Written by: Bryce Coward | Knowledge Leaders Capital

Jerome Powell tossed the market a bone by hinting that the Fed would be patient in raising short-term interest rates due to the continued slack in the US labor market and inflation that would likely be “transitory”. Yet, today, the unemployment rate dropped more than expected to 4.6%, a relatively low level of unemployment. Wouldn’t a low unemployment rate like 4.6% cause the Fed to at least begin talking about a faster taper of asset purchases or even rate increases?

As always, the devil is in the details. When looking at why the unemployment rate fell in October one of the primarily reasons was because the employment participation rate fell as well! That is, the unemployment rate fell, in part, because many people exited the labor market. A smaller labor market is troubling because it implies:

- a skills mismatch between employers and job seekers, which is bad because it could mean the participation rate will be slow to recover and

- also implies a lower level of growth, since GDP growth = labor force growth * productivity growth

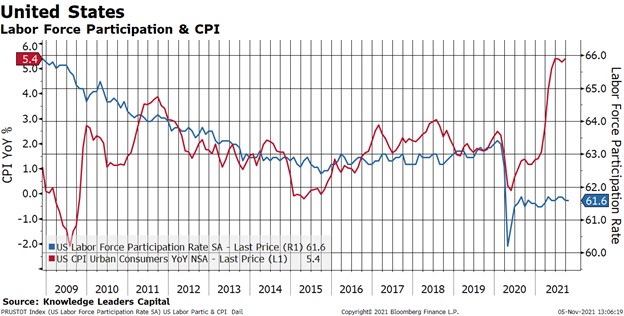

As the reader can see, the participation rate fell from about 63.5% pre-COVID to just 61.6% today. The overall participation rate has been flat for a year and a half now.

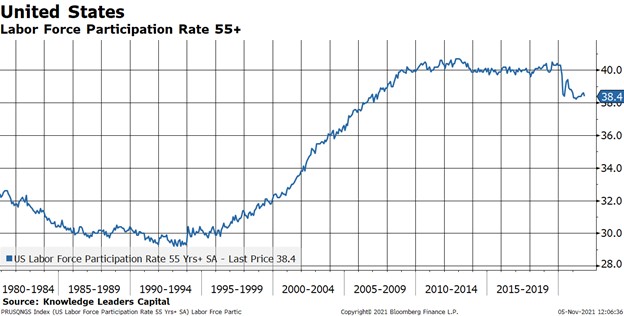

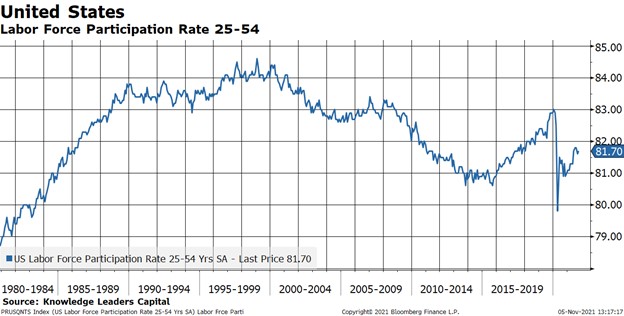

When we dig deeper into the participation rate we notice that all ages of workers are dropping out of the labor market. In the 55+ category, the participation rate is down 2% from the pre-COVID level and is showing no signs of improving. In the 25-54 category, the participation rate is also 2% lower than pre-COVID, but is at least on an upward trajectory.

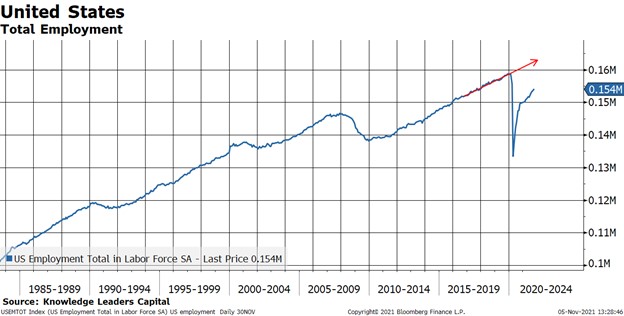

In total, lower labor force participation has caused the total US labor force to shrink from 159m pre-COVID to 154m today, or an aggregate loss of 5m jobs.

That loss of 5m jobs ignores that, but for COVID, the total number of employed people in the US would likely have grown due to population growth and millennials entering the labor force faster than boomers exit. Had the US job market continued adding jobs through 2021, total US employment would be more like 162m by now. So, the total number of folks that are not in the labor market, but could be, may actually be more like 8m (162m-154m) than 5m.

What would cause the Fed to raise rates even though as many as 8m people may be out of the labor market and the participation rate is making no progress? Inflation, of course.

But, we must also take note of how the Fed looks at the world. The Fed sees a link between employment and inflation. Indeed, while such a link ebbs and flows through time, it has been strong in the post Great Financial Crisis era. As the reader can see, the employment participation rate and CPI have moved in the same direction since the 2009…until 2021. The fact that the participation rate has made no progress in nearly 18 months is one strong data point that would suggest to the Fed that inflation is “transitory”. If inflation is “transitory” then there is no need to tighten policy aggressively.

Perhaps that is why 2 year yields have fallen 10bps in the last several days, gold has rallied by a few percent, and the Fed Funds futures market is starting to price out rate hikes for 2022?