That’s what I asked myself when I started analyzing the markets today, as I do every day. And yeah, I ask myself a lot of questions. Especially lately. And not only because we just “pre-launched” our new Sungarden YARP Portfolio investing group at Seeking Alpha, which is already introducing us to a wider audience, for which we are most grateful. No, the “questions to self” part of my day as a longtime professional investor come as fast and furious as ever, given how markets are changing, especially for dividend investors. Frankly, that’s why the launch of the new service is so timely.

To get some of the most relevant questions, analysis and answers out of my head (yes, there are plenty of irrelevant ones that didn’t make the cut here…you’re welcome) and into the minds of our audience, here’s a quick FAQ (frequently asked questions)-style summary of what I’m thinking about and concluding after the long-awaited election.

Note that these are the more “evergreen” items I’m pondering, but I’ll use current market examples to make my points.

1. Is dividend stock investing the same as it used to be?

No way! This is THE biggest missing link for retired and pre-retired investors as I see it. Because the rules of engagement have changed. Market volatility is more tricky, and investors are rewarded more for their willingness to be more active. I didn’t say hyperactive, just not the investor version of a couch potato.

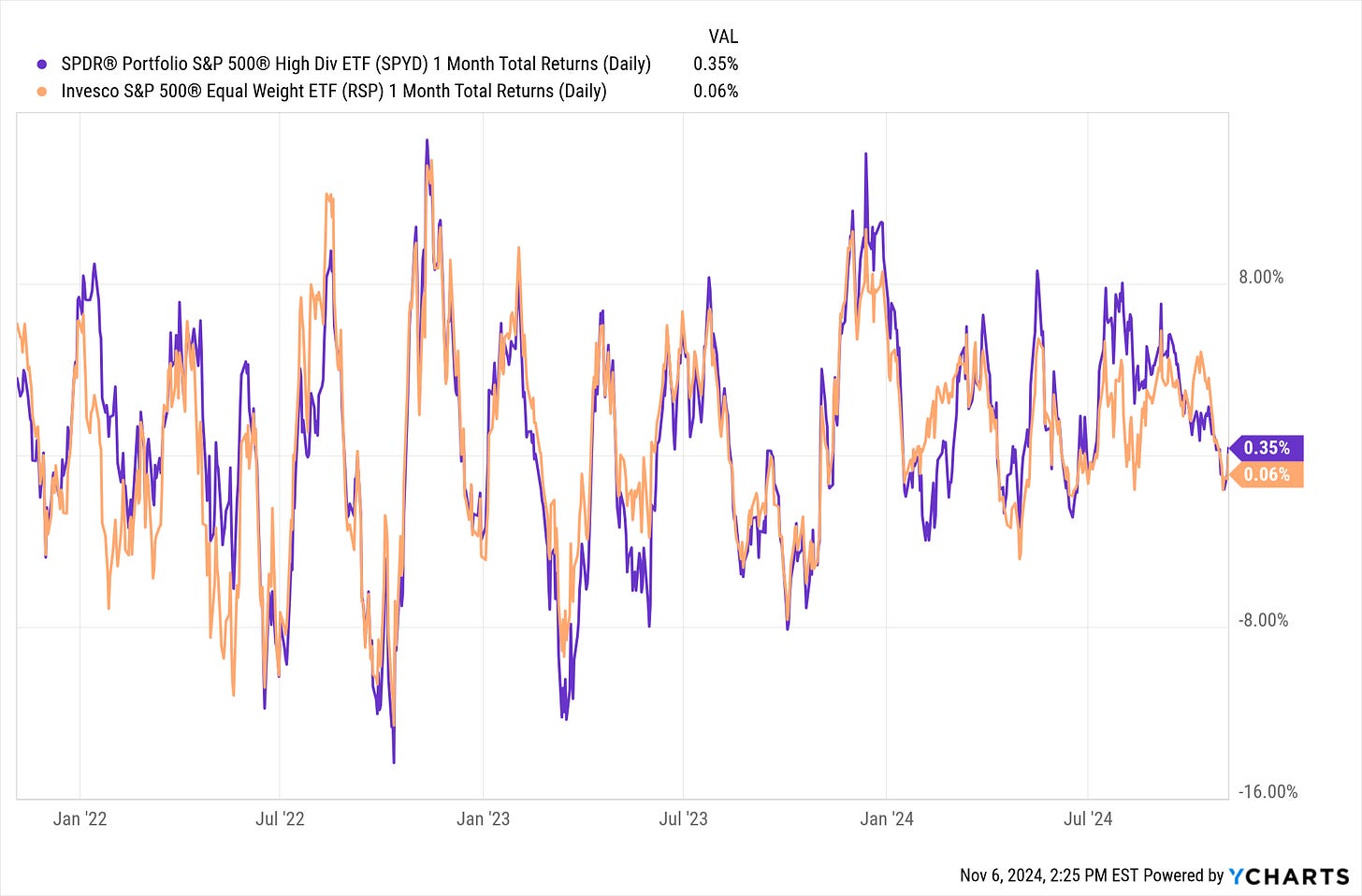

The chart below shows that many stocks move in sync, and this is becoming a feature of modern markets, not a bug, as the saying goes. “High correlation” among stocks is what we call it. That’s the average S&P 500 stock (RSP) and the 80 highest-yielding S&P 500 stocks (SPYD).

The good news is that sometimes the stocks we own are part of a rising tide that lifts all boats. But when markets are rough, there’s often no place to hide. And, a corollary to this aspect of modern stock investing is that dividend stocks act more like the average stock. That is to say, not like the giant Nasdaq stocks that have carried the market in recent years.

