Written by: David Waddell | Waddell and Associates

As markets gyrated this week between “will they” or “won’t they” June rate cut debates, I withdrew to focus on larger and more important questions. First, if the Fed decides rates need to be “higher for longer”, can this market rally continue? Second, using the dotcom tech cycle as an analog, will the AI tech cycle make earnings and investor returns “higher for longer”?

THE NOISE: INTEREST RATES

While the Federal Reserve determines the level of short-term interest rates with policy decisions, markets determine the level of long-term interest rates with pricing decisions. Pricing inputs include economic growth assessments, inflation assessments, monetary and fiscal policy assessments, myriad risk assessments, and supply/demand factors, just to name a few.

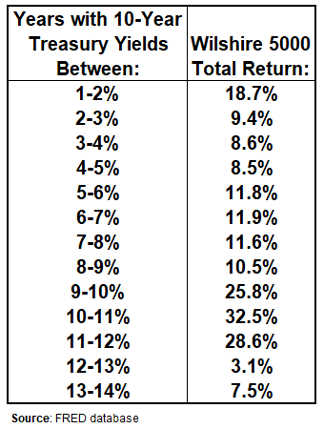

These inputs alchemize dynamically, in real time, to determine interest rate levels. Currently, the 10-Year U.S. Treasury yields 4.40%, up from 3.87% at the beginning of the year. That’s an absolute rise of .53% and a percentage rise of 13%. Yikes! Wall Street has adopted a belief that higher rates equal lower stock prices. Therefore, shouldn’t the market be lower? And if the Fed chooses to hold policy rates “higher for longer”, then stock prices should be “lower for longer”, shouldn’t they? Maybe, but historically… no. Consider the following 10-year Treasury yield levels and the corresponding stock market returns, based upon calendar years:

Today, the 10-Year Treasury yields between 4-5%, a range where the stock market has averaged returns of 8.5% since the early 1970s. Historically, a climb in yields up to a range of 5-6% actually improved average returns to 11.8%. Even more confounding for the modern narrative that higher rates lead to lower returns, the highest cluster of investor returns occurred when yields ranged between 9-12%. Why so? Because higher rates correspond with higher nominal GDP growth and higher nominal GDP drives higher earnings growth. In sum, interest rates are the noise. Earnings growth rates are the news.

THE NEWS: EARNINGS GROWTH

Historically, S&P 500 earnings grow by 7-8% a year. Tack on a 2-3% dividend yield and you arrive quickly at the 10% long-term return projection for equities. Periodically, however, breakthrough technology periods accelerate earnings growth rates. The last time we experienced a fully distributed breakthrough technology cycle was the proliferation of the internet between around 1994 and 2006. During that cycle, earnings growth averaged 11% per year—for 12 years!

That period also included a 30% earnings crash in 2001 coincident with the NASDAQ stock market crash. If we remove 2001 and isolate 1994-2000 (I think of this as the internet installation period), earnings grew 11.25%, annually. If we isolate 2002-2006 (I think of this as the internet integration period), earnings grew 18%, annually.

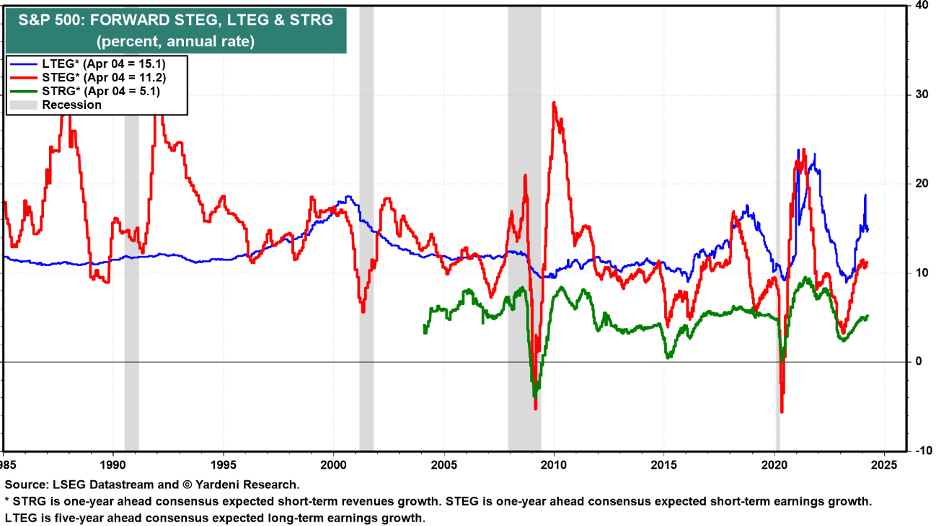

Now, consider the earnings impact potential of AI. If you believe that AI adoption holds at least as much promise for corporate profit enhancement as internet adoption, you should baseline your earnings growth assumption over the next decade at 11% as well. While professional analysts typically don’t look out that far, they do publish their expectations for the next 5 years. Here is their current collective view:

According to analysts, the STEG rate (Short-Term Earnings Growth – 1 year ahead) for the S&P 500 is 11.2%. The LTEG rate (Long-Term Earnings Growth – 5 years ahead) is 15.1%. Translating that into investor returns, the S&P 500 closed today (April 5th, 2024) at 5200. Should the S&P 500 simply track corporate earnings higher over the next 5 years, at those rates, the S&P 500 will hit 10,000 by 2029. Add in reinvested dividends and that number climbs higher still.

Now… I am not predicting this; I am just highlighting the potential, given that the AI technology breakthrough feels like the internet breakthrough on steroids. So, tune out the interest rate noise.

Earnings are the news!

Sources: FRED, Yardeni

Related: POW POW Powell!