Written by: Marc Odo | Swan Global Investments

Risks for Equity Investors to Consider

In a previous post, we explored the negative impact of rising inflation upon bond holders. Does this mean that equities are the solution to inflation? Unfortunately, equities are not immune to the scourge of inflation. In this post we will explore why.

How Does Inflation Impact Corporate Profits?

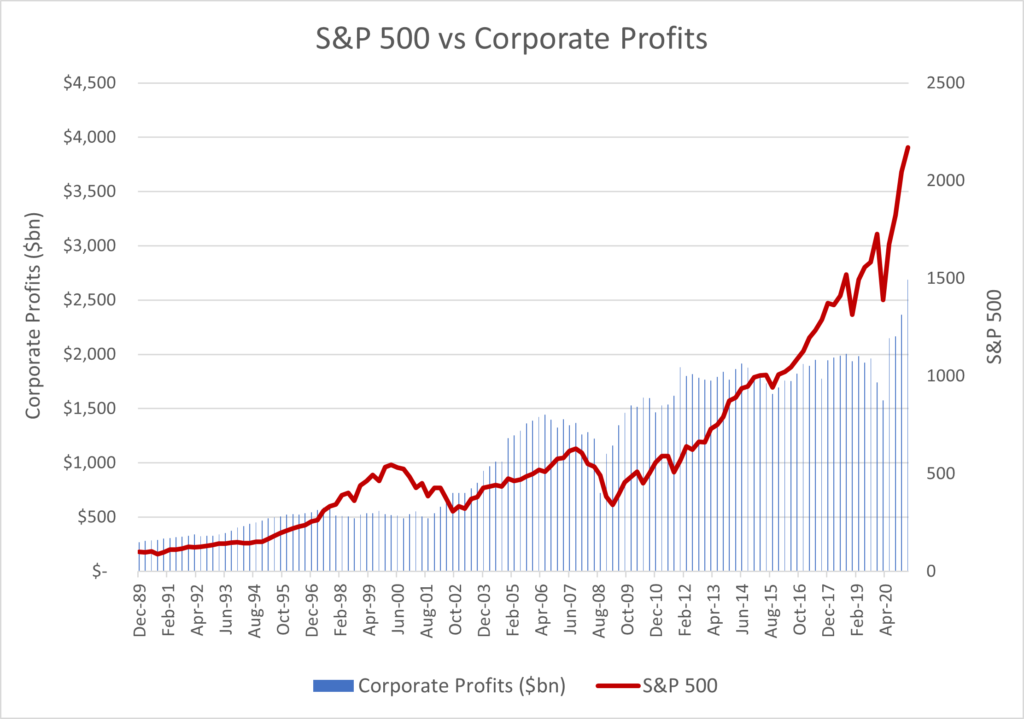

There is no denying that U.S. equities have been a terrific investment over the last several decades. Even taking into consideration the bear markets of the Dot-Com Crash (2000-02), the Global Financial Crisis (2007-09) and the Covid-19 Panic (2020), the S&P 500 was up an average of 10.5% per year since January 1990. This culminates in a 2,271% return through September 30th, 2021.

Source: Zephyr StyleADVISOR, Federal Reserve Bank of St. Louis. Corporate Profits After Tax (without IVA and CCAdj), Billions of Dollars, Quarterly, Seasonally Adjusted Annual Rate

Throughout this period, the profitability of corporate America also surged, setting record highs. Corporate profitability, shown as the blue bars in the graph above, has been bolstered by many factors, including:

- A low inflationary environment, which allowed companies to plan for the future and make capital expenditures

- Globalization and the off-shoring of supply chains, keeping costs low

- A docile labor force, unable to demand meaningful wage increases

- An extremely loose monetary policy, which enabled firms to issue record amounts of debt at very low servicing costs

As one surveys the post-Covid landscape it is fair to ask how many of these factors have been thrown into reverse. Whether transitory or secular, the return of a higher rate of inflation impacts all the above. Inflation adds uncertainty to long-term planning and rising interest rates can hurt companies’ balance sheets. The cost of inputs to production- both physical and human- are rising. Production is being reallocated around the globe, bottlenecks appear in the supply chain, and workers are demanding and receiving wage increases.

