Markets are mixed as a myriad of central bank developments coincide with softer-than-expected economic data. News that the BoE decided to keep rates steady ahead of an election despite inflation reaching its 2% target is sending yields north. The development is worrying rate watchers of a hawkish precedent that may extend to the Fed. Meanwhile, the lowest level of stateside construction activity since the depths of the pandemic alongside upside beats on unemployment claims are concerning investors about the consequences of the long and variable lags of restrictive monetary policy.

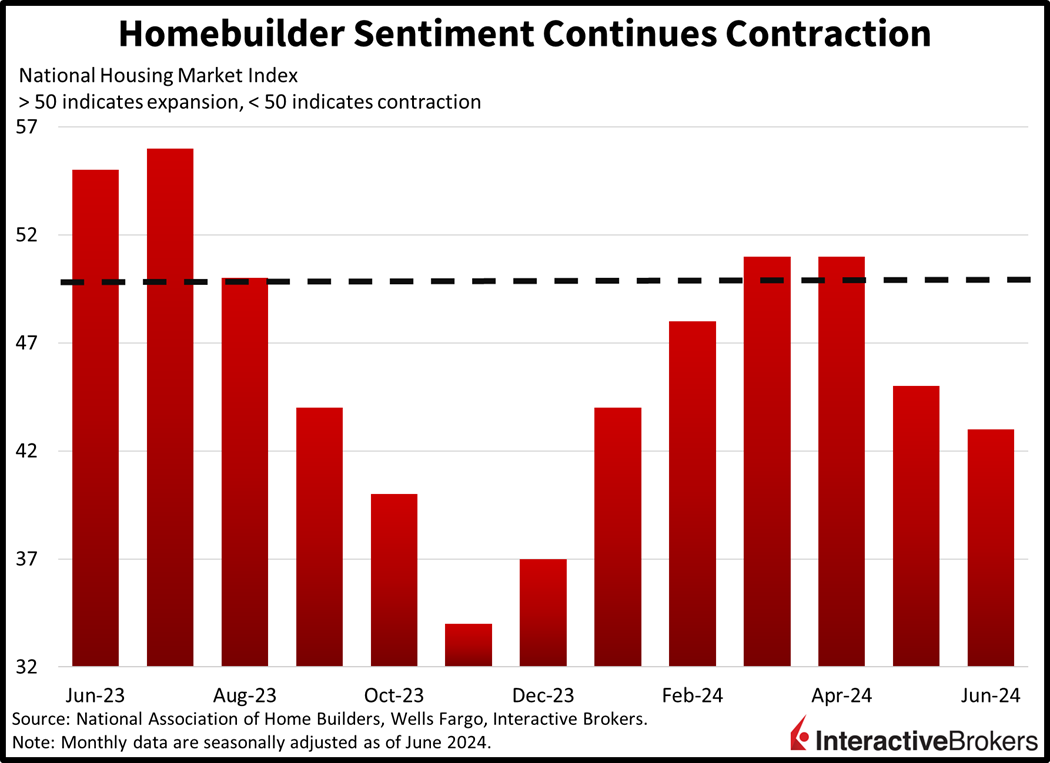

Homebuilder Sentiment Contracts

Homebuilder sentiment sank in June with the NAHB/Wells Fargo Index declining to 43 from May’s 45. It was the second-consecutive drop after the benchmark lingered at 51 in March and April and it substantially trailed the analyst expectation of 46. For June, sentiment for present single-family sales dropped from 51 to 48 while the subindex for single-family sales during the next six months fell from 51 to 47. The level of prospective buyers also sank, dropping from 30 to 28.

The National Association of Homebuilders (NAHB) attributes the decline to higher interest rates, a chronic labor shortage and a lack of buildable lots. Interest rates for 30-year mortgages declined 8 basis points (bps) recently but are still high at approximately 6.94%. Builders are trying to fight the headwind of lofty mortgage rates by making their pricing more appealing. According to the NAHB, 29% of builders say they have reduced prices while 61% are offering sales initiatives, up from 59% in May.