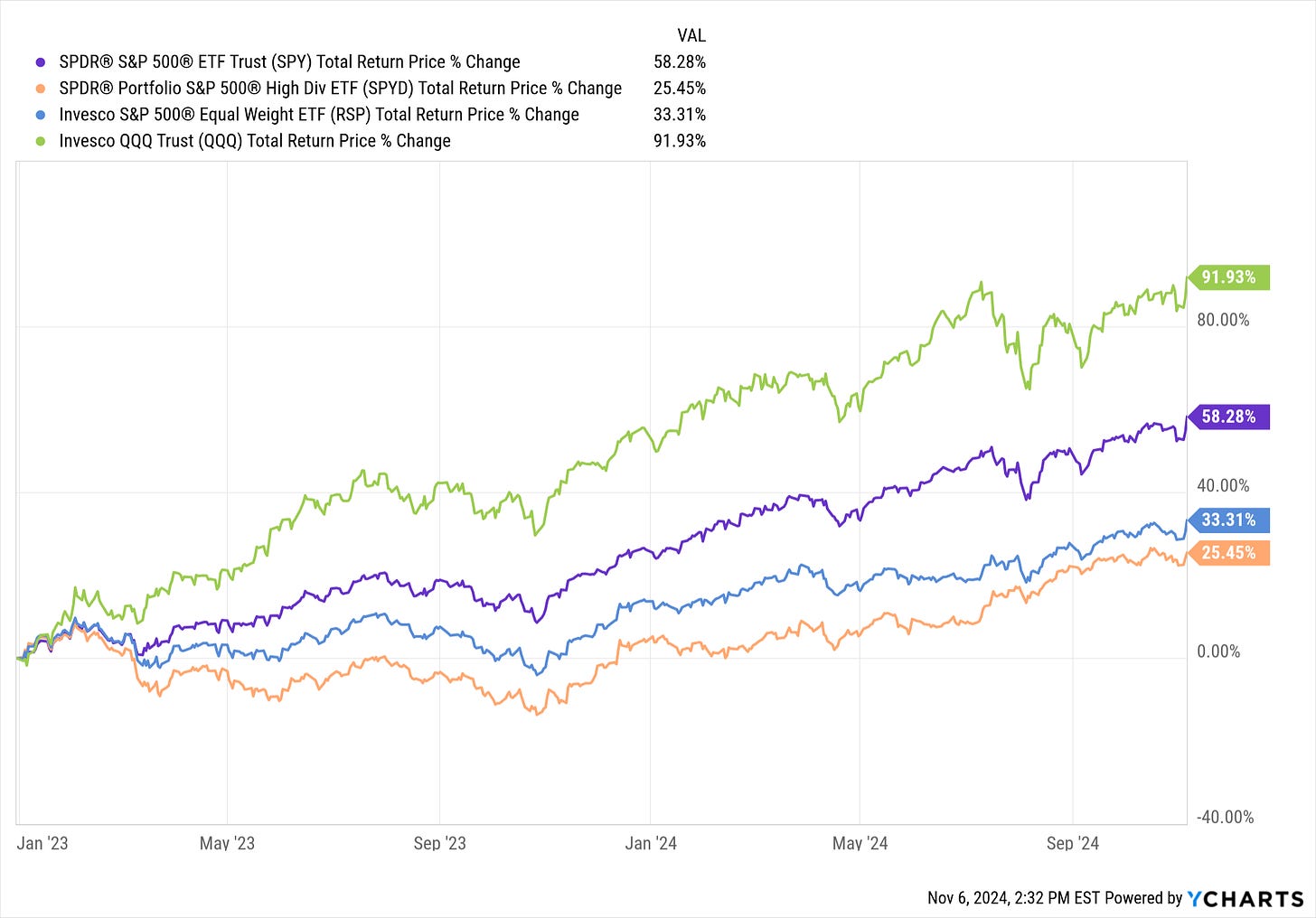

Shown below, the regular, size-weighted S&P 500 ETF (SPY) has outperformed both of these handily since the start of 2023, and we can see why: the big stocks in QQQ are also most of the biggies in SPY.

The takeaway: when investing for dividends, it takes some extra effort to add “alpha” (excess return for the risk taken) above what “everyone else” a.k.a. the market is doing.

2. Are bonds finally a good idea again?

Like so many investing questions, the answer can be frustrating if you invest traditionally. Because you’ve probably been trying to “pick the right time to get in” following that series of 11 Fed rate hikes which took bond yields way up. But recently, the markets told us that while the rate the Fed controls (very short-term) is dipping a bit, longer-term bonds are having another round “in the wood chipper,” to quote a famous movie.

