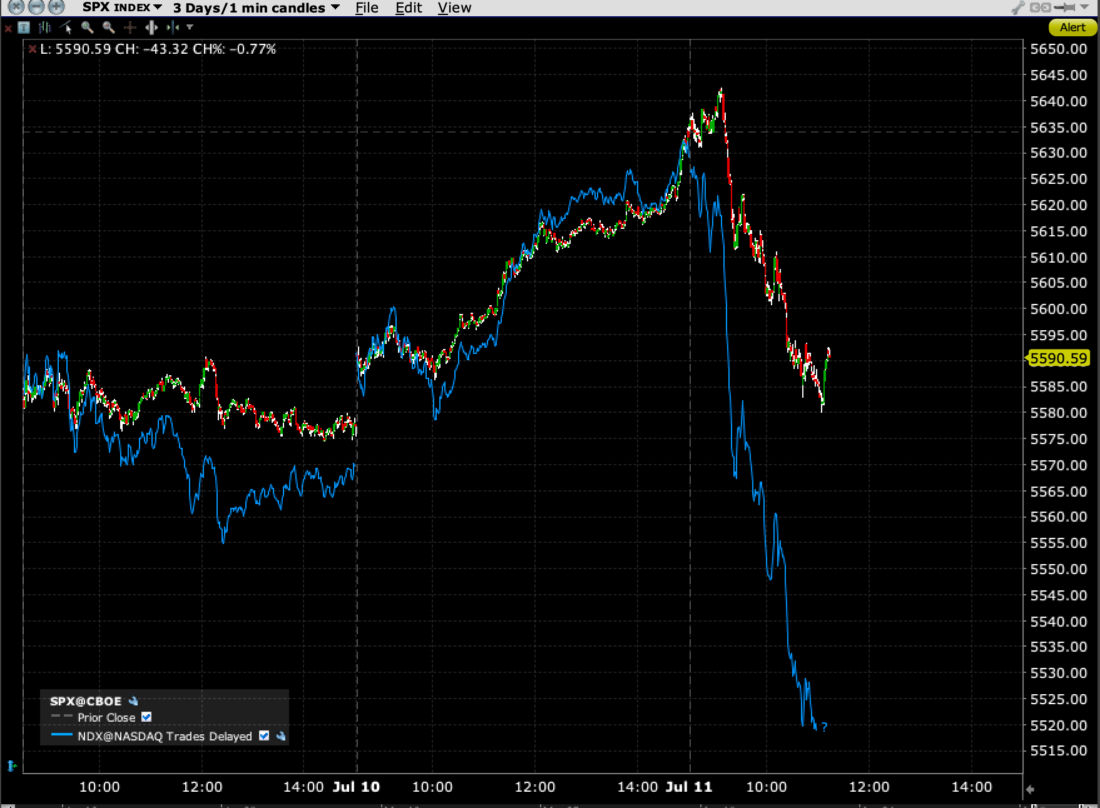

If you look at the reactions of the S&P 500 (SPX) and Nasdaq 100 (NDX), you’d think that today’s benign CPI report was bad for stocks. In reality, today’s report is helping the vast majority of shares trade higher. Yet because the “wrong stocks” are heading south, so are the market capitalization-weighted indices that they dominate. We are getting a dose of the “healthy rotation” that many have hoped for, yet it is impacting key indices nonetheless.

As I type this, around midday, SPX is -0.9% and NDX is -2%. Ouch. And this is despite Treasury yields plunging by 10-12 basis points across the curve. But the Russell 2000 (RTY) is +3%, and advancing stocks are outpacing decliners on the NYSE by a roughly 6:1 ratio and by about 3:1 on Nasdaq.

Care to guess why the key indices are underperforming? I’ll bet that many of you know the answer already…

All of the “Great Eight” stocks – the Magnificent Seven plus Broadcom (AVGO) are getting shredded today. Tesla (TSLA) was the lone stock bucking the trend until we learned that their highly anticipated robotaxi announcement will be delayed from August to October. Now it is leading the declines. Other major tech stocks find themselves under pressure, with the Philadelphia Semiconductor Index (SOX) down more than -3% as we see investors pivot from growth to value. The Vanguard Russell 1000 Growth ETF (VONG) is down nearly -2% while its Value counterpart (VONV) is up nearly +1%.

Today’s moves are hardly cause for alarm. Heck, SPX hasn’t even given back all of yesterday’s gains (though NDX is far worse). But this type of market activity points out in vivid detail why the top-heavy concentration of cap-weighted indices is a source of potential instability for a tech-driven market.

A prolonged sell-off in some of the biggest names could pressure the main indices that investors watch, even if the majority of stocks remain initially unscathed. That in turn could cause investors to lighten their exposure to key index-based investments, such as ETFs like SPY and QQQ. If that occurs, then the selling could swamp the index as a whole, hurting the now laggard value stocks nonetheless. They would outperform on a relative basis in that scenario but could still get swamped by selling anyway. Remember, when one buys a “diversified” SPX-linked index fund or ETF, about 35% of it is concentrated in the eight stocks referenced above. That is far less diversification than many investors realize.

This concern is of greater importance as we enter earnings season. Delta Airlines (DAL) gave it an auspicious start, but the season “officially” kicks off tomorrow when JPMorgan (JPM), Wells Fargo (WFC), and Citibank (C) report. The megacaps don’t begin reporting for nearly two weeks, but it doesn’t mean that we shouldn’t consider what could happen if one or more severely underperforms market expectations. It is not unreasonable to think that those expectations have been pumped sky-high during the recent rally. This fear was brought home when Micron Technologies (MU) reported otherwise excellent numbers but sank because its raised expectations fell short of the market’s most aggressive hopes.

One day does not a trend make. But as someone who has been advocating and hoping for a broader market rally and a rotation into value from growth, today’s activity makes me wonder if I should be more careful about what I wish for.

3-Day Chart, SPX (red/green 1-minute candles), NDX (blue line)