For years, the U.S. has been the dominant player in military spending, with American companies like Lockheed Martin and RTX (formerly Raytheon) commanding the global arms market. But now, Europe—specifically its arms manufacturers—may be the next big opportunity for savvy investors.

A recent, long-awaited report by Mario Draghi, former Prime Minister of Italy and former head of the European Central Bank (ECB), paints a clear picture: Europe needs to boost its defense spending.

Draghi’s report outlines a plan to increase national defense budgets, prioritize defense research and development (R&D) and reduce Europe’s dependence on U.S.-made military equipment.

These recommendations echo Polish Prime Minister Donald Tusk’s comment back in March that the continent had entered a “prewar” era and needed additional investment in its defense sector.

I imagine this talk must be music to the ears of European arms manufacturers, and for investors like you, it could signal a potentially interesting chance to start participating.

Europe’s Defense Sector Must Invest More in R&D

Draghi’s report should be a wake-up call to Europe’s leaders. The region may be the second-largest military spender in the world, but that doesn’t tell the full story. For decades, European nations have underfunded their defense sectors, relying heavily on the U.S. for both technology and equipment.

In the 12 months through June 2023, 78% of the €75 billion ($83 billion) spent by European countries on defense went outside the continent, with 63% landing in the hands of U.S. manufacturers, according to Draghi’s findings. This over-reliance on foreign arms, primarily American, has left Europe exposed.

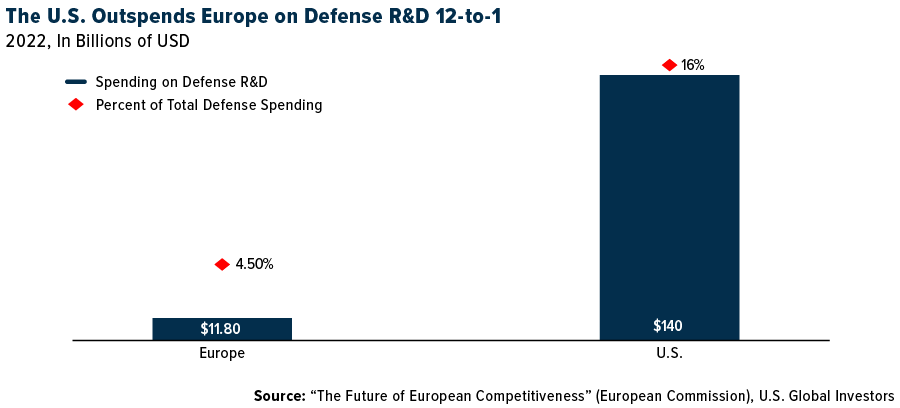

Draghi’s assessment highlights this vulnerability and argues for a significant shift in strategy. He points out that Europe’s defense R&D spending was a mere €10.7 billion ($11.8 billion) in 2022—about 4.5% of total defense spending—compared to the U.S., which spent a whopping $140 billion, or 16% of total defense spending. This isn’t sustainable if Europe hopes to become more self-reliant in defense, especially as tensions with Russia continue to escalate.

Indeed, the Russia-Ukraine conflict has forced European governments to rearm rapidly, and Draghi’s report underscores the urgency of the situation. Europe can no longer afford to sit on the sidelines of its own defense. Leaders are beginning to understand that their reliance on the U.S. must end if they are to build a robust defense strategy capable of handling threats from adversaries like Russia, which announced this week that it’s increasing the size of its army by 180,000 troops to 1.5 million active personnel.

Capitalizing on Europe’s Rearmament

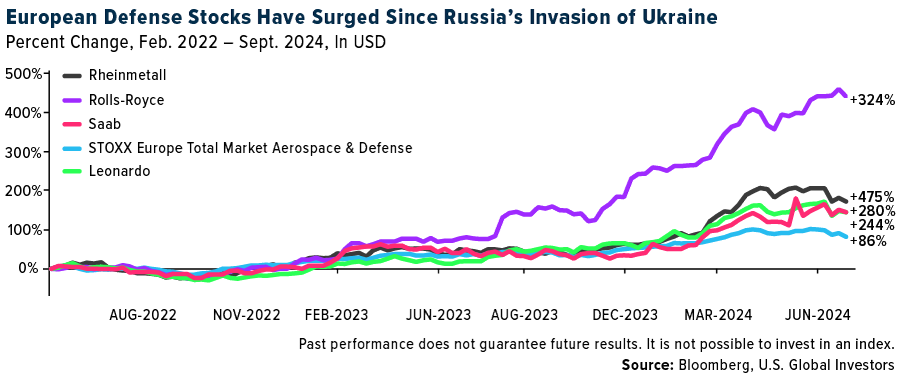

But here’s the kicker: While the demand for military equipment is skyrocketing, European arms manufacturers have been underutilized. Draghi’s call to action could be the catalyst that finally unleashes their potential. Germany, for example, has already ramped up its arms exports by 30% in the first half of 2024, and companies like Rheinmetall are reporting record-breaking orders. Rheinmetall’s CEO, Armin Papperger, recently said, “We have never seen such growth.”