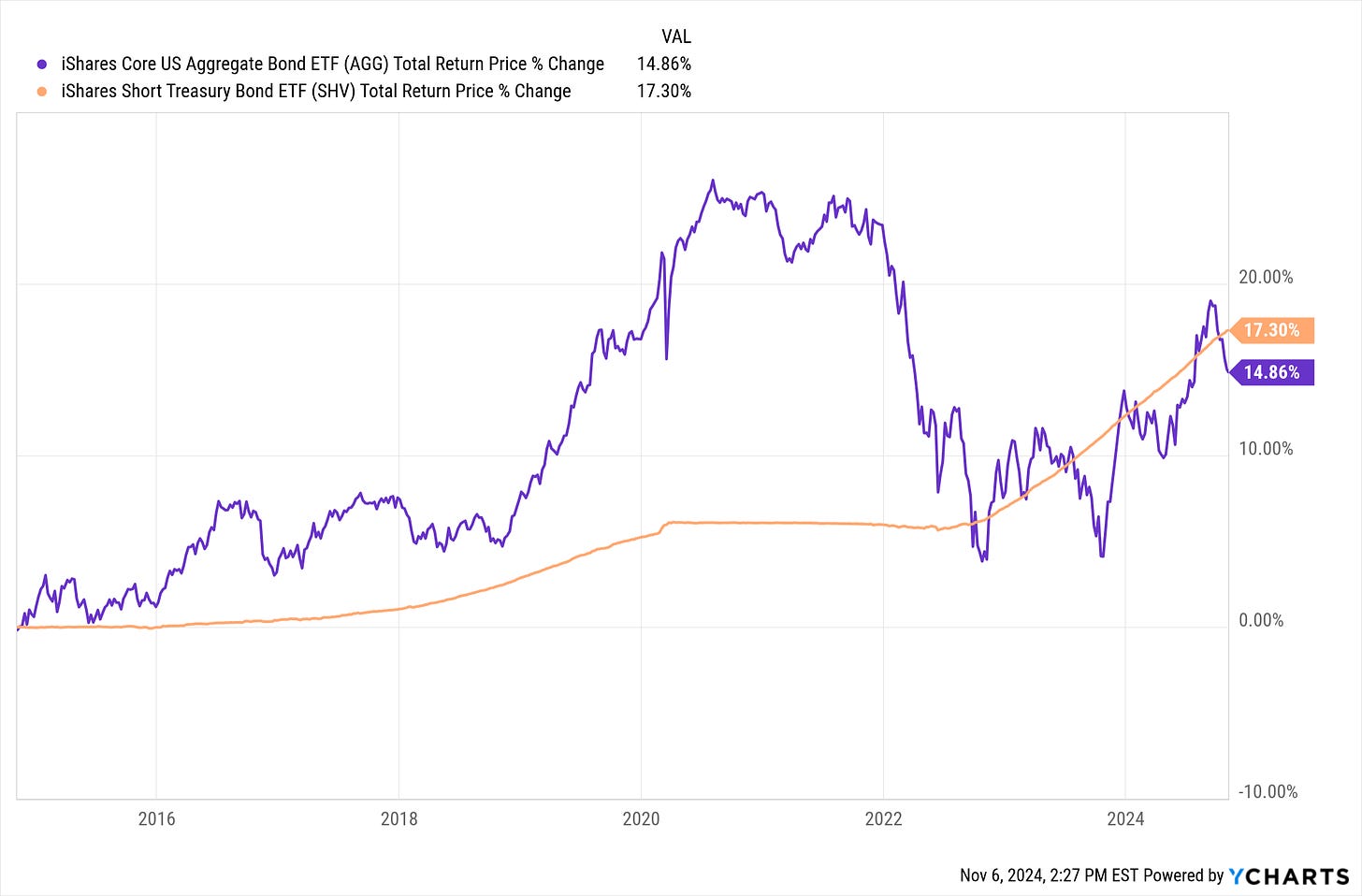

This has gone on for so long, if we go back 10 years, a T-bill ETF (SHV) has actually now outperformed AGG, which is the most popular benchmark for US bonds. 10 years! And that, with T-bills yielding near zero the majority of the time. Wow.

Takeaway: bonds don’t work like they used to. That means income investing doesn’t work like it used to. Bonds have a price-volatility component to them now that today’s investor did not have to grapple with most of their investing lives. So they are unprepared.

3. When rates go up, am I better off in cash since bond prices go down?

If you want to settle for trying to shoehorn standard investment methods into dramatically different market conditions that exist today, I guess the answer is yes. But that prompts another question: why would an investor ever want to settle for that?

