I think the probability of a recession happening in the next 12 to 18 months is much higher than at any point over the past 12 months. But whether I am right or wrong is irrelevant; the question is, does it really matter?

I will argue that it does not.

I will argue that what matters is what happens to your investments and what, if anything, you should do to get ready in case I am correct.

It would be unwise to continue this blog without restating one of my broken record sayings: you should always be ready for A recession rather than trying to get ready for THE recession.

Another way of saying this is that there is a 100% probability that we will have a recession in the future, but there is close to a 0% chance that you can actually guess when it will start and end.

That means you can’t time your investments based on when you think a recession will start and end. So, you are always better off being ready for a recession at all times as it relates to your investment strategy.

Here are some reasons why I think there is a high probability of a recession over the next year or so:

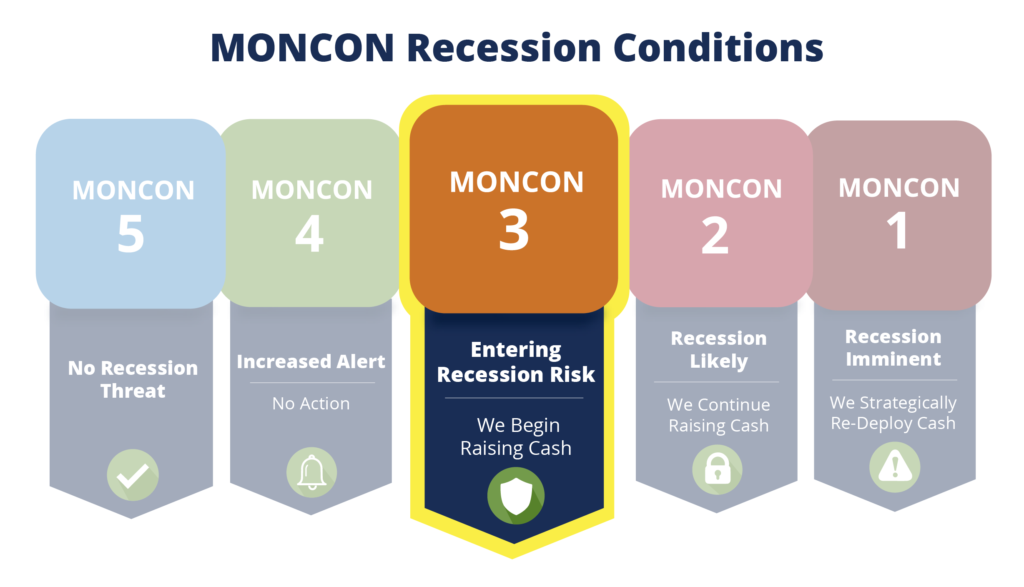

- Our MONCON reading is at THREE, and that’s the first time it has not been a FIVE since we started officially regarding it in our decision-making process*. See our blog here for an explanation of MONCON and how we use it.

*The COVID recession change in MONCON from 5 to 1 in one week doesn’t count in my book because that recession was caused by a single event vs. a changing economy and MONCON tracks the changes in economic indicators. In other words, it’s not an event crystal ball.

- Yield Curve Inversions – While there is a lot of talk about the inversion of the 2/10 yield curve, we have started looking at all the different combinations of yields. There are 28 combinations of yield spreads with enough meaningful data to watch, and 68% of them are inverted.

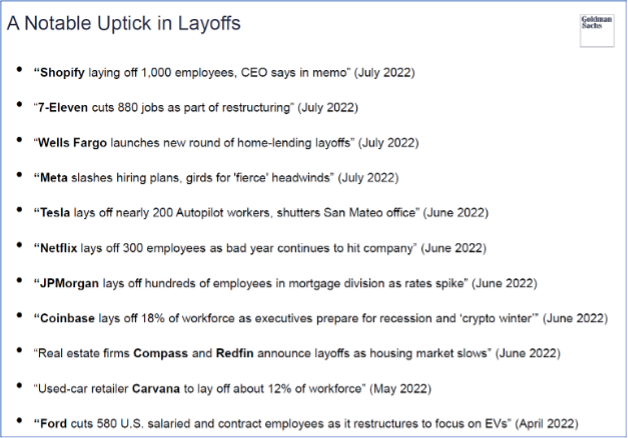

- There have been a lot of layoffs – see below:

