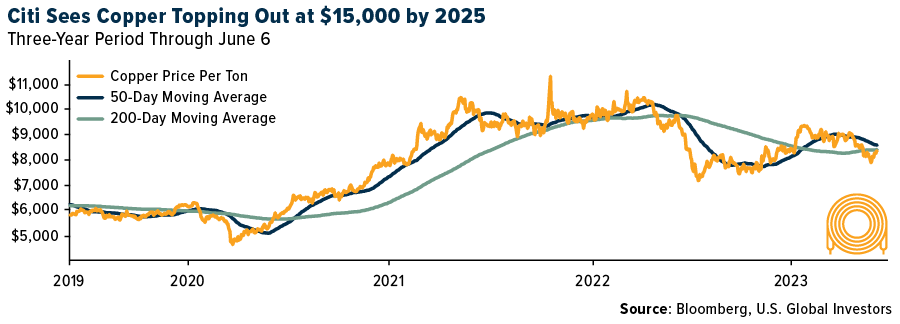

In an interview with Bloomberg this week, Max Layton, Citi’s managing director for commodities research, said he believes now is an ideal time for investors to buy, as the price of copper is still muted on global recession concerns. The red metal is currently trading around $8,300 a ton, down approximately 26% from its all-time high of nearly $11,300, set in October 2021.

According to Layton, copper could top out at $15,000 a ton by 2025, a jump that would “make oil’s 2008 bull run look like child’s play.”

Citi also pointed out that copper may dip further in the short-term but could begin to rally in the next six to 12 months as the market fully recognizes the massive imbalance between supply and demand, a gap that’s expected to widen as demand for EVs and renewables expands.

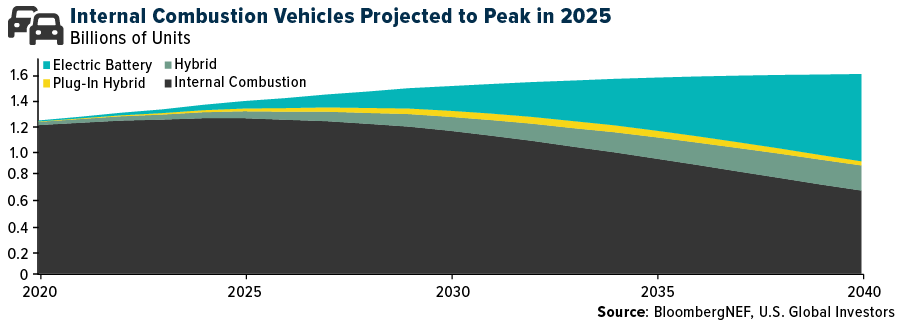

Internal Combustion Vehicle Sales Set To Peak This Decade: BloombergNEF

As I’ve shared with you many times before, EVs can use up to triple the amount of copper as traditional internal combustion engine (ICE) vehicles do. This poses a problem, as fewer and fewer copper deposits are being discovered, and the time between discovery and production has lengthened over the years as costs rise. According to S&P Global, of the 224 copper deposits that were discovered between 1990 and 2019, only 16 were found in the past 10 years.

Meanwhile, EV sales continue to rise. Last year, these sales reached a total of 10.5 million, and projections by Bloomberg New Energy Finance (NEF) suggest that they could escalate to around 27 million by 2026. Bloomberg predicts that the global fleet of ICE vehicles will peak in as little as two years, after which the market will be dominated primarily by EVs and, to a lesser extent, hybrids. By 2030, EVs might constitute 44% of all passenger vehicle sales, and by 2040, three could account for three quarters of all vehicle sales.

