Written by: Stephanie Aliaga

The housing sector was one of the hardest hit areas of the economy when the Fed began raising rates, but there are signs activity has turned a corner.

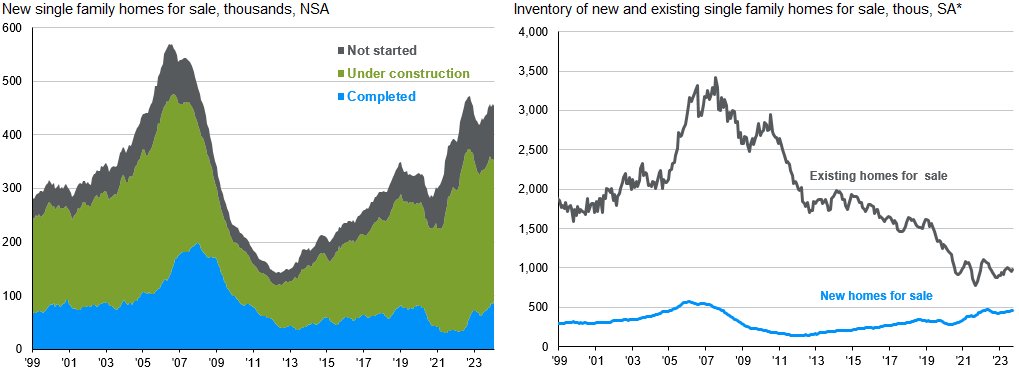

The “mortgage lock” effect, where households that had locked in low mortgage rates are disincentivized to move and assume higher rates, has severely limited the supply of existing homes for sale in the market, shown on the right-hand chart. This supply is beginning to thaw, with our measure of seasonally adjusted existing homes for sale showing a steady upward trend since last Spring. Some relief should also come from new home supply underway, with 1.6M units currently under construction and housing completions hitting their highest level in 17 years in February. Improved homebuilder sentiment, strong hiring and a chronic undersupply of housing should support strong construction activity in the years ahead.

The demand side has also proven resilient. Despite recent strong housing completions, homeowner and rental vacancy rates have hardly budged off their multi-decade lows. A surprising immigration boom may be contributing to this, raising the bar on housing units needed for population growth, but modest declines in rates have seemed to help stimulate activity and improve home affordability. The 30yr fixed mortgage rate is currently at 6.9%[1], off its peak of 7.8%, and while mortgage rates will remain elevated relative to pre-pandemic levels, Fannie Mae sees further inches down to 6.4% by end-2024 and 6.2% by end-2025. Over the longer term, the recent NAR settlement on realtor commissions may also lower home prices by reducing transaction costs.

For the average household, the “mortgage lock” has been an important layer of immunity to higher rates. The average effective mortgage rate in the economy is at 3.8%, just 0.5% above its historic low in mid-2022. This immunity will gradually fade, but alongside improving real wages and strong balance sheets, consumers should be able to weather incremental exposure. Moreover, while the recovery in housing market activity will be gradual, resilient supply and demand dynamics underscore that it is not a source of vulnerability for the economy. While we don’t expect a recession this year, whenever one occurs, the lack of private sector imbalances suggest that it is unlikely to be a severe one.

More new homes should be coming to market soon, although a much smaller part of the overall inventory

Source: Census Bureau, NAR, J.P. Morgan Asset Management. *Seasonally adjusted by J.P. Morgan Asset Management. Data are as of March 27, 2024.

[1]Source: Freddie Mac. Average 30 year fixed rate mortgage for the week ending March 22.

Related: Consumer Confidence: Impact on Subsequent S&P Returns