What were once tailwinds for corporate profitability are now headwinds. Companies are now left an unappetizing set of options:

- They can eat the higher costs, cutting into their own profitability

- They can squeeze their suppliers, impacting the profit margins of the supplier companies

- They can pass on higher costs to their customers, depressing demand and market share

Taken to their logical conclusion, all these bad choices should negatively impact the valuation and outlook for corporate America. Given the fact that equity market valuations are near historic highs, this could cause problems if one revisits or changes their assumptions about inflation.

Inflation’s Impact on Stock Valuations

There is an additional consideration to keep in mind when it comes to the impact of inflation on the broad stock market. Today the S&P 500 is heavily tilted towards growth stocks and price/earnings ratios are near historic highs.

Why is this a problem? After all, if growth stocks represent the most dynamic part of the economy, shouldn’t they be best placed to outrun inflation?

Not necessarily.

The problem has to do with attempting to find the current value of future earnings. In a recent blog post, “What is a Stock Worth?” we explored the idea that the long-term value of an equity is based on its earnings.

A second recent post, “The Effects of Inflation”, discusses the idea that future cash flows must be discounted by the time value of money – i.e., inflation. If we combined these two concepts, we see why the growth-tilt and high valuation of the S&P 500 might be susceptible to rising inflation.

If an investor is happy to purchase a stock with a P/E ratio of 30, the implication is that the next 30 years’ worth of earnings is adequate compensation for the cash price today. But the problem with a high inflationary environment is the far-off earnings decades from now should be discounted or penalized by a higher rate to accommodate the corrosive impact of inflation.

The valuation of a stock today should be less if its future earnings will not be worth as much in real terms. Just like a 30-year bond is more susceptible to inflation than a 10-year bond, a stock with a P/E of 30 is more sensitive to inflation than a stock with a P/E of 10.

Inflation’s Impact on Demand

The beauty of a free market economic system is that it contains self-correcting mechanisms that reign in excesses. Suppliers respond to high prices by producing more. Consumers respond to high prices by curtailing their demand or finding substitutes. Barring outside interference, the “invisible hand” will naturally guide supply, demand, and prices until an equilibrium is reached.

However, that doesn’t mean that when these corrections occur, there won’t be losers. If the big post-COVID-19 run-up in the markets was driven by fiscal and monetary stimulus coupled with pent-up demand, it is reasonable to ask how the market will fare once those drivers are halted or reversed.

- Will higher airfare, rental car, and hotel prices cause vacations to be postponed?

- Will the surge in lumber and building supply costs cause homeowners to delay putting a new addition on the house?

- How expensive is it to hire labor to build that planned new addition?

- Will price spikes in necessary purchases of staples like food and gasoline leave less money to be spent on fun items like a new flat-screen television or a new iPhone?

Across America these are the kinds of questions households are asking themselves. While individually these decisions might not seem like much, together they form the two-thirds of the economy that is consumer demand. Should inflation rise far and fast enough, it might dampen demand to the point of having a negative impact on the economy and the stock markets.

Solution for Equity Investing In an Age of Inflation

There are numerous inflationary pressures impacting the economy right now. The duration and intensity of the inflation will ultimately determine the impact on the capital markets. If bonds are threatened by inflation and if equities are also susceptible to inflation risks, what is the average investor to do?

Swan believes downside risk is ever-present in the market but is especially relevant today. Given the interest rate environment, equity markets appear to provide better long-term returns. While many have tilted portfolios towards increased equity exposure to fuel returns, they do so while taking on more risk.

We believe hedged equity provides investors with a timely option.

Our “Always Invested, Always Hedged” approach to hedged equity combines passive investment in equities to fuel potential returns and active risk management using put options, which are designed to increase in value during market sell-offs. Our distinct investment approach, first launched in 1997, is applied to a range of hedged equity funds and strategies.

No one knows how stocks might fare in the face of higher inflation, but investors utilizing Swan’s hedged equity approach are prepared.

Related: DRS vs. Put Spread Collars