Did you see Palantir Technologies’ (PLTR) stock this week?

The company knocked it out of the park with its earnings.

And its stock shot up 25% in one day.

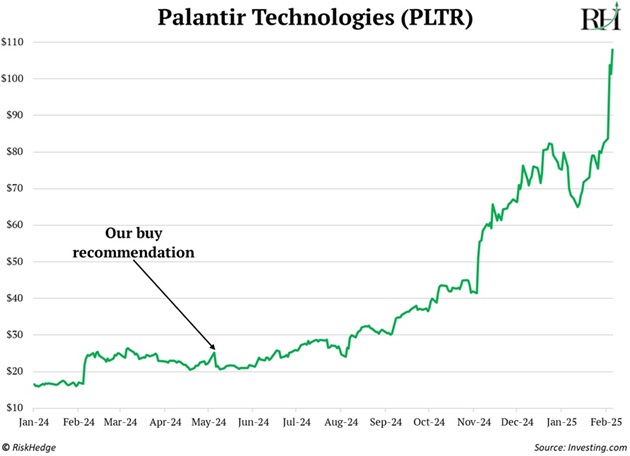

PLTR has now more than tripled since last May. That’s when we first recommended it to our Disruption Investor members:

I wouldn’t be surprised to see Palantir keep surging in 2025.

As I showed you last week, the biggest stock winners tend to sprout up during periods of huge technological disruption.

Amazon (AMZN) jumped 85X during the '90s internet boom. Apple (AAPL) surged 80X after its iPhone kickstarted the smartphone revolution. Netflix (NFLX) soared 27X during the peak of the cloud computing boom.

Today, Palantir is at the forefront of perhaps the biggest tech disruption of them all—artificial intelligence (AI).

Palantir’s powerful software acts like a digital detective. It’s system processes billions of data points—from satellite photos to financial records—and spots patterns that would take human analysts years to find.

It packed this AI into two platforms…

Gotham helps the US government locate and track terrorists and other bad guys. It collects intelligence data, then connects the dots to spot potential terrorist threats. It can show relationships among suspects, timelines of their activities, and even predict future actions or targets. And it presents insights in simple graphics that humans can easily visualize.

But Palantir’s big money-making opportunity is its AI platform for businesses—Foundry.

Big businesses generate mountains of data every day—way too much for any human or group of humans to make sense of. Palantir brings all that data together, makes sense of it, and helps businesses boost revenues and reduce costs.

Palantir has been completely overlooked by most investors because it’s not a consumer-facing company. It’s not on every TV like Netflix. Nor at every doorstep like an Amazon package. It serves other businesses. Many investors find this boring.

But investing isn’t about being entertained. It’s about making money.

Palantir’s latest earnings report showed demand for Foundry is shooting through the roof. In the last year, Foundry sales have jumped 64% and its backlog of customers doubled.

The AI revolution is barely getting started.

Palantir’s CEO agrees:

We are still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades.

Palantir’s stock has soared 12X in just the last two years.

If you missed it, don’t worry. Many, many more big winners will come from AI.

Already, AI is helping the most valuable companies on Earth save (and make) huge sums of money:

Credit card giant Mastercard (MA) processes $8 trillion in payments annually. AI is now letting it catch 20% more fraud attempts.

Amazon estimates it saved the equivalent of “4,500 developer years of work” by tasking AI with upgrading its internal software.

Alaska Air Group (ALK) saved 500,000 gallons of fuel last year. Its new AI navigation system acts like “Google Maps in the air.”

This is just the start. AI is transforming every industry in one way or another. It’s helping biotech firms slash drug discovery time in half. AI-powered robots are moving parcels around in Amazon warehouses. Teachers are using AI tools like Khanmigo to help students excel in school.

That’s why, here at RiskHedge, we’re not just sitting back and celebrating Palantir’s big surge.

We're hunting for the next breakthrough stock like Palantir.

In fact, we just completed a two-month study in which we used AI to analyze every US stock in existence over the last 20 years.

Prior to the debut of ChatGPT and other AI tools, this would have been nearly impossible. It would have required a team of data scientists and coders. Most people don’t yet realize what a gamechanger AI is for sophisticated financial research. A small team that leverages AI can get results that used to require the resources of a hedge fund.

In our study, we identified all the stocks that have gained 1,000% or more over the last 20 years. We found these “10-baggers” share four core traits.

One of the traits is they tend to be smaller companies that rarely appear on the first page of financial news.

Everyone else is piling into yesterday’s winners. But we’re positioning ourselves in the “dark horse” disruptors of tomorrow. That’s where the biggest gains will come from.

Related: Top Stocks That Skyrocketed During Major Tech Disruptions in the Past 20 Years