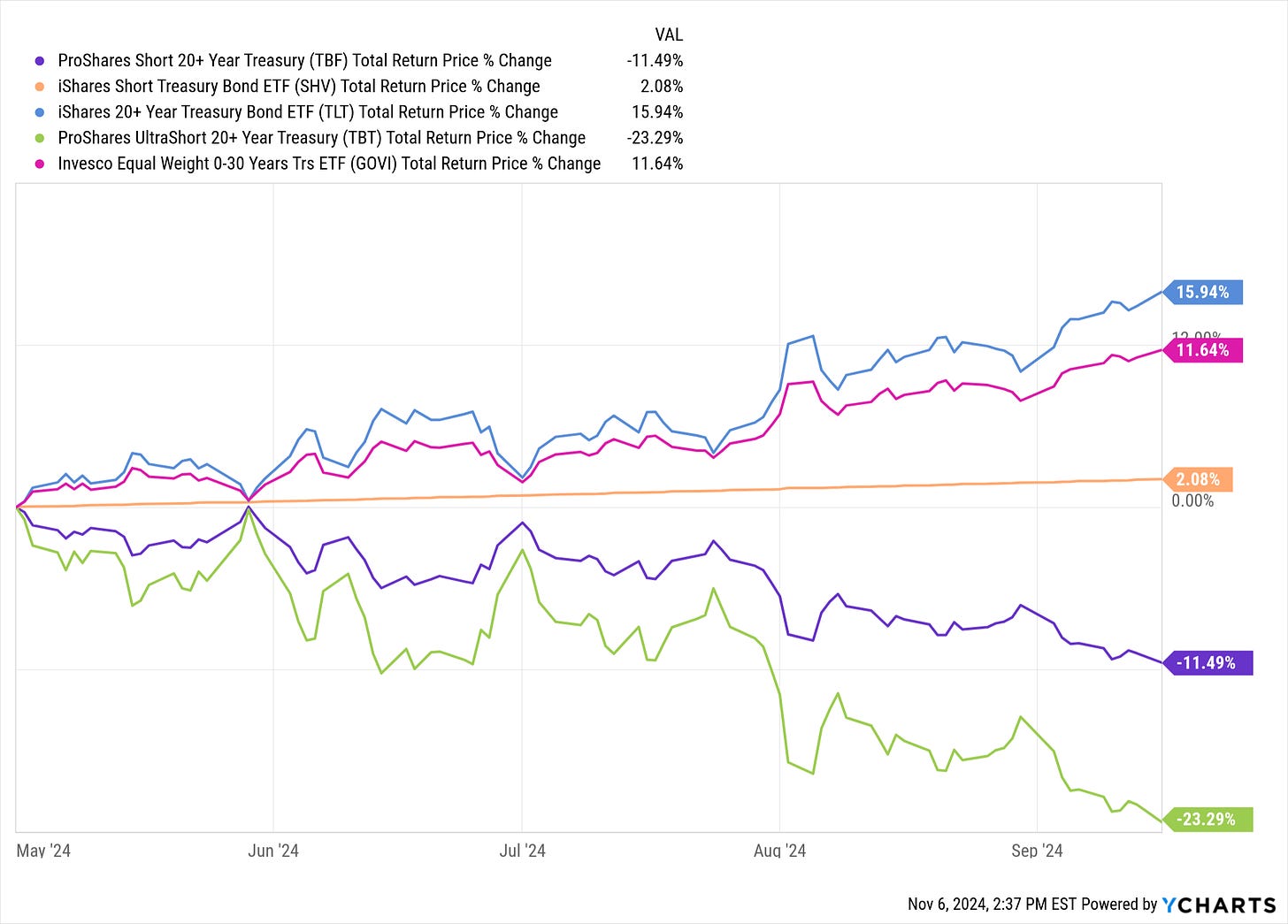

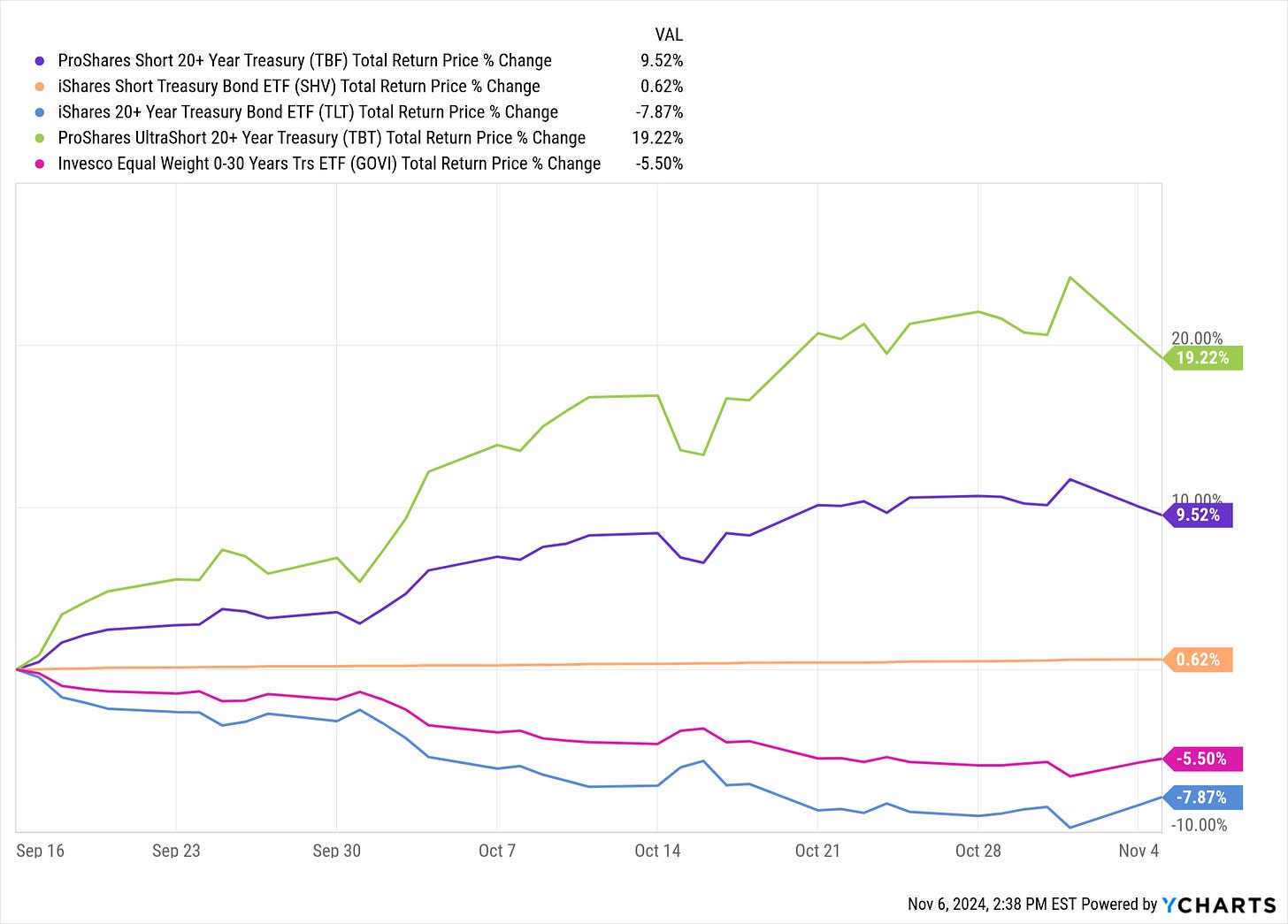

Here’s an exercise in expanding your mind when it comes to just one of many aspects of how modern markets reward the curious, proactive, open-minded types. Below is a chart of 5 different, but related ETFs over the past 6 months, since the date I started the current incarnation of the Sungarden YARP Portfolio using the majority of my own liquid portfolio (yes, we eat our own cooking around here).

These are all related because they all address the same end goal: using the bond market to generate consistent returns with reasonable yield. Or as we call it, Yield At a Reasonable Price (YARP). Pictured are the return paths (including dividends) for that same T-bill ETF I used above, as well as a long-term US Treasury bond ETF (TLT), a “laddered” Treasury ETF (GOVI) and a pair of ETFs specifically designed to do something I suspect most investors didn’t know they could have so easily:

An investment that rises in price when long-term interest rates rise.