The Düsseldorf-based company is benefiting from increased defense spending across the European Union (EU) and the North Atlantic Treaty Organization (NATO), along with significant orders from Ukraine. Rheinmetall’s strategic foresight—investing early in defense te1chnology, starting in 2014 when Russia first invaded Crimea—has paid off handsomely.

With an expected annual sales growth of €2 billion ($2.2 billion) in the coming years, Rheinmetall is, I believe, a solid play for those looking to capitalize on Europe’s rearmament. (Germany announced this week it would temporarily suspend weapons exports to Israel while it deals with “legal challenges,” Reuters reports.)

Then there’s Thales, one of France’s largest defense contractors. The company has seen record orders in 2024 due to increasing military budgets, with its earnings before interest and taxes (EBIT) margin hitting a new all-time high of 11.5% in the first half of the year.

Thales recently secured three contracts worth over €500 million ($556 million) each, making it one of the best-positioned defense stocks in Europe today. We believe its mix of advanced defense tech and a diverse portfolio makes it a potentially attractive option for investors looking for both growth and stability.

Surge in Defense Funding Bucks Broader VC Downturn

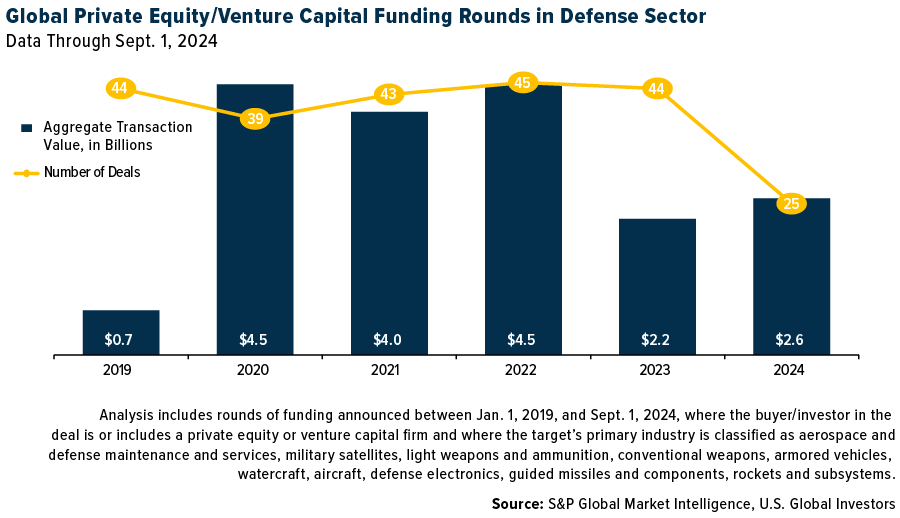

What’s even more compelling is the influx of private equity and venture capital into the defense sector.

As of September 1, 2024, nearly $2.6 billion has been poured into 25 funding rounds, surpassing the full-year total for 2023, according to S&P Global.

This surge in investment contrasts with the broader decline in venture capital funding across most sectors this year. Defense is clearly becoming a priority for investors, and this trend is only expected to grow as Europe gears up for increased military expenditures.

U.S. Election a Wildcard

One wildcard in this equation is the upcoming U.S. presidential election. Analysts at Alpine Macro suggest that a Donald Trump victory could lead to reduced global geopolitical risks. If reelected, the former president might push Ukraine to negotiate a peace deal with Russia, which could de-escalate the conflict and stabilize Europe’s defense outlook.

A Kamala Harris presidency, on the other hand, could exacerbate tensions, as her perceived inexperience might embolden adversaries like Russia and China to test her administration’s resolve, Alpine Macro says.

Despite spending more on its military than the next nine countries combined, the U.S. is, like Europe, contemplating raising defense spending to meet new geopolitical challenges. Speaking before Congress this week, Jane Harman, Chair of the National Defense Strategy (NDS), recommended that the U.S. return “to the levels of spending on national defense, proportionally, as we did in the Cold War.”

That would be a tall order. The U.S. currently spends 3.7% of its GDP on national defense, down significantly from the 15% to 16% it was spending at the height of the Cold War in the early 1950s.

Regardless, European nations will continue to rearm, as they can no longer depend solely on the U.S. for their defense.

The Draghi report should serve as a clarion call for investors. European nations are waking up to the reality that they need to ramp up their own defense capabilities, and arms manufacturers like Rheinmetall, Thales and others are primed to benefit. With the war in Ukraine showing no signs of slowing and geopolitical risks remaining high, there’s hardly been a better time to consider adding European defense stocks to your portfolio.