Written by: Tim Pierotti

We have a problem. It is not a problem that can’t be fixed but looks increasingly likely to worsen. Decades of an ever-falling cost of capital have led to a predictable outcome: higher debt and higher structural deficits. If the threat of inflation is nowhere to be found and borrowing costs are des minimis, why not? Why not push through another tax cut? Why not authorize increased spending on defense and entitlements? Unfortunately, every good party comes to an end. We have come to the end of what economists call “The Great Moderation.” After so many years of falling inflation, a decade-long crescendo of zero interest rate policy, and finally the spending bonanza that was our response to the COVID pandemic, we finally pushed to the point where inflation was awakened from its dormancy.

In WealthVest’s upcoming whitepaper, Deficits, Populism, and Higher Rates, we will discuss the outlook for our debt and deficits, focusing on the many unpredictable variables that will determine the path. Not only are there economic unknowns, such as long-term productivity, but also a myriad of unknowable political variables. Ultimately, we rely on our elected officials to continuously find prudent compromise. It is our view that prudence is unlikely.

DEFICITS

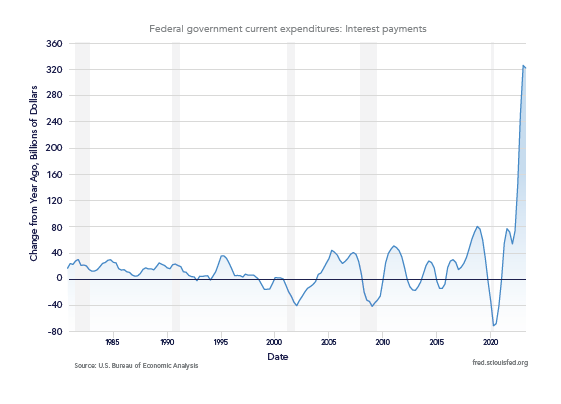

As this chart illustrates, interest expenses are inflicting higher. Higher interest rates add to our deficits. While our deficits have grown unevenly over time, what has changed suddenly is interest rates. In 2024, interest expense is estimated to be higher than defense spending. The return of inflation and the tangible servicing cost of higher interest rates bring deficits to the top of mind for markets.

Related: What Is the QRA and Why Does Everyone All of a Sudden Care About It?