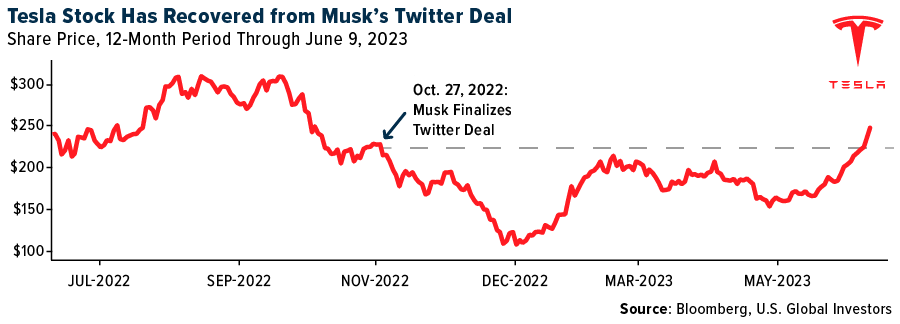

Tesla Stock Supported By String Of Positive News

Tesla, which remains the world’s largest EV manufacturer, has seen its stock increase over 100% year-to-date in 2023, making it the third best performer in the S&P 500, following NVIDIA (+166%) and Meta (120%). In fact, shares of Tesla have now fully recovered (and then some) from October 2022, when CEO Elon Musk purchased Twitter for $44 billion. This raised concerns among investors about Musk’s ability to run the EV manufacturer while taking on a new, time-intensive project, not to mention also juggling SpaceX.

Today marked the 11th straight day that shares of Tesla have advanced, representing a remarkable winning streak that we haven’t seen since January 2021.

The Austin-based carmaker got a huge boost this week after it announced that its popular Model 3 now qualifies for a $7,500 EV consumer tax credit. This action means that in California, which applies its own $7,500 tax rebate for EV purchases, a brand new Tesla Model S is cheaper than a Toyota Camry.

To qualify for the U.S. tax credit, Tesla had to make changes to how it sourced materials for its batteries in accordance with the Inflation Reduction Act (IRA), signed into law in August 2022. The IRA stipulates that 40% of electric vehicle battery materials and components must be extracted or processed in the U.S. or in a country that has a free trade agreement with the U.S. This manufacturing threshold will increase annually, and by 2027, 80% of the battery must be produced in the U.S. or a partner country to qualify for the full rebate.

Tesla stock also benefited from yesterday’s announcement that drivers of EVs made by rival General Motors (GM) would be able to use Tesla’s North American supercharger network starting next year. The deal not only gives GM customers access to an additional 12,000 charging stations across the continent, but it also vastly increases Tesla’s market share of the essential charging infrastructure.

Musk’s Hunt For Copper

Thinking ahead, Musk reportedly met virtually last month with L. Oyun-Erdene, prime minister of Mongolia. The details of their discussion were not fully disclosed, but it’s worth pointing out that Mongolia is a copper-rich country, home to the world’s fourth-largest copper mine, operated jointly by Rio Tinto and the Mongolian government. In May, Rio Tinto announced that production had finally begun at the mine, which sits 1.3 kilometers (0.8 miles) below the Gobi Desert.

With access to this copper, perhaps Tesla is planning to build a metals processing plant in Mongolia? This would make sense, as the company maintains a factory in Shanghai, China.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.34%. The S&P 500 Stock Index rose 0.37%, while the Nasdaq Composite climbed 0.14%. The Russell 2000 small capitalization index gained 1.83% this week.

- The Hang Seng Composite gained 1.99% this week; while Taiwan was up 1.07% and the KOSPI rose 1.53%.

- The 10-year Treasury bond yield rose 5 basis points to 3.74%.

Airlines And Shipping

Strengths

- The top-performing airline stock of the week was Turkish Air, which increased by 17.9%. Recent data from the International Air Transport Association (IATA) indicates a two-point improvement in global passenger traffic compared to 2019 in April, with South America leading the surge by four points. European traffic was at 92% of 2019 levels, and global capacity improved 3 points to 92% of 2019 levels. The Middle East led this advance while Europe remained steady at 94%. Overall, global loads were stable at 81%, with Europe at 84%.

- After two years of negotiations, FedEx Express has reached a tentative agreement with the Air Line Pilots Association, International. The union’s negotiating committee will present this agreement to the chair of the FDX ALPA Master Executive Council. If leadership endorses the deal and calls for a ratification vote, the agreement’s full text will be released. This development follows the union’s strike authorization in May, which intended to pressure FDX into reaching an agreement rather than initiating a strike.

- According to IATA, airline profit expectations have risen by $5.1 billion to $9.8 billion, marking a $13.4 billion increase from 2022’s loss of $3.6 billion. The largest profit revision was in Europe, which rose by $4.5 billion to $5.1 billion. Despite a lower traffic growth forecast, Middle East profits also increased modestly to $1.7 billion.

