no means grossly out of line. In the meantime, stock traders seem more than happy to take the bond market’s lead. As opposed to yesterday, when NDX closed +0.12% higher but the S&P 500 (SPX) closed -0.27% lower after both dropped about -1% at the opening drop, both indices are higher today. Also, we saw a large preponderance of decliners to advancers yesterday, but today we have a more broad-based advance. If the usually dour bond market can get excited about today’s PPI report, why shouldn’t stocks?

Related: Bessent's Bond Market Insights: Anticipating the Impact of Upcoming Jobs Data and Amazon's Earnings