Investors are seeking to lock in the rates of the day following another arrival of weaker-than-expected economic data this morning that may very well shorten our journey across the monetary policy bridge. This morning’s sizable miss on job openings, which is pointing to a decelerating labor market and a greater likelihood of earnings softness, is sending yields to the basement while failing to help stocks. Furthermore, not even meme mania and the accompanying ferocious call option buying are generating broad upside for equity indices. Market players are indeed wondering if rate cuts are a negative development at this juncture, as fixed-income odds point to September as the month of the first fed fund reduction.

Job Vacancies Dwindle

Labor vacancies dropped precipitously in April, according to this morning’s Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics. Job openings slipped to 8.059 million in April, missing expectations of 8.34 million by a considerable margin and sinking to the lowest level since March 2021. Broad weakness existed across sectors, with the professional/business services and trade/transportation/utilities segments offering the only reprieve across major segments, adding 122,000 and 15,000 for-hire signs during the period. Meanwhile, the leaders of job growth this year, namely the private education/health services, government and leisure/hospitality groups, led the decline in openings, subtracting 154,000, 109,000 and 72,000. To make matters worse, March’s headline figure was downwardly revised to 8.355 million, confirming waning labor market momentum.

Cat Scratch Fever Fades in Early Trading

Stock investor Roaring Kitty appears to have pounced again, igniting a rally of GameStop at the market open yesterday. The meme mania moderated somewhat, causing the stock to surrender most of its gains and return 25% for the day. The rally started when a Reddit account believed to be tied to Keith Gill, AKA Roaring Kitty, disclosed a new $175 million position in GameStop along with 120,000 options contracts allowing the holder to purchase shares at $20 each, or a total allocation of $65.7 million. Yesterday’s posting also sparked a market-wide rally that quickly reversed in early trading. GameStop also rallied in May in response to Roaring Kitty posting on X (formerly Twitter). Like yesterday’s trading action, the monstrous rally was short-lived. Meanwhile, a brokerage firm is considering whether it should ban Keith Gill from its platform based on concerns that the investor is manipulating markets.

Durable Goods Revisions In-Line

In manufacturing land, this morning’s factory orders report from the US Census Bureau didn’t deviate much from the preliminary durable goods report released two weeks ago. April factory orders rose 0.7% month over month, matching March’s rate and arriving slightly above projections of 0.6%.

Investors Flee Risk Assets

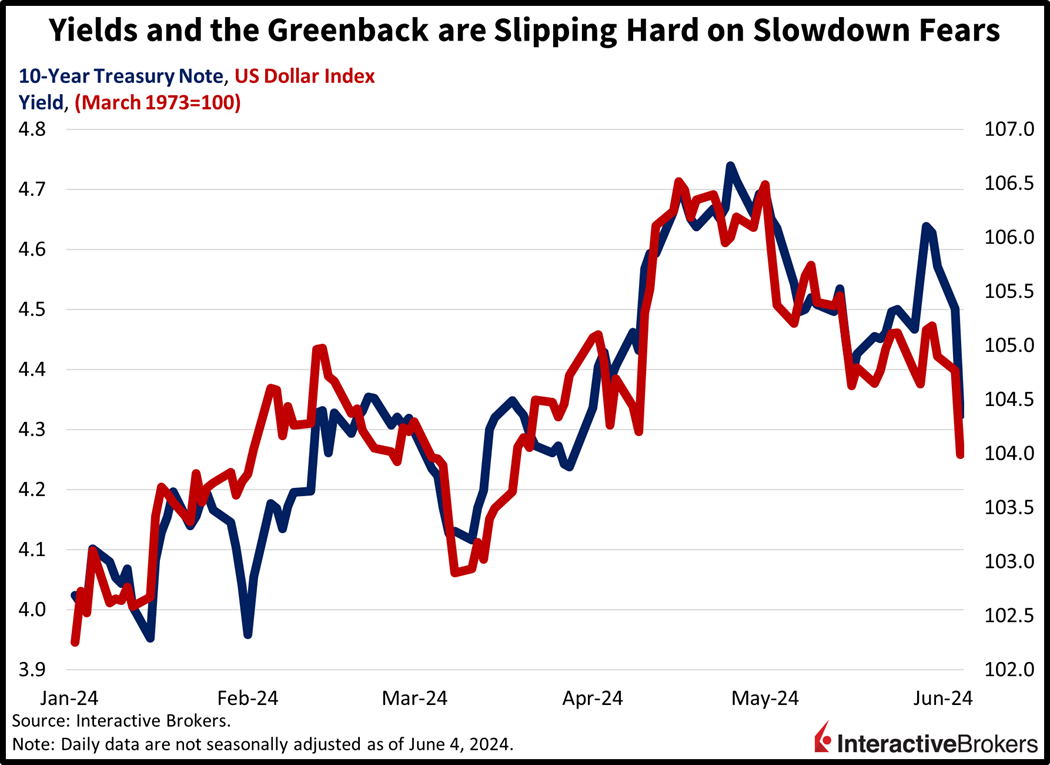

Risk assets are getting clobbered across stocks and commodities as investors reach hand over fist to grab defensive sectors and Treasuries. All major US equity indices are traveling south, led by the rate-sensitive, small cap Russell 2000 index; it’s down 1% as lighter financing costs are unexpected to offset the pain of the revenue pressures that coincide with a weakening economy. The Nasdaq Composite, S&P 500 and Dow Jones Industrial benchmarks are losing a more modest 0.3%, 0.3% and 0.1%. Sectoral breadth is just terrible, with market players only buying up real estate due to reduced borrowing costs and defensive health care and consumer staples that are expected to maintain revenues and earnings despite the possibility of turbulent economic conditions. The sectors are up 1%, 0.5% and 0.1%. Treasuries are catching strong bids with the 2- and 10-year maturities changing hands at 4.78% and 4.35%, 3 and 5 basis points (bps) lighter so far. Reduced yields and softening economic prospects are weighing on the dollar, with the greenback’s index down 9 bps to 104.13 as the US currency loses value relative to the yen, franc and yuan but gains versus the euro, pound sterling and Aussie and Canadian dollars. Those same demand and currency concerns are crushing commodities, with silver, copper, gold and lumber selling off by 3.8%, 2.7%, 1% and 1%. Energy markets are also tanking on economic downturn worries and OPEC+’s recent decision to defend market share instead of prices; WTI crude is down a whopping 5%, or $3.85, to $73.27 per barrel.

Another Day of Uncertainty

Yesterday’s disappointing results for ISM-Manufacturing and construction spending sparked fears that the economy is weakening and increasing the likelihood that equity analysts bring their scissors to their next boardroom meeting to cut earnings estimates. The ability for corporations to generate strong profits is crucial with equities currently trading at nosebleed valuations of 21 times forward earnings. These concerns started a strong rotation into bonds as investors sought to lock in existing fixed-income yields while reducing exposure to risks associated with profitability disappointments. The weak job vacancy data today is reinforcing those worries, with non-cyclical sectors that have been leading job creation, such as government and education/healthcare, experiencing a strong decline in for-hire signs. Among cyclical sectors, leisure and hospitality has been one of the strongest job creators, but it appears households have exhausted their spending on services, illustrating another weak spot in today’s report. The two-day combination of weak data has supported optimism that the fed may cut rates sooner than expected, but even two 25-bp reductions and lower financing costs probably won’t make up for softening corporate revenues and lower profit margins resulting from weak consumer spending and a stagnating economy.

Related: Bears Pounce on Weak Earnings From Wall Street and Main Avenue