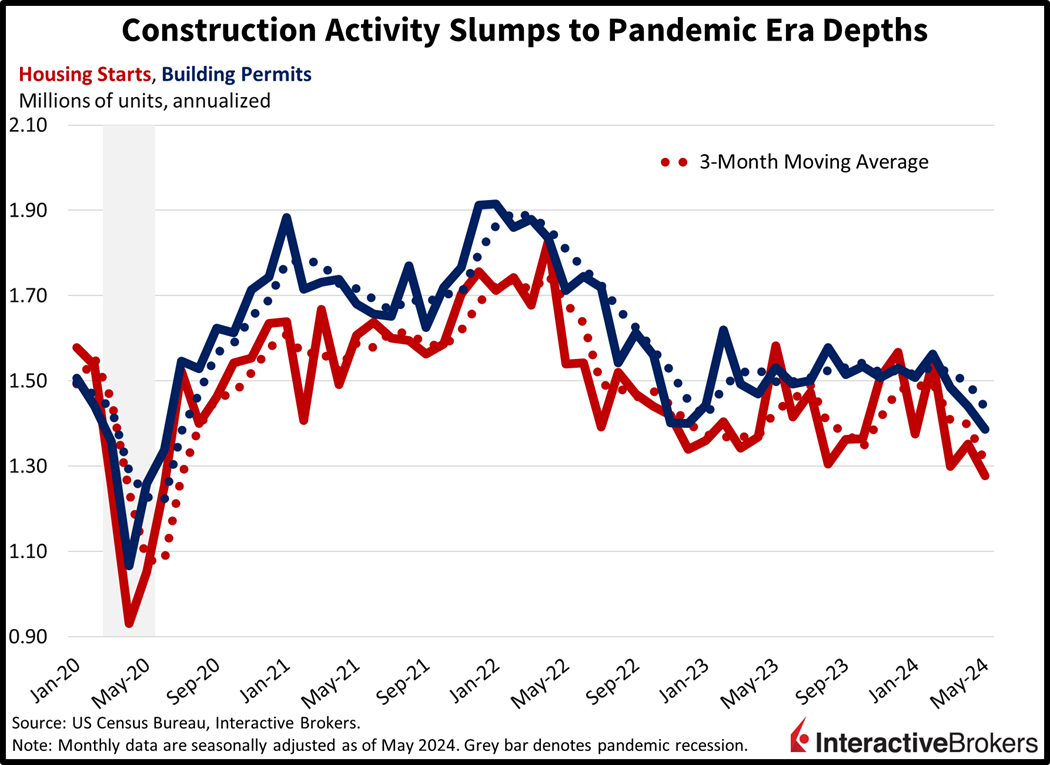

Construction Activity Tanks

Out-of-reach housing affordability, a result of the unfavorable rate-price mix, sent homebuilders to their bunkers last month. Construction activity dropped to its weakest volume since the summer of 2020, months characterized by stay-at-home lockdown orders resulting from the Covid-19 pandemic. Indeed, building permits and housing starts slumped to the basement last month, as 1.386 million and 1.277 million seasonally adjusted annualized units printed the lowest levels since June 2020. May’s figures dropped from April’s 1.44 million and 1.352 million and missed economists’ projections for increases to 1.45 million and 1.37 million.

The apartment building category weighed most on construction activity last month with single-family projects declining more modestly. Multi-family permits and starts declined 6.1% and 10.3% month over month (m/m), while the single-family segment slipped by 2.9% and 5.2%. From a regional perspective, only the West made progress on both permits and starts, with m/m activity increasing 7.1% on the former and 10.4% for the latter. Meanwhile, the Northeast and South saw m/m decreases of 22.4% and 6.6% for permits and 2.5% and 8.5% for new starts. The Midwest saw bifurcated action, as permits grew 8.4%, but starts slid 19% during the period.

