Since the start of the pandemic, we’ve seen consumers around the globe shift much of their spending from services and experiences to goods, and consumers in China were no exception, according to a recent report by consultancy firm Bain & Company.

Last year, luxury sales in China reached 471 billion yuan ($74.3 billion), an increase of 36% from 2020 and almost double the amount from 2019. What’s more, the country represented $0.21 of every dollar spent globally on high-end goods from apparel and handbags to fragrances and cosmetics to luxury automobiles.

Bain believes China’s personal luxury market can enjoy low double-digit growth again this year.

Much of the spending in 2021 was driven by online and duty-free shopping, particularly in the southern Chinese island-province of Hainan, which has transformed virtually overnight into a popular luxury mecca for consumers restricted from international travel.

Says Bruno Lannes, a partner at Bain, China is now on track to surpass the Americas and Europe to become the world’s biggest luxury market in as little as three years. By 2025, China is estimated to represent between 40% and 45% of global luxury goods sales, compared to the Americas’ 21%-23% and Europe’s 16%-18%.

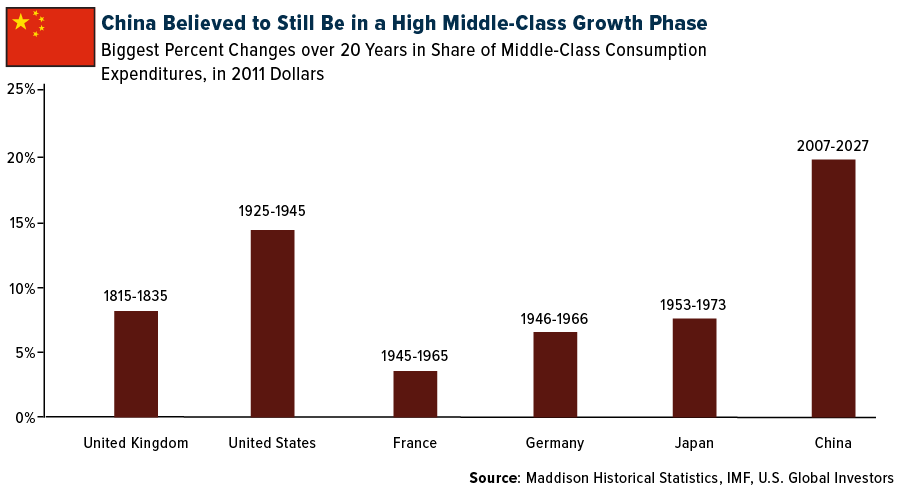

World’s Largest Middle Class Expected To Continue Rapid Expansion

Bain’s prediction is in line with the rapid growth of China’s middle class, already the largest in the world. One estimate, by the Brookings Institution, says that China’s middle-class expeditures in 2020 totaled a whopping $7.3 trillion in international dollars, compared to $4.7 trillion for the U.S., the world’s number two consumer.

And yet the Asian country’s transition to a middle-class country is not yet complete, the implication being that there may still be incredible growth potential for investors seeking exposure to Chinese discretionary spending. In the 20-year period through 2027, the Chinese economy will have seen history’s most rapid middle-class expansion phase, beating similar growth periods in the U.K., U.S. and other high-income countries.

We believe we’re well-positioned to take advantage of this unprecedented surge in new middle-class consumers. Among the largest holdings in our China Region Fund (USCOX) are sports equipment and “athleisure” wear makers ANTA Sport Products and Li-Ning. In its interim 2021 report, ANTA said gross profits in the six months through June 30 was 14.4 billion yuan ($2.3 billion), an incredible 73% increase from the same period in 2020. Growth was even larger for Li-Ning, which reported gross profits of 5.7 billion yuan ($901 million) in the first six months of 2021, up 86% from a year earlier.

We’re also very bullish on auto sales in China, the world’s largest market. In September 2021, the most recent month of data, Chinese consumers purchased 18.7 million autos. Comparatively, U.S. consumers bought 12.1 million autos during the same month, Europeans 7.9 million.

To get exposure to China’s growing luxury vehicle market, USCOX has a position in Yongda Automobile Services, which is involved in the sale, service and leasing of a number of high-end auto brands such as Porsche, BMW, Lexus and more.

We happen to own shares of Porsche, BMW and other luxury automakers in our Global Luxury Goods Fund (USLUX), as of December 31, 2021.

Luxury Goods Have A Track Record Of Strong Pricing Power To Fight Inflation

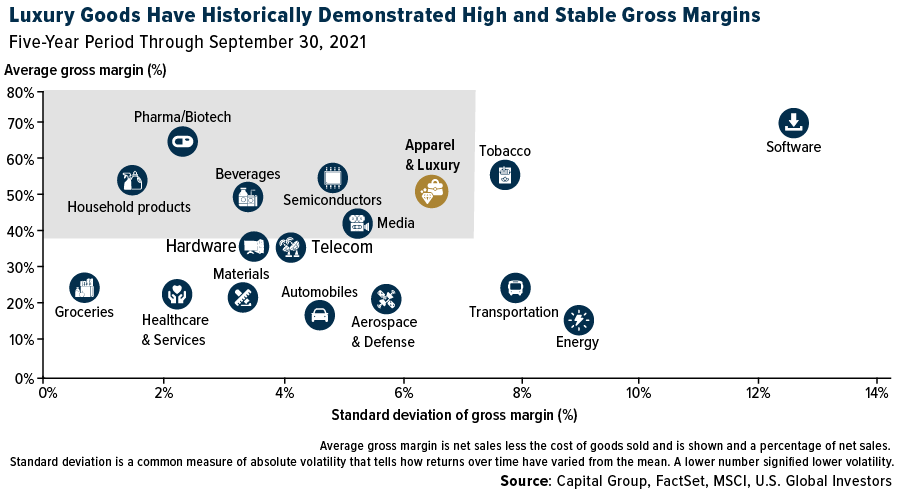

We like luxury goods manufacturers in general for a number of reasons, not least of all because they have a history of maintaining not just high but also relatively stable gross margins, according to Capital Group.

The financial services company recently shared a chart that shows which sectors have had the pricing power to fight inflation, which has rocketed up to multi-decade highs in the past year. Among the sectors that have been able to raise prices without experiencing huge profits losses is apparel and luxury. For the five-year period through September 30, 2021, the group had an average gross margin of just above 50%, with a standard deviation of between 6% and 7%. This put luxury in Capital Group’s “preferred” box along with other sectors that have demonstrated strong pricing power, including pharmaceuticals, household products, semiconductors and more.

Our favorite luxury goods makers, all of which are owned in USLUX, include LVMH, Hermes, Burberry, Christian Dior and Prada.

Related: The Great Gold Love Trade Is Alive And Well, As India Buys A Record Amount