This article is for investors who desire broad exposure to the various levels of “capitalization” in the US equity market. In other words, you want an investment approach that provides meaningful exposure to huge companies, medium-sized companies and small/micro companies in the US market. (The term “capitalization” is often shortened to “cap” and is a way of describing the size of companies. Large “cap” = large capitalization, midcap = medium capitalization, etc.)

The investment approach described here solves a problem that is inherent in mutual funds and ETFs that mimic the S&P 500 Index—the most popular U.S. equity index. The S&P 500 Index focuses exclusively on large US companies and is market capitalization weighted, meaning that the largest companies in the index are weighted much more heavily than smaller large-cap companies. As of early 2024, nearly 31% of the return of the S&P 500 index was determined by the performance of the largest 10 stocks. In other words, the largest 10 stocks (2% of the 500 stocks in the index) determine 31% of the overall performance of the index.

The performance of the two largest holdings (Apple and Microsoft) account for roughly 14% of the total percentage return of the S&P 500 Index. Is that a problem? If the largest 10 companies perform well, it’s clearly not a problem. However, if they stumble it could be a big problem because the poor performance of only a few stocks (the few really BIG companies) will disproportionately impact the overall return of the index.

Indexes (and funds that mimic those indexes) that employ market cap weighting place a lot of eggs in very few baskets—so to speak. A visual illustration of market cap weighting versus equal weighting is shown by the two “quilt” images. The size of each colored box represents the “weighting” or percentage allocation assigned to each stock in the S&P 500 Index (as of late 2023). The smallest weighted stocks (in the bottom right corner of the top quilt) have very little impact on the return of the S&P 500 Index. In an equally weighted index (bottom quilt) every company has an equal impact on the overall return of the index. Over the past 53 years (1971-2023) the equally-weighted S&P 500 Index (EW) annually outperformed the traditional market cap weighted S&P 500 Index 54.7% of the time and produced a 53-year average annualized return of 12.3% vs. 10.8% for the capitalization weighted S&P 500 Index. Over the past 25 years (1999-2023) the annualized return of the EW S&P 500 Index was 9.5% compared to 7.6% for the cap weighted S&P 500 Index. Over the past 10 years (2014-2023) the cap weighted S&P 500 Index had a 12.0% return vs. 10.4% for the EW S&P 500 Index.

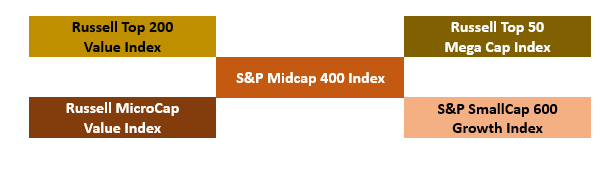

Let me propose a possible solution to the distortions caused by market cap weighting: use several mutual funds (or ETFs) that individually focus on the various layers of “capitalization” in the US equity market. In this way we gain meaningful exposure to companies of all sizes. To demonstrate the benefit of this approach I’ve identified five indexes that represent various “cap” layers of the U.S. equity market as well as “growth” and “value” orientations. The five indexes are shown below. A 22-year performance comparison of these five indexes vs. the cap weighted S&P 500 Index is also provided in Table 1.

As shown in Table 1 the five indexes (equally weighted at 20% each and annually rebalanced) outperformed the S&P 500 Index by 6 basis points over the 22-year period from 2002-2023—and with slightly less volatility! The margin of outperformance using a five-index approach was particularly notable (nearly $700,000) in a retirement account analysis when money was being withdrawn each year (in this analysis the annual end-of-year withdrawal was $50,000). The virtue of broad diversification is particularly important for retirees due to the simple fact that money is being withdrawn—a burden made safer when there are diverse “buckets” (funds) from which to make those withdrawals.

Genuine diversification across the various segments of the US equity market is a prudent investment philosophy both in the accumulation years AND during the retirement years. The importance of being broadly diversified across multiple mutual funds and/or ETFs during retirement is particularly crucial. Doing so gives a retiree the ability to withdraw money from the best performing funds each year.

Actual ETFs (recall that it’s not possible to invest in raw indexes) that might be used in this type of “five-fund” approach could be MGV, MGK, XMHQ, FDM, and DWAS. Or, for those who prefer mutual funds, HOVLX, MFOCX, FSSMX, BRSVX, and WMKSX are worthy candidates.

Related: Uncorrelated Alpha – A Market-Neutral, Hedge Fund-Of-Funds Investment Strategy