Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

The current bull market turned two this week. With sentiment and valuation levels approaching historic highs, many doubt this bull’s forward potential. Fortunately, bull markets tend to follow an observable pattern. Markets rise in anticipation of earnings growth and then rise further when earnings growth arrives. This appears to be just such a moment of rally transition as valuations hold while earnings growth accelerates, leading us to believe that while this bull may be aging… it’s far from retired.

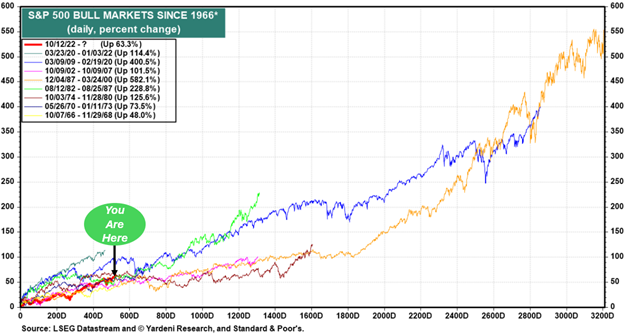

This current bull market turned two years old this week. Over the last 24 months, the S&P 500 has climbed over 60% without experiencing a correction of more than 10%. While this may sound superlative amidst the backdrop of disinflation, AI breakthroughs, solid GDP growth, and Federal Reserve support, these returns within the first two years of a new bull market are astoundingly average:

Fortunately, if this bull turns out to be simply “average”, then it’s quite young with further to run. The average duration of the bull markets profiled above was just under five years, with an average gain of 164%.

But this doesn’t mean there weren’t any down years. Remember, bull markets continue, by definition, until drawdowns exceed 20%. In the full bull markets for the set above, 14.6% of the bull market years were down years. Fears around growth, war, policy, etc., can threaten bull markets, but it takes larger economic forces to end them, i.e., the COVID recession, the GFC recession, or the Dot Com recession.

Within this current bull, GDP growth has averaged nearly 3%. Analysts project GDP growth for the quarter ended at 3%. While some economic indicators have softened recently, so has the Fed, activating an economic insurance policy.

Economists expect continued economic growth over the coming quarters, heartened by the prospect of further rate cuts. With economic growth intact, the larger bull should remain intact. However, the bull run to date has benefited from rising sentiment, rising valuations, and rising earnings. Things could get a little trickier from here.

We Feel Good!

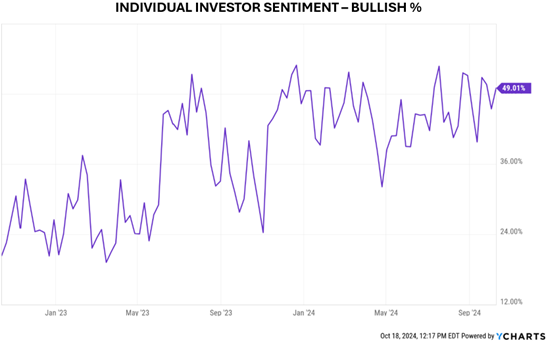

When this bull market began two years ago, only 20% of individual investors polled counted themselves as “bullish,” meaning 80% were “not bullish,” amounting to an extremely pessimistic environment. However, as sentiment levels inevitably rise, so do investment levels, making low levels of optimism highly opportune for investors.

Two years into this bull market, individual investors count themselves as 49% bullish, a level of euphoria rarely seen. Over the last ten years, only 7% of weekly sentiment readings have registered above 50%. Pessimism has squarely become optimism, limiting further uplift from gains in sentiment alone.

We Pay More!

When this current bull market began, pessimistic investors were only willing to pay 15x for S&P 500 earnings. Today, optimistic investors are willing to pay 22x for S&P 500 earnings.

Like sentiment, we have seen levels above the current levels, but not often. During the Dot Com melt-up, the forward P/E on the S&P 500 topped out over 25x, leaving little comparable headway for multiple expansions today unless the current AI melt-up mimics the Dot Com melt-up of the late ’90s. Fortunately, lower interest rates support higher valuations, so while rate cuts from the Fed likely won’t lift valuations further, they do help fortify them. Nonetheless, the multiple expansion portion of this current bull market appears complete, limiting further uplift from valuation expansion alone.

Show me the money!

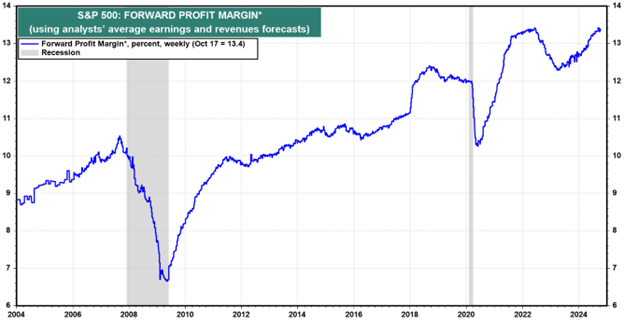

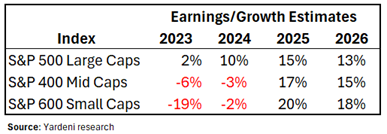

With investor sentiment and valuations at or near peak levels, further rally heights require earnings escalation. Fortunately, we find broad-based earnings promise. Real GDP running 2%+ with inflation running 2%+ creates a revenue environment for corporations of 4%+. Additionally, as companies utilize AI and other advanced technologies to drive efficiencies, investors should see profit margins expand… and indeed, they are:

With revenues growing briskly and profit margins expanding, earnings should be rising rapidly… and indeed, they are:

Analysts expected a 3.5% earnings growth rate for the current quarter for S&P 500. Based on initial releases, the final tally will likely double that. Since this bull began, analysts have consistently undershot their economic growth projections, their earnings growth projections, and their stock market performance projections. Many will say that this market appears toppy given peak sentiment and peak valuations. They may be right in the short run, but if corporate earnings arrive anywhere near expectations over the next couple of years, this middle-aged bull has plenty of pep left. Happy Birthday Baby Bull!

Sources: LSEG Datastream, @Yardeni Research, Standard & Poor’s, Y Charts, Morningstar, Edward Jones

Related: Market Efficiency or Investor Apathy: What’s Really at Play?