Who will win the AI arms race?… The easiest way to profit off AI… Is Facebook the next great "autopilot stock"?

1. It’s an AI arms race—here’s how I’m playing it…

Artificial Intelligence (AI) is one of the hottest buzzwords on Wall Street right now.

Ever since AI chatbot ChatGPT burst onto the scene in November, any stock even remotely related to AI has soared.

I even warned a bubble was forming in “pure play” AI stocks in February. These stocks include C3.ai (AI), SoundHound AI (SOUN), and BigBear.ai (BBAI).

But ChatGPT is just the tip of the iceberg.

Tech giants Microsoft (MSFT) and Google (GOOG) have already built ChatGPT-like chatbots into their search engines. And Amazon (AMZN), Apple (AAPL), and Tesla (TSLA) are incorporating new AI models into their businesses.

I expect many more companies will follow suit to compete in the AI arms race.

Who will come out on top?

You don’t have to guess...

You can buy the “picks and shovels” providers of AI—the companies standing to benefit no matter who adopts this game-changing technology. One of these stocks is already up 58% this year and is a legitimate business, as you’ll see.

2. Have you ever asked what makes AI possible?…

It’s all thanks to specialized computer chips called graphics processing units (GPUs).

GPUs can perform millions of calculations simultaneously, meaning they can process vast amounts of data at the same time. That’s different from how other computer chips work. Most computer chips—like the one powering the laptop or phone you’re reading this on—calculate one by one.

At first, GPUs were mostly used to create realistic graphics in video games.

Remember the blocky Nintendo graphics from the early ‘90s? GPUs helped render those early images into the movie-like gaming graphics you see today.

As it turns out, GPUs are also ideal for training AIs to think like humans.

And one company is the default GPU maker for powering AI…

3. The #1 company benefiting from the AI boom…

Nvidia (NVDA) is known for its industry-leading GPUs.

Today, its chips are head and shoulders above the competition. According to firm New Street Research, Nvidia already owns 95% of the AI GPU market.

As the AI craze heats up, so will demand for Nvidia’s GPUs.

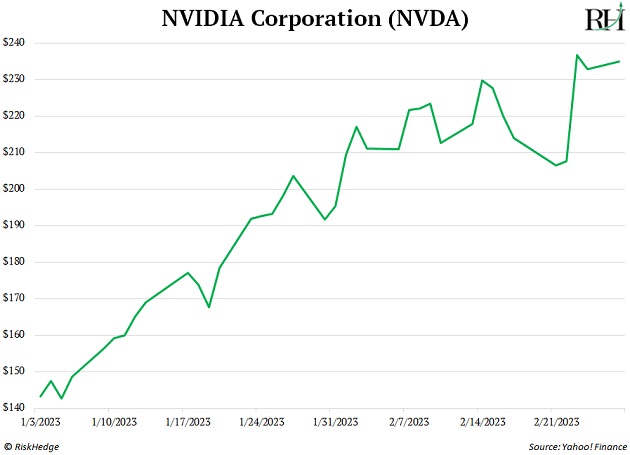

In fact, NVDA has already leaped 58% in 2023:

Investment bank UBS estimates OpenAI, the parent company of ChatGPT, used 10,000 Nvidia GPUs to train the AI… enough to fill an entire warehouse.

But ChatGPT is tiny compared to the AIs Microsoft and Google are building.

The big difference is Microsoft’s and Google’s AI chatbots will have real-time access to the internet, and ChatGPT doesn’t. This means they’ll have to crunch much larger amounts of data.

More data = more GPUs. Tens of thousands more…

For example, New Street Research estimates Microsoft would need 160,000 GPUs to make its Bing Search AI accessible to everyone.

That’s why…

4. If I could only buy one stock for the next five years, it would be NVDA.

That’s what I said about Nvidia back in 2018. Readers who acted on my guidance saw 404% peak gains.

And I see huge upside for this chipmaker over the next five years, too.

For one, the company reported stellar sales figures last week. Its data center business—which houses AI GPUs—raked in $15 billion in 2022.

That’s a 41% jump from the year before… the most on record.

But this is just the beginning…

Research firm GMI estimates the AI chip market will grow by 26X over the next 10 years.

So Nvidia’s $15 billion in AI GPU sales could swell to $400 billion by 2032.

This is why Nvidia remains one of my top ways to play the AI boom.

But a “picks and shovels” stock like Nvidia is just one way to profit from the AI trend. Another is looking at individual sectors where AI will make the biggest, most imminent advancements.

5. Is Facebook the next great “autopilot stock”?

Autopilot stocks are great investments.

In short, they can generate big, predictable streams of cash month after month by selling subscriptions as if on “autopilot.”

For example, Adobe stock soared 2,030% after launching its Creative Cloud subscription-based offering back in April 2012.

Now Facebook (META) is trying to do the same…

The company just rolled out Meta Verified, a subscription service that verifies your identity and adds a blue verification badge to your profile.

The feature costs $11.99/month on smartphones and $14.99/month on the web.

6. How much can Facebook realistically make from Meta Verified?

Bank of America estimates Meta Verified will increase sales by $1.7 billion over the next year.

This may sound like a lot of money, but it’s not for Facebook. The social media giant makes $117 billion in revenue each year. So, the subscription service would add just 1.5% to its bottom line.

I have no interest in owning Meta.

Related: Are AI Stocks the Next Bubble?