Written by: Meera Pandit

The S&P 500 has reached a new milestone: crossing 5000. It is up 5.4% year-to-date, compared to the equal weight S&P 500, up just 0.7%. Although it seemed like the rest of the market was poised for a rally, the Magnificent 7, which account for nearly 30% of the index, have surged 12.7% since the start of the year. While we would not advocate allocating to an equal weight index, there is scope for broader participation in the rally which investors can access through more active stock selection.

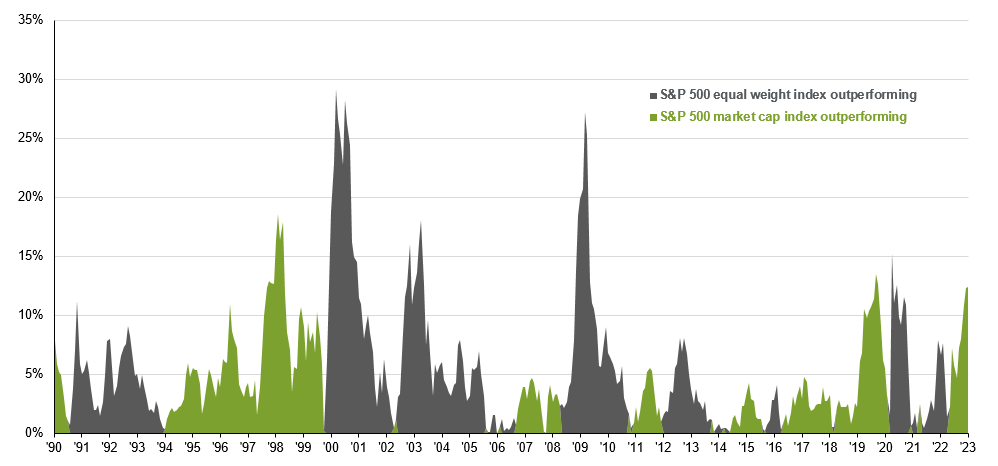

Historically, market concentration lends itself to market cap outperformance when there is momentum behind a small cohort of stocks. This was the case during the tech bubble of the late 1990s, before the financial crisis when energy’s weight in the index doubled, and since 2017 when tech concentration began reasserting itself. However, we’ve seen reversals of this after the tech bubble burst, when the Fed began raising rates at the end of 2015 and in 2022, or when participation broadened out the immediate recovery from the financial crisis or in 2021, when energy, financials, and real estate posted big rebounds as the economy reopened. In addition, when the VIX is above its long-term average of 19.6, equal weight outperforms on average compared to periods of low volatility when market cap prevails, like last year.

In 2024, we do not expect a reversal in big tech, but rather a broadening out in market participation due to valuations and profits:

- Valuations: In 2023, 68% of S&P 500 returns were attributable to multiple expansion, leaving valuations somewhat rich. The S&P 500, which is market-cap weighted, is about 26% more expensive than its average valuation of 16.2x back since 2009, while the S&P 500 equal weight is only 5% more expensive. From a valuation perspective, there may be more room to run for a broader set of stocks. In addition, profits, which are estimated to grow by nearly 11% in 2024, should be a key determinant of returns this year.

- Profits: Last year, the Magnificent 7 essentially drove all the S&P 500’s returns and profit growth, with profits up an estimated 31% in the Magnificent 7 in 2023 compared to profits contracting 4.3% in the rest of the S&P 500. This year, that leadership should broaden out, with 39% of profit growth projected to come from the Magnificent 7 and 61% coming from the rest of the index.

Even if market leadership broadens out, this does not advocate for an equal weight index of all stocks. Investors should not be forced to choose between high concentration and low conviction. Instead, active stock selection can maintain diversification while overweighting the best stocks, not necessarily the biggest.

S&P 500 market cap and equal weight relative performance

Rolling monthly y/y total returns, outperformance = high - low

Source: S&P, Factset, J.P. Morgan Asset Management. Data are as of February 9, 2024.

Related: Are Chinese Equities Cheap Enough?