Written by: Mark Abssy and Chris Versace

Will the September CPI and PPI data support a no-landing scenario for the economy?

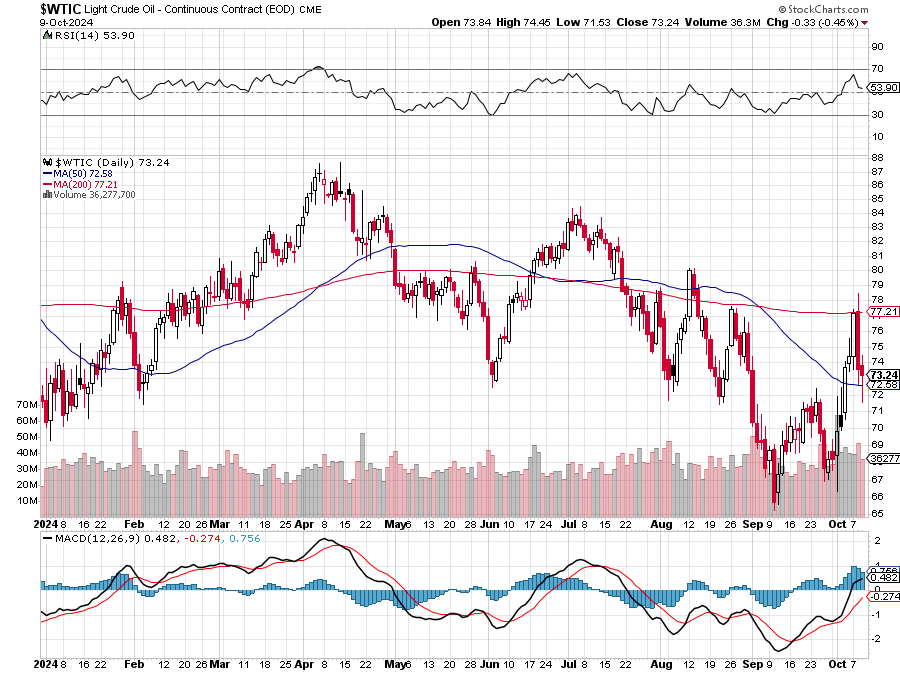

With Hurricane Milton knocking out power to an estimated three million people in Florida, equity futures are modestly in the red ahead of this morning’s September Consumer Price Index (CPI) report. When that data is released at 8:30 AM ET, we’ll see how on the money the market consensus forecast is, which calls for headline CPI to fall to 2.3% YoY while core CPI for September remains at 3.2% YoY. Sequentially, lower oil and gas prices should have a positive impact on headline figures but higher wage data found in the September Employment Report and spiking price data contained in ISM’s September Service PMI data signal the market may be disappointed with the published figures.

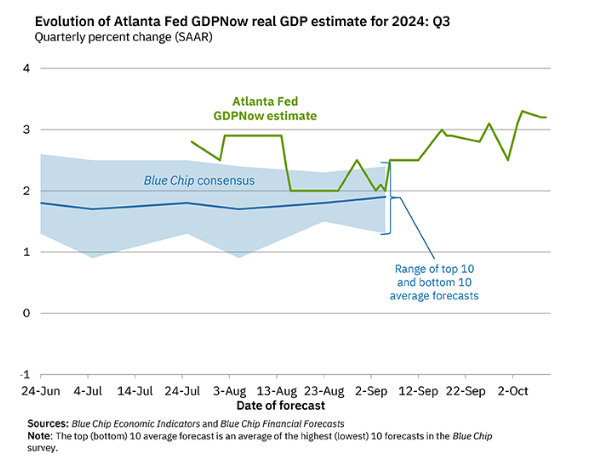

Investors will also be interested in post-CPI report comments from four Fed officials making the rounds today, especially because the September Employment Report has tilted the market narrative closer to a no-landing scenario for the US economy. Yesterday’s upward revision for the Atlanta Fed GDPNow model to 3.2% for the current quarter did little to argue against that scenario, supporting the potential for fewer rate cuts by the Fed in the coming months.

We’ll go through this again tomorrow with the September Producer Price Index (PPI), and the same September Service PMI data from ISM argues we could see another tick higher in core PPI data following the one recorded in August. That would be another flag for the Fed officials as they monitor the rebound in oil prices that has unfolded in the last few weeks.

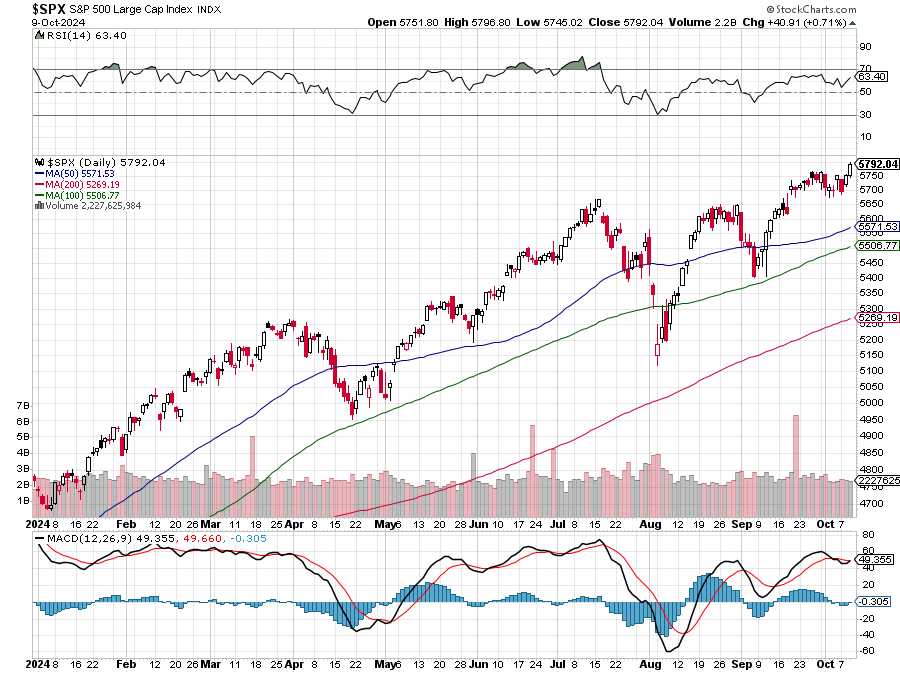

With the S&P 500 closing last night at 23.9x expected 2024 EPS, it’s more than fair to say that the P/E valuation multiple is stretched. As we head deeper into the September quarter earnings season, which will refresh S&P 500 EPS expectations for the 2H 2024, it shouldn’t be lost on folks that the latest P/E ratio for the S&P 500 is back near levels last seen since 2002.

Could a better-than-expected set of inflation data today and tomorrow propel the market higher?

It’s possible, but that would only serve to extend the market multiple even further and potentially push the S&P 500 into overbought territory. Should that come to pass, it would bring extremely high expectations for September quarter earnings and guidance for the coming quarters. That’s a high tightrope for companies to walk amid election uncertainty, hurricane destruction and damage, and selective consumers.

Related: Israel-Iran Tensions Escalate: Impact on September ISM Services PMI and Jobs Data