Weaknesses

- The weakest performing airline stock of the week was Qantas, falling by 7.3%. European airline bookings as a percentage of 2019 levels dropped to 88%, after remaining stable for the previous two weeks. Overall net sales dropped by 2% week-on-week, with intra-Europe net sales down 15% compared to 2019 and 3% higher week-on-week. International net sales fell 11 points to 89% of 2019 levels (versus 106% in the previous week) and declined by 3% week-on-week.

- A labor deadlock between West Coast terminal/ocean carriers and the International Longshore and Warehouse Union (ILWU) has essentially halted or considerably restricted operations at the ports of Los Angeles, Long Beach, Oakland, Seattle, Tacoma and several smaller West Coast ports. The current negotiation is especially heated, occurring at a time when cargo volumes are significantly lower (with LA/LB inbound containers down 31% year-on-year), and when held inventory levels have greatly decreased.

- Delta Air Lines has reduced its capacity in September by 60 basis points and in October by 100 basis points, primarily in domestic markets. As a result, third-quarter capacity is tracking about a point below their 18.5% forecast.

Opportunities

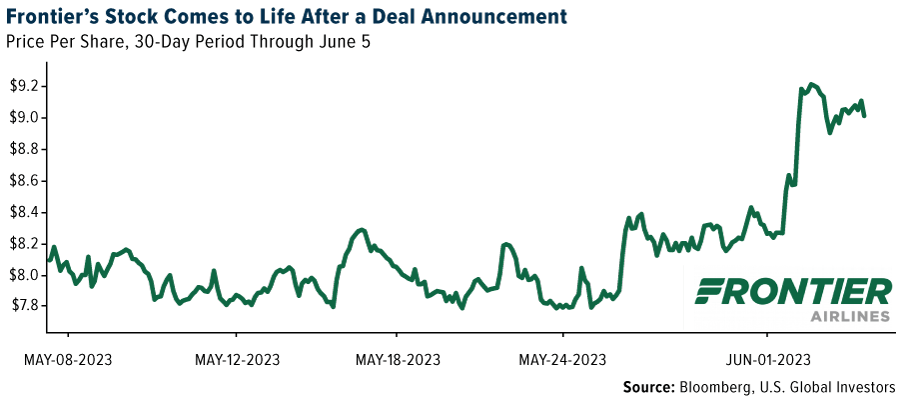

- JetBlue and Frontier have signed a definitive agreement whereby JetBlue will divest all of Spirit Airlines’ holdings at New York’s LaGuardia Airport to Frontier, if JetBlue successfully acquires Spirit. The agreement includes the transfer of six gates at the Marine Air Terminal and 22 takeoff and landing slots, but only if JetBlue’s acquisition of Spirit Airlines succeeds.

- Teekay Tankers predicts that the tight supply-demand balance in the mid-size tanker market will persist, given that the tanker orderbook stands at 4%-5% of the operational fleet, near historic lows. Although new orders have begun to rise, this year’s orders are anticipated to total only 24 million deadweight tons, below the historical annual average of 30 million and far below prior super-cycles when day rates were high. The earliest delivery of new vessels remains in 2026.

- According to El Financiero, the FAA completed its audit of AFAC’s security standards last Friday. AFAC anticipates that Mexico will soon be upgraded back to category 1. Of the eight critical areas, two—medical and accident investigation—are still pending approval, due to misunderstandings about how the recently approved aviation law will function. The FAA now has 40 days to deliberate and communicate whether Mexico will indeed regain category 1 status.

Threats

- American Airlines announced that it will appeal the judge’s decision in the Northeast Alliance with JetBlue. This move is not surprising as they seek to increase their relevance in New York, where Delta, JetBlue and United Airlines have larger operations.

- Given strong supply pressure from new vessels, there might be a further deterioration in the balance of supply and demand, leading to further correction of container shipping spot rates. Recent data from Clarkson indicates potential worsening capacity utilization in the container industry. Factors contributing to this are: potential slippage of new ship volume delivery into 2024 or later, less extensive scrapping or laying up of ships in 2023 than expected, and current weaker demand for container ships, especially on North American routes.

- UBS maintains a bearish stance on Mexican airports. They expect traffic growth to decelerate starting in Q2 2023 due to increasingly tougher comparisons and a high traffic base. The expected upgrade of Mexico to Category 1 by the U.S. FAA in the second half of 2023 would lead Mexican airlines to increase capacity allocation on Mexico-U.S. routes instead of domestic ones.

