Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

Do not let the media cacophony distract you. Investors must rely on economic and fundamental assessments to direct investment decisions. Trump has a method that often resembles madness by design. Don’t take the bait. A sober survey of economic growth, earnings growth, and interest rate levels offers reassurance that this rally remains rational, and rational actors far outperform irrational actors over time. Having said that, historically, when NFC teams win the Super Bowl, the S&P 500 ends the year 10% higher versus 8% higher when AFC teams win. Cheer accordingly. FLY EAGLES, FLY!!!

No one consumes typeset like Donald Trump. Between tariff fire drills, department closures, federal layoffs, and border reversals, Big Don’s executive orders have rendered the media breathless. Expect this to continue, but don’t lose sight of what ultimately drives stock prices: economic growth prospects, earnings growth rates, and interest rates. Let’s review!

Economic Growth Prospects

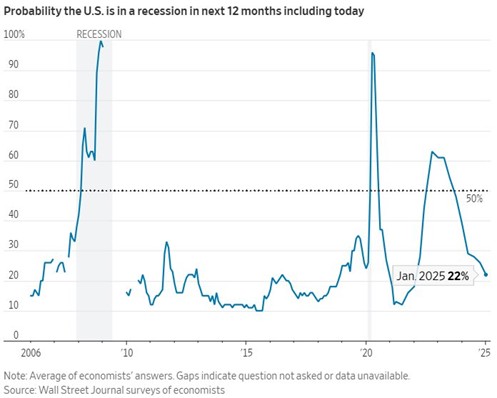

According to the US Federal Reserve, the USA has a long-term potential GDP growth rate of 1.8%. Therefore, anything above 1.8% indicates an economy overperforming and anything less than 1.8% indicates an economy underperforming. While the GDP growth rate descended in the fourth quarter to 2.3%, the US economy advanced 2.8% for the full year, a full percentage point above our potential growth rate and down only slightly from 2023’s 2.9% growth rate. Currently, the Fed’s GDP Now model predicts a 2.9% growth rate for Q1 2025 based on economic data releases to date. For the full year, economists expect the US economy will continue growing above potential while recession odds continue to recede:

Love Trump or hate Trump, the resilient US economy appears poised for another year of above-average growth.

Earnings Growth Rates

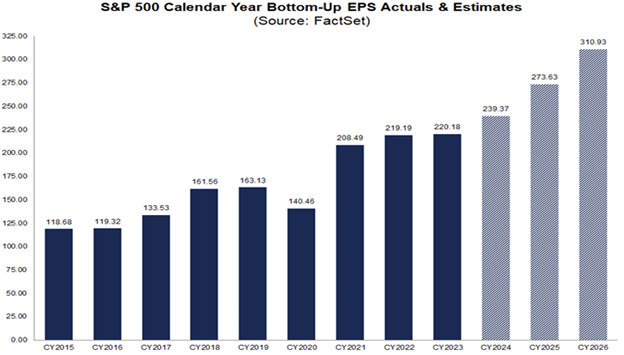

So far, 270 of the S&P 500 companies have reported earnings. Seventy-eight percent have beaten analyst estimates, delivering a 13.5% growth rate overall, exceeding the less than 12% rate expected. For all of 2025, analysts forecast a 13.7% growth rate for S&P 500 earnings, followed by a 14% growth rate in 2026. Should these growth rates materialize, S&P 500 earnings at year-end 2026 will stand a full 30% above year-end 2024 levels. Furthermore, earnings beyond the S&P 500 show even more promise, with S&P 400 companies (mid-caps) expected to grow 32% and S&P 600 companies (small caps) expected to grow 41%.

Source: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_020725A.pdf

Love Trump or hate Trump, US corporations appear poised for another year of above average earnings growth.

Interest Rates

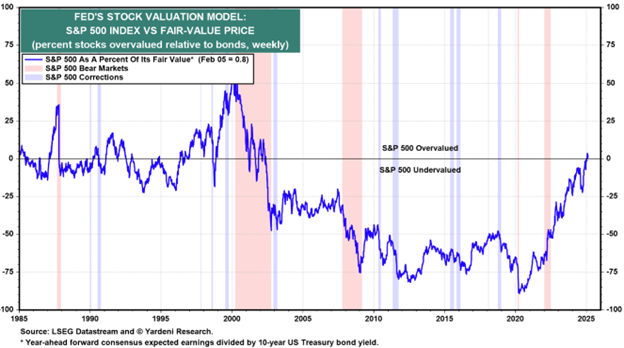

Modern investors pay a disproportionate amount of attention to the short-term Federal Funds rate. While Federal Reserve policy decisions hold high economic influence, most asset prices, and certainly stock prices, rely on longer-term interest rate levels to compute valuation. For simple math, a 3% 10-year Treasury yield supports a P/E level of 33x for the stock market. A 4% 10-year Treasury yield supports a P/E level of 25x for the stock market, and a 5% 10-year Treasury supports a P/E level of 20x for the stock market. With a yield of 4.44% currently, the 10-year Treasury currently supports a P/E level of 22.7x, roughly where the S&P 500 is valued today:

Source: https://yardeni.com/charts/feds-stock-valuation-model/

The chart above compares S&P 500 P/E levels with 10-year Treasury yields. After the great financial crisis, the Fed distorted interest rate levels with zero interest rate policies and continuous quantitative easing campaigns. The markets rightly expected these programs to end and didn’t bid stocks up to astronomical valuation levels as a result.

So, ignore the distorted 2000’s and focus instead on the 1985-2000 period. Clearly, stock valuations and bond yields held a tighter relationship until the late 90s when stock valuations overshot, only to earn their comeuppance in the early 2000s. For the first time in over 20 years, stocks and bond valuations have harmonized. Therefore, movements in the 10-year Treasury yield this year will greatly influence market performance. Of the 51 year-end forecasts compiled by Bloomberg, only three expect higher yields than today. On average, the 51 forecasters expect a 4.12% ten-year yield at year-end.

What about tariff-driven inflation? Won’t that drive up yields?

We received our answer this week as Trump’s tariff talk reduced rates rather than raised them. Why? Raising prices 25% happens once, while the downshift in growth persists. Therefore, the downward force on rates from falling growth expectations exceeded the upward force on rates from rising inflation expectations. For rates to rise materially from here, GDP growth rates would need to rise materially from here. Were that to happen, earnings expectations would rise as well, providing a counterbalance.

Lastly, this week, Trump and Treasury Secretary Bessent called for lower interest rates. The media denounced this as Central Bank meddling. The duo then explained they meant the 10-year Treasury rate, not the Fed Funds rate. Economics… they understand.

Love Trump or hate Trump, the 10-year Treasury appears poised to spend the year within a narrow range that supports current valuation levels.

Special Note: W&A clients will notice trade confirmations in their mailboxes next week. Our investment committee decided to reposition two strategic equity holdings to reduce risk and better align with the Trump agenda. The SEC prohibits us from providing details here. For specific information, please contact your advisor directly. For additional rationale, please tune into our 2025 Outlook on February 20th!

Have a great weekend and enjoy the game!

Related: The Financial Side of Home Automation: Key Business Insights

Sources: Wall St. Journal surveys of economists, FactSet, LSEG Datastream and Yardeni Research