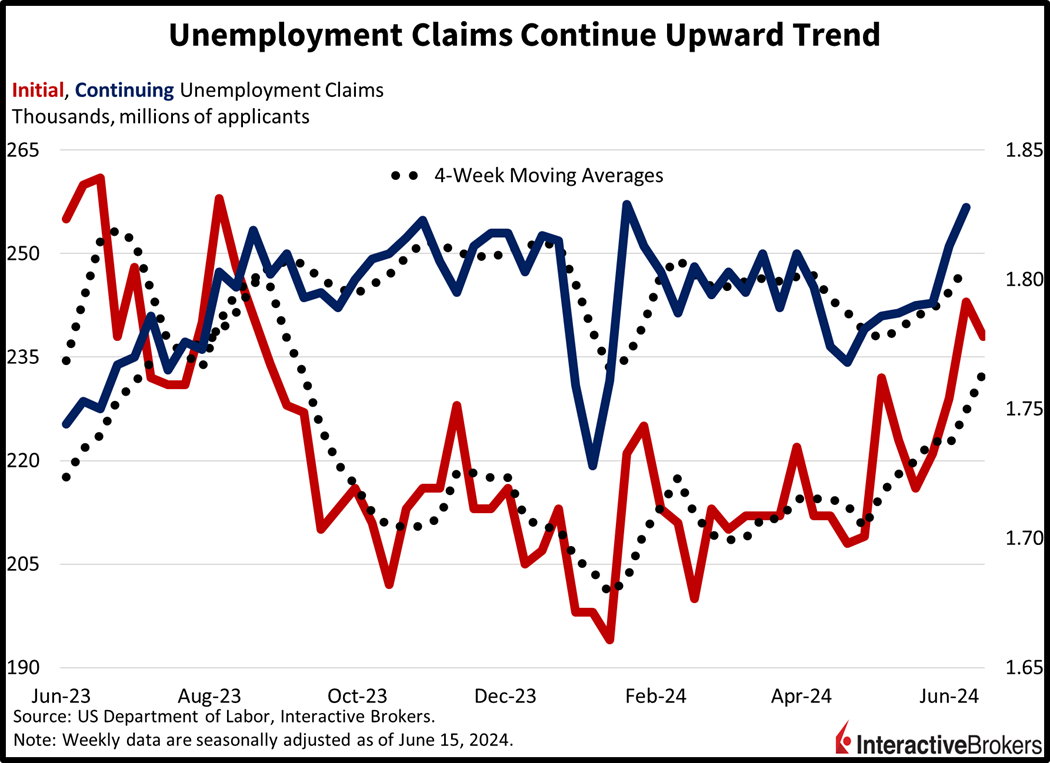

Labor Market Continues Cooling

After reaching multi-month highs for layoffs and continuing claims for the weeks ended June 8 and June 1, respectively, today’s data showed continued cooling. Initial jobless claims slipped slightly to 238,000 for the week ended June 15. Analysts expected claims to reach 235,000. Continuing unemployment claims, however, climbed from a revised 1.813 million to 1.828 million and exceeded expectations for 1.81 million.

The four-week moving averages for initial claims and continued claims were 232,750, an increase of 5,500 from the previous period, and 1.806 million, up by 10,250 from the preceding 28-day timeframe, reflecting softening employment trends.

UK Maintains Rates While Switzerland Makes Second Cut

The Bank of England (BoE) this morning refrained from making an initial rate cut, but certain policymakers expressed optimism that inflation is waning significantly, creating enthusiasm about potential for the organization to ease its policy in August. The bank said the decision to maintain the current record-high 5.25% rate was “finely balanced” among its nine members, and Governor Andrew Bailey said he is encouraged by inflation dropping to the BoE’s 2% target, the first time it has done so in nearly three years. Much like the US Federal Reserve, however, Bailey said he wants to be sure that inflation is subdued before lowering the rate. In addition to BoE comments, a June 11 report showing that unemployment unexpectedly climbed to 4.4% is supporting expectations for an August rate cut, with investors placing a slighter better than coin-flips odds of the central bank doing so. Similarly, Norway’s central bank announced yesterday that it expects to maintain its current 4.5% key rate for some time. Strong wage growth is likely to support price pressures and cutting rates now could sustain inflation.

While the UK and Norway are in holding patterns, the Swiss National Bank (SNB) cut its rate 25 bps to 1.25%. It is the second reduction following the March start of the country’s easing phase. Last month, inflation dropped to 1.4%. In announcing the rate cut, the bank revised its annual inflation forecast to 1.3%, down 10 bps from its previous forecast. The bank also estimates that GDP inflation will average 1.1% in 2025 and 1.0% in 2026 based on the current rate being maintained. It expects the economy to expand approximately 1% this year and 1.5% in 2025.

Equities Seek Gains but Yields Climb

Market trading is bifurcated as stocks attempt to extend gains while yields, commodities ex-lumber and the greenback move north. All major US equity indices are modestly higher, achieving increases between 0.1% and 0.3%. Sectoral breath is split and featuring unfamiliar leadership stemming from the energy and utilities segments; they’re up 1.9% and 0.5%. Energy is carrying the most upside as US supplies contracted more than expected last week, pushing up the price of WTI crude oil 1%, or $0.80, to $81.40 per barrel. While today’s gainers haven’t led in a while, neither have today’s biggest losers, as technology leads the laggards with its basket lower by 0.4%. Real estate and consumer staples are also losing 0.2% a piece. Hawkish central bank moves and bearish technicals are pushing up borrowing costs, with the 2- and 10-year Treasury maturities being offered at 4.75% and 4.27%, 4 and 5 bps loftier on the session. Comparably, the Dollar Index is higher by 31 bps, as the greenback gains relative to all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. The Swiss franc surrendered value in response to the central bank cutting rates. In commodity land, most majors are higher with silver, gold and copper gaining 3.1%, 1.3% and 0.9%. Lumber is getting hammered, however, on the back of the dismal prospects of the real estate sector; it’s down a whopping 2.9%.

Could the Fed Pull a BoE?

This morning’s econ figures and central bank moves are leading to tricky trading in markets. While sluggish numbers typically weigh on rates, the impact of troublesome real estate trends and decelerating labor conditions is being negated by messages from central bankers. If rates have bottomed in the near-term against the backdrop of rising commodity prices and stocks at all-time highs, there’s certainly room above for borrowing costs to go higher. Furthermore, if the BoE’s patient rhetoric is emulated in the states to the tune of a delay in the initial rate reduction being measured in numerous months of even quarters, as proposed by brand-new St. Louis Fed President Alberto Musalem, markets will need a sharp adjustment.