Luxury Goods And International Markets

Strengths

- Louis Vuitton maintains its position as the most popular luxury brand, followed by Dior and Gucci, according to research by the Cross-Border Shopping Platform, Ubuy. Louis Vuitton leads with the most global monthly searches (8,330,000) and website visits (15,500,000). In 2022 alone, Louis Vuitton amassed over £15 billion in sales, scoring 32.75 in popularity, followed by Dior with 31.73 and Gucci with 23.39.

- Inditex, the Spanish retailer best known for its Zara brand, reported strong results this week. Operating income rose by 43% in the first three months of this year. According to Bloomberg, the company achieved a record first-quarter gross margin and its sales growth momentum continues into the second quarter.

- Faraday Future Intelligence was the top performer among S&P Global Luxury stocks over the past five days, with a gain of 35.7%. The California-based electric vehicle start-up revealed the new FF 91 2.0 Futurist Alliance, limited to 300 units. The FF 91 2.0 EV Futurist Alliance boasts three electric motors that produce a maximum of 1,050 horsepower, enabling an acceleration from 0 to 60 mph in just 2.3 seconds.

Weaknesses

- Last week, Manufacturing PMIs for the major global economies (U.S., eurozone and China) were reported below the 50-mark, and this week’s data showed a weakening in global Service PMIs as well. The U.S. Service PMI was reported at 54.9 in May, lower than the expected 55.1. The Eurozone Service PMI came in at 55.1, below the expected 55.9. The Caixin Service PMI in China dropped to 56.4 in May, short of Bloomberg Economists’ expected reading of 57.0.

- The Stoxx Europe Luxury Index declined by 8.24% (in dollar terms) in May, marking the second-largest monthly correction year-to-date.

- Signet Jewelers was the poorest performer among S&P Global Luxury stocks over the past five days, with a loss of 8.5%. The company’s shares suffered this week after it reduced its outlook for the remainder of the fiscal year.

Opportunities

- Car manufacturers are progressively shifting from combustion engine vehicle production to more environmentally friendly alternatives. Ferrari plans to complete its electric vehicle plant by mid-2024 and intends to debut its first EV car in the first quarter of 2025. Last year, Ferrari’s CEO, Benedetto Vigna, stated that the company aims to achieve carbon neutrality by 2030.

- Last month, Tesla reported selling 77,695 cars in China, a 2.4% increase from the previous month. Despite facing stiff competition in the domestic market from cheaper, longer-range Chinese EV cars with more advanced features and high-quality materials, Tesla has managed to hold its ground. Furthermore, the company has announced plans to establish a new electric vehicle factory in Spain to increase production in Europe.

- Spanish luxury brand Fendi launched its new Fendi Active: Basketball Capsule for men as part of its summer collection. Available in select stores worldwide and online from June 1, the collection includes $120 socks, a $490 keychain, a $750 basketball jersey, $1,550 pants, and $1,790 basketball sneakers. A basketball hoop, part of this top-of-the-line sports range, is available for $10,000.

Threats

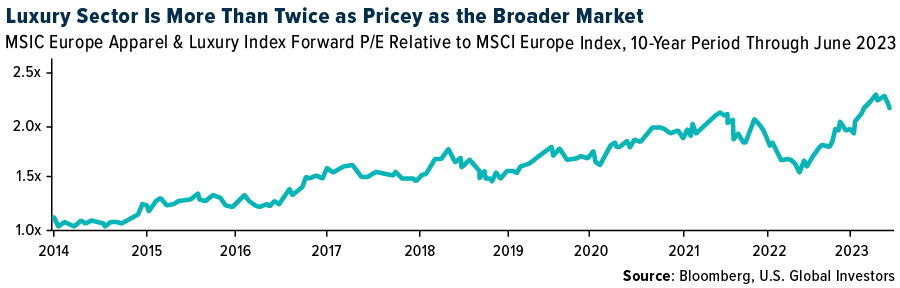

- Despite a recent correction in the luxury sector, further weakness is anticipated. The MSCI Europe Apparel, Textiles & Luxury Goods Index has risen 26% year-to-date (as of May 19), primarily driven by China’s post-pandemic reopening. According to the chart provided by Bloomberg below, the luxury sector’s premium to the broader European market is at its highest in nearly a decade, suggesting a potential for further correction.