From May 1 through September 16 of this year, long-term bonds made up for some lost time, gaining a whopping 16% (TLT), while the laddered portfolio ETF gained over 11%. SHV, the steady one in the group, putted along at a nice 2% return, not bad for 4 1/2 months, with no price volatility (it simply owns T-bills). The other two ETF, the did what we’d expect them to do: lose value.

But here’s the rub: the point I’ve made throughout this post is that today’s markets are like a 4-year old. They rarely sit still. So to me, the missing piece for many, even if they are for the most part “buy and hold” types, is some additional segment of the portfolio that is WILLING TO BE active. This is designed not only to reduce risk, but to exploit volatility.

Why bother? Because while many in my industry have spent the past 2 years trying to “pick the bottom” in bond prices/peak in long-term interest rates, I never assume I’m that smart. Instead, I keep my toolbox full of tools, so that when my market indicators point me toward a higher likelihood of bond prices moving in one direction or the other (or flat, in which case those T-bill yields look juicy), I have the ingredients to pursue total return in any environment.

That really helps when we see that “buying opportunity” in TLT and GOVI evaporate quickly, as it did the past 2 months. See below, where the blue and purple lines that were the “leaders” above quickly turned to “laggards” and vice-versa. TBF responded to that rise in rates/drop in bond prices with a 9.5% return in just the past 7 weeks. And if we danced with the bond market using a bit of leverage, TBT (which is essentially TBF x 2 on a daily basis), rose more than 20% before a brief pullback (note: it was up 5.3% today).

What does all of this mean?

The above has nothing to do with “market timing” and everything to to with risk management and adding flexibility and adaptiveness to the investment process. That’s what my approach has been all about for 3 decades, first as an investment advisor, fund manager and Chief Investment Officer (CIO), and now as what Seeking Alpha calls an Investing Group Leader.

Related: The Simple Step You’re Missing in Objection Handling