Here are some reasons I could be wrong:

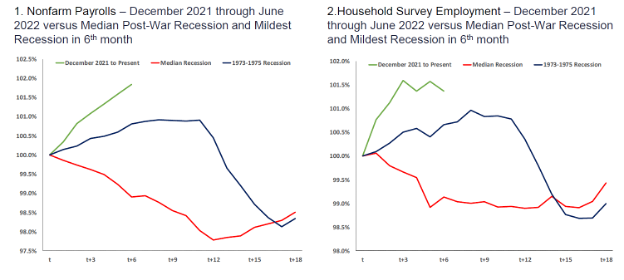

- The recent jobs report – Up solidly this year…not normal in a recession

- The recent household Survey Employment report – Up solidly this year…not normal in a recession

See the green lines below in the charts from Goldman Sachs…it’s just not looking like it normally does in a recession.

BUT DOES IT MATTER!!!???

I think what matters more than being right or wrong about a recession is what happens in the markets (unless you lose your job, but that’s another story).

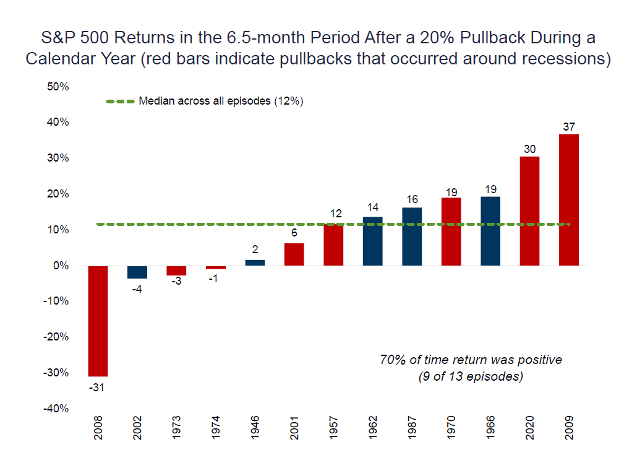

The reality is that 70% of the time, the S&P 500 has positive returns within the next 6.5 months after a 20%+ pullback. Here’s proof, again from a Goldman report – pay attention to the red bars, which indicate the pullback happened during a recession.

Now, here’s what I ALSO see…there are four times when the S&P 500 was negative after 6.5 months after a 20% pullback. (Sorry, that’s a lot of ‘afters’ but I’m not dwelling on it.) Of those four, three are down single digits, with negative 4% being the worst of those three times.

That negative 31% is OUCH of course, but that was 2008. And I don’t think we are in 2008.

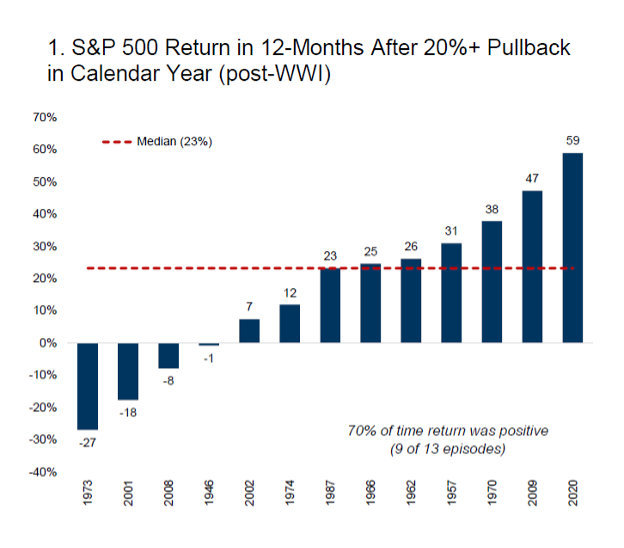

6.5 months – okay, that’s weird…why not 6 or 7? Not sure, but here are the returns lookin’ out at the 12-month mark. (Again: Goldman Sachs)

There is some serious OUCH in here, but again, look at the odds and the returns…70% of the time, the market is positive and the median return is 23%.

By the way…for those of you asking, “Okay, what about two years out?” I’ll spare you the graph and just tell you it’s a +32% median return over the two-year holding period post a 20%+ pullback.

One last point about how it matters more what the market does than if we are in a recession…I promise this is it.