- Next week, the U.S. will release its CPI data on Monday, followed by the Eurozone on Friday. The Federal Reserve (Fed) will then decide on Wednesday whether to hike rates or leave them unchanged. However, the CPI data due on Monday will be closely scrutinized ahead of the Fed’s announcement. Generally, further global tightening is expected in an attempt to lower prices, posing a potential threat to future demand.

- U.S. retail sales data is scheduled for release on Friday, June 16. Most Bloomberg Economists predict a decline of 0.1% in May, following an expansion of 0.4% in April.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was iron, with a rise of 7.7%. According to Goldman Sachs, the OPEC+ meeting yielded moderately bullish results. Firstly, Saudi Arabia committed to an additional 1mb/d unilateral “extendable” output cut in July. Secondly, voluntary cuts from the nine OPEC+ countries are now expected to continue until December 2024, a year longer than initially planned. Lastly, output baselines will be redistributed in 2024 from countries struggling to reach their targets to those with ample spare capacity.

- Peru’s Ministry of Mines and Energy (MINEM) announced that mining production in April increased by 30% year-over-year for copper, but decreased by 1% for gold. Copper production in Peru has reached a total of 832 kt in the year-to-date 2023, which is 15% higher than the levels observed in 2022 (724 kt).

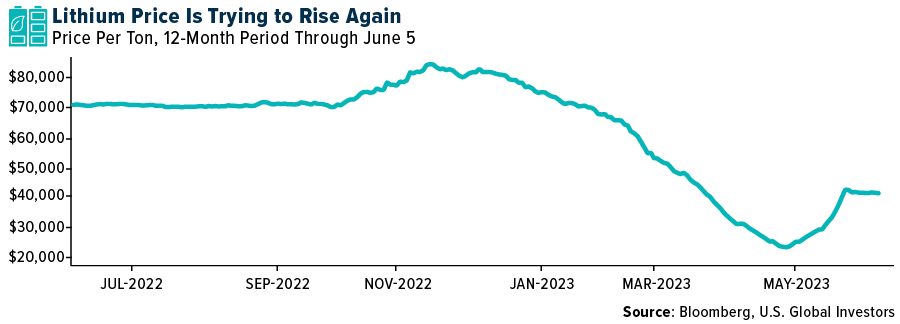

- According to Benchmark, lithium weighted average prices rose by around 17% in the past week, to approximately $43-$44k. In response to rising prices in China, CIF Asia spot prices increased by 11.9% week-over-week to $37,900/ton for carbonate, and hydroxide prices rose by 7.1% week-over-week to $45,000/ton. Prices in North America, South America, and Europe remained stable.

Weaknesses

- The worst performing commodity for the week was corn, falling by 2.0%. The U.S. rig count continues to decline (-15 week-over-week, -83 year-to-date). Baker Hughes reports that the U.S. rig count dropped to 696 this week. Unconventional gas rigs stayed at 126, as declines in the Haynesville to 52 (-2 week-over-week) were balanced by gains in the Permian to 5 (+2 week-over-week). Unconventional oil rigs led the weekly decrease, falling to 502 (-14 week-over-week) due to losses in the Permian to 331 (-4 week-over-week), the Eagle Ford to 54 (-2 week-over-week), and the Williston to 36 (-2 week-over-week).

- Petra has announced the postponement of Tender 6 (F2023; June year-end) due to weaker diamond demand. Plans are in place to defer the sale of goods to August 2023, which will be Petra’s first tender of F2024. Despite the company’s sufficient liquidity, a prolonged weakness in the diamond market could force Petra to make challenging capital allocation decisions.

- South African platinum exports declined 12% month-over-month in April, driven by lower volumes of palladium (-19%) and platinum (-14%). However, rhodium exports (+38%) showed signs of recovery for the first time in 2023. Year-to-date, South African platinum group metals (PGM) exports are down 16% year-over-year.

Opportunities

- In its latest Renewable Energy Market Update report, the International Energy Agency (IEA) stated that renewable power is set to break more records as countries around the globe accelerate deployment. The IEA now predicts global renewable capacity additions to reach 440 GW in 2023, marking an increase of 107 GW or 32% from 2022. It further projects this number to rise to 460 GW in 2024. This contrasts with the agency’s previous report from December 2022, which forecasted global capacity additions of 350 GW in 2023 and 380 GW in 2024.

- According to J.P. Morgan, an excess supply is anticipated in the oil market, necessitating supply-side solutions to maintain balance. Their analysis suggests decisive action will be required in Q1 2023, with their models predicting another round of OPEC+ cuts starting from March and continuing through the end of the year.

- Goldman Sachs predicts a rise in hardwood prices towards — though remaining under — the marginal cost of production in the second half of 2023, driven by consumer restocking. Despite the weight of new supply and high producer stocks on price recovery, they anticipate prices will stabilize at a higher level than their previous forecast.

Threats

- In China, housing completions have rebounded and are up by 18% YoY year-to-date. However, steel-intensive new starts continue to lag, down by 21% YoY year-to-date. Consequently, China’s steel demand has decreased by 3.3% YoY this year, which is a slight improvement on the 8.8% decline seen in 2022.

- Goldman Sachs notes that iron ore, having driven the metals rally at the start of the year, has also led the retracement lower due to China’s deteriorating activity. While downward pressure on price in Q2 has been somewhat moderated by underlying trends in the iron ore market, such as a deficit phase in H1-23 reflected in lower port and mill ore stocks onshore, they predict a clear surplus phase in H2-23. They have revised their forecast for an average price of $90/ton in H2, down from the previous $110/ton.

- Lumber prices have been steadily declining over the past few months. Most mills in British Columbia are currently operating at or below cash cost. Sawmills in the Pacific Northwest (PNW) are also not generating much profit at current levels. Year-on-year demand remains down. An additional issue has been the surge in European imports in late 2022 and early 2023.

Bitcoin And Digital Assets

Strengths

- Out of all cryptocurrencies monitored by CoinMarketCap, Terra Classic performed best over the past week with a 16.15% increase.

- Digital asset firm BitGo Holdings announced an agreement to acquire the parent company of Prime Trust, a crypto custodian for the Binance.U.S. trading platform, according to Bloomberg.

- Despite the recent filings by the U.S. SEC alleging certain tokens as securities, the value locked on DeFi applications operating on those tokens’ blockchains has remained mostly stable, as reported by Bloomberg.

Weaknesses

- Among the cryptocurrencies tracked by CoinMarketCap, Sui was the worst performer of the week, declining by 20.61%.

- Bloomberg reported that the SEC has accused Binance and its CEO CZ of mishandling customer funds, misleading investors and regulators, and violating securities rules. The allegations were detailed in a 136-page complaint filed on Monday in a U.S. federal court in Washington.

- Liquidity on one of the most prominent crypto exchanges, Binance.US, has declined following significant regulatory actions by U.S. officials. According to data reported by Kaiko via Bloomberg, the Bitcoin bid-ask spread on Binance.US has dramatically worsened.

Opportunities

- Bloomberg reported that Hivemind Capital Partners, a digital-asset investment firm founded by former Citigroup executive Matt Zhang, is launching a $300 million fund to invest in crypto tokens. This move is happening despite a U.S. regulatory crackdown that has dampened investor sentiment in the sector.

- New York’s Metropolitan Museum of Art has agreed to return $550,000 in donations it received from FTX shortly before the crypto exchange’s collapse in November, according to Bloomberg.

- The Ethereum blockchain’s daily average gas fee is approaching a two-month low after last month’s memecoin trading frenzy caused a surge in costs, as reported by Bloomberg.

Threats

- Reginald Fowler, a former minority owner of the NFL’s Minnesota Vikings, has been sentenced to over six years in prison, ordered to forfeit $740 million, and pay $53 million in restitution after admitting he helped cryptocurrency exchanges evade money-laundering rules, according to Bloomberg.

- The SEC has filed a lawsuit against Coinbase Global in a New York federal court, alleging that the crypto firm violated its rules for years. The regulator claimed in a 101-page complaint that Coinbase evaded regulations by allowing users to trade multiple crypto tokens that were actually unregistered securities, as reported by Bloomberg.

- Cryptocurrencies experienced a broad decline after the US SEC accused Binance Holdings of mishandling funds and deceiving regulators, according to Bloomberg.