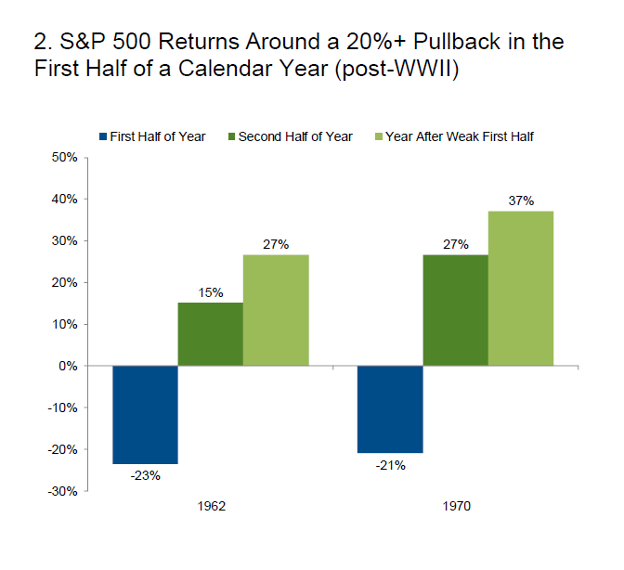

Everyone keeps saying this was the worst first half of a calendar year ever. Okay, if we are going to zero in on a period of time…let’s play it out:

I don’t think I need to explain this any further.

In other words, mic drop on that topic. Hat tip to 1970, where the returns in the second half completely wiped out the losses from the first half of that year, and one full year later, there was a 37% positive return.

What to do

Look, I just have a lot of conviction in the following advice – no one can guess these things any more than someone can guess what two dice will turn up on a craps table. All I know is that a SEVEN is the number where everyone loses. (If you are a craps pro, give me some leeway here so I don’t have to explain the “Come Out” roll.) And SEVEN is also the number with the most combinations of the two dice. After that, the most likely combo is SIX and EIGHT.

Craps players love SIX and EIGHT…because it’s likely to come up.

But with investing, many people like to think they know what’s coming next.

So I’m adamant that using the odds that are in your favor is the best strategy when everything else is simply guessing.

The key here is also knowing there will be times that you may still lose even though the odds are in your favor. See this blog I wrote on the outcome of the Superbowl LIV in 2020. It was when the San Francisco 49’ers had a +90% chance of winning the game against the Kansas City Chiefs with 7:13 seconds remaining in the game.

The 49er’s, with a 10% chance of losing, F’ING LOST.

Your best bet is to take good odds and have a long-term outlook in the market and a short-term outlook on liquidity (meaning HAVE CASH).

Because no one knows what will happen, I think each investor needs to look at how much of their cash they have depleted from their savings and see if it’s enough to make it another 12 months.

If not, given that there has been a rebound back to about a -13.5% loss (depending on when you read this) vs. the low of -22.55% off the last S&P 500 high, you would be silly to forgo doing a plus up the cash now.

Better to be wrong at -13.5% than if we took another downturn and need to raise the cash then.

We may already be in a recession, or it may still be on the horizon, but the equity market does not speak the same language. I advise playing the odds while also playing it a little safe. I do not see the economy as being in an unstable state, which means I have some decent confidence in the odds of the market doing better, even if it’s into the teeth of a recession.

“Create and stick to a plan – that’s the best thing you can do.” Billy Beane, the guy from the movie Moneyball, said that about investing.

(Okay, I made that up, but I swear he would say that 70% of the time if you asked him about investing, so it’s possible I could be wrong.)

Oh, and tune out the noise and the debate over whether we are in a recession or not…it’s all political party bullshit. I can assure you that if it was 2017, when the R’s held the majority in both houses and the White House, R’s would be saying there was no recession, and the D’s would be screaming that two back-to-back negative GDP prints is the classical definition a recession.

Insert face palm emoji.

AND WHO CARES – none of them know a damn thing anyway. So do yourself a favor and turn on the new season of Below Deck Mediterranean Season 7 and watch some real drama if you need a break. Or the Old Man with Jeff Bridges on Hulu…really good after you make it through the first 45 minutes of the first episode.

This first appeared on Monument Wealth Mangement.

Related: The Need for Speed: Navigating the Market Like an F1 Race