Gold Market

Strengths

- The most robust performing precious metal for the week was silver, gaining 2.6%. G Mining Ventures has signed a binding agreement with CEMIG to supply the Tocantinzinho Project with cost-effective renewable energy. The fixed energy pricing, applicable between 2024 and 2026, will cover the commissioning, ramp-up, and initial production years at Tocantinzinho. Commercial production is expected to begin in H2/2024, resulting in a 25% reduction in electricity costs.

- After a modest 2022, the junior and intermediate producers we cover have started the year strongly. Year-to-date, junior producers have risen 8% while intermediates have surged 15%, outperforming the senior producers who are flat for the year, and spot gold, which has risen 7%. On a P/NAV basis, intermediates now trade at a premium to the seniors (0.72x NAV vs. 0.65x for seniors), whereas junior producers trail at 0.52x NAV. Notably, junior producers are projected to generate a 23% sustaining free cash flow (FCF) yield in 2024.

- At Evolution Mining, Ernest Henry capital expenditure is expected to be between $450-500 million, in line with consensus. The mine life extends to 2040, surpassing consensus expectations. The resource update in September is likely to reveal additional potential to be incorporated into the September 2025 feasibility study. The life extension of the Mungari mine also exceeded expectations, with construction set to complete by March 2026.

Weaknesses

- The weakest performing precious metal for the week was palladium, falling 6.2%. Argonaut announced a delay in first production at Magino, which has been postponed to mid-June (previously expected in late May). Despite the delay, wet commissioning activities are well underway.

- Zijin Mining’s Colombia gold mine, a significant producer in the Andean country, has halted 60% of operations due to recent attacks against workers, allegedly by illegal miners associated with a major crime gang. Following two attacks within two weeks, the company has prioritized worker safety.

- Ecuadorian President Guillermo Lasso invoked the “Muerte Cruzada,” dissolving the national assembly and allowing him to rule by decree under the supervision of Ecuador’s Constitutional Court. National elections will now be held in August, followed by a second round in October, with the new authorities serving until May 2025. Notably, neither President Lasso nor his party will seek re-election.

Opportunities

- Petra, currently holding 75% of Williamson with the remaining 25% owned by the Government of Tanzania (GoT), will now share equal ownership with Taifa, each holding 37.5%. Post-ratification of two existing agreements, Petra will retain a 31.5% stake in Williamson, with Taifa holding an equivalent 31.5% and GoT owning the remaining 37%.

- Eldorado announced a C$81.5 million strategic equity investment from the European Bank for Reconstruction and Development (EBRD) along with a concurrent C$135 million bought deal financing. With this funding and a €680M project debt facility, the company gains added balance sheet flexibility.

- The World Gold Council’s sixth annual central bank gold reserves survey reveals that among the 57 central bank respondents, 24% anticipate increasing gold reserves over the next 12 months, demonstrating a robust outlook for gold.

Threats

- Strong end-market demand has resulted in high prevailing prices, some diamond producers were (briefly) realizing >50% like-for-like price increases in 2022. Diamond demand is driven by the US at it is 50% of global consumer demand (China is only 14% of demand). As the Fed pivots following a series of rate hikes, there is the risk that diamond fundamentals weaken as U.S. consumer confidence weakens and discretionary spending falls.

- Bank of America downgraded Royal Gold, a precious metals royalty and streaming company, from Neutral to Underperform and lowered their target to $130 per share (down from $149). The price objective is based on a 2.25x net asset value (NAV) multiple, which is lower due to heightened operational and execution concerns around significant assets in Royal Gold’s portfolio. This concern was especially directed towards Mount Milligan, which constitutes 21% of NAV and is owned by Centerra Gold, where 2023 gold production guidance was recently tempered.

- According to a Financial Times report, the Mexican mining industry is threatened by sweeping new regulations. The modifications in the mining code make it difficult for companies to secure mineral concessions and could instigate a wave of lawsuits by Canadian miners with investments in Mexico. The new legislation mandates all mining exploration activities to be conducted by the Mexican Geological Service, a state-run agency with insufficient funding. This could severely hamper exploration efforts.

Related: Airlines Are Bracing For Record Summer Travel. A Golden Opportunity For Investors?