After the Dow hit a fresh record high yesterday, futures point to further gains when equity markets open later this morning. Helping provide some of that lift this morning are reports of China’s central bank unveiling a broad package of monetary stimulus measures to jump-start its economy. People’s Bank of China governor Pan Gongsheng announced the bank will cut a key short-term interest rate, the PBOC will open their equivalent Fed Lending window directly to non-bank investors, and unveiled plans to reduce the amount of money banks must hold in reserve to the lowest level since at least 2018.

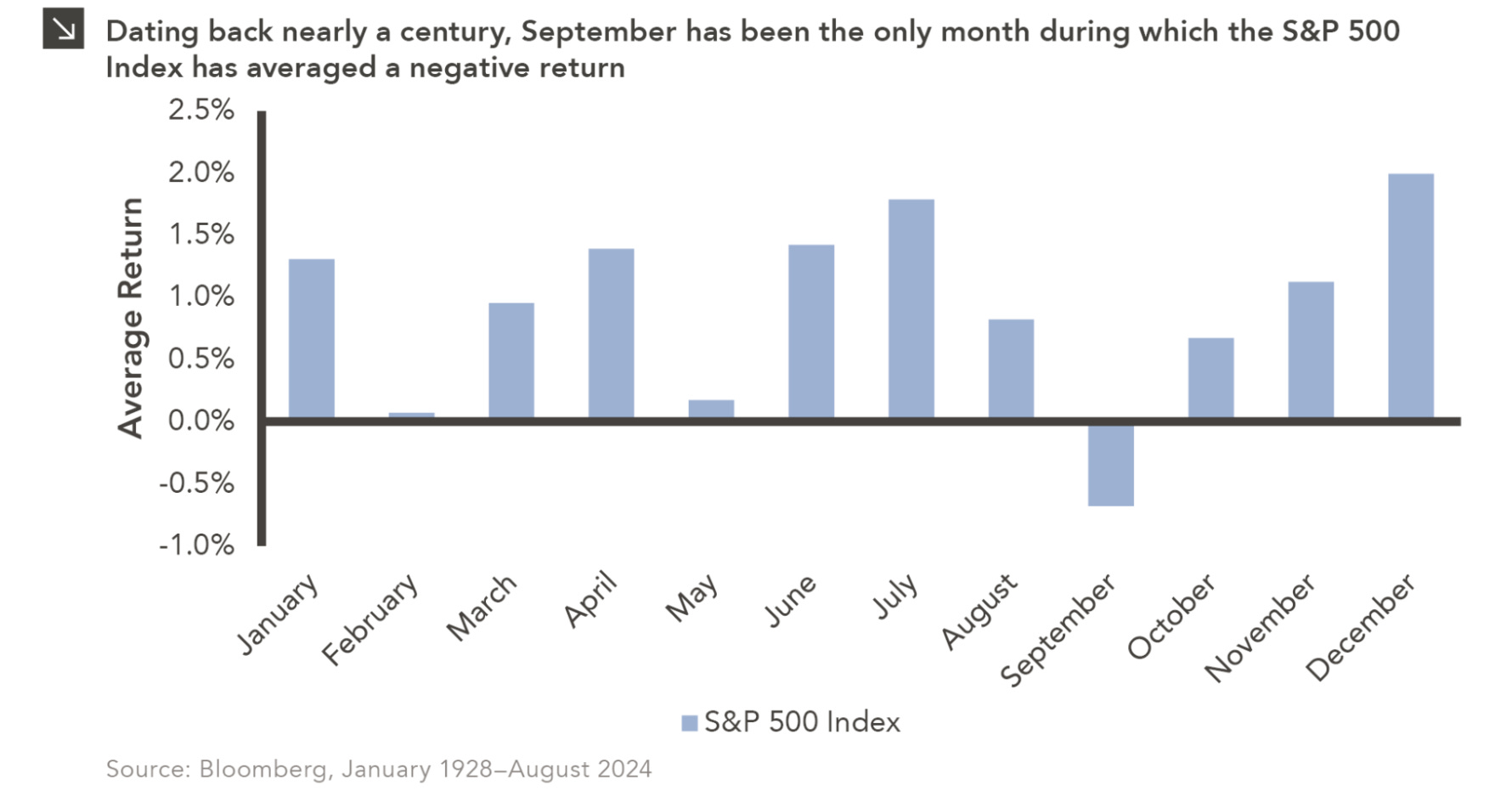

So far, September has bucked the trend

Despite September’s reputation for being a challenging month, with five trading days left to go in the month, so far the S&P 500 and the Nasdaq Composite are up 1.2% and 1.4%, respectively, month to date. Those gains have once again pushed the market into short-term overbought and stretched the S&P 500’s P/E valuation to 23.6x consensus 2024 EPS. However, 2H 2024 EPS growth levels compared to 1H 2024 have continued to soften and stood at 6.8% coming into this week, down from 11.2% at the end of July.

September Flash PMI: The job market weakened… again

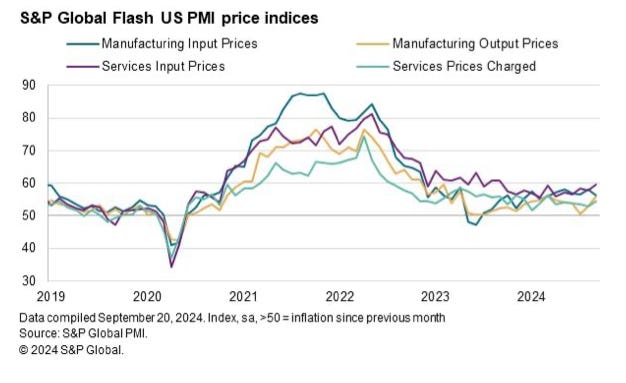

Coming off yesterday’s S&P Global’s Flash PMI report that showed US business activity “remained robust in September… signaling a sustained economic expansion…” However, the report also noted order books moderated, while business expectations softened with survey respondents citing uncertainty ahead of the Presidential Election. The Flash report also showed prices charged rose at the fastest rate in six months as input cost growth hit a one-year high. Notably, Service sector input cost growth hit a 12-month high largely due to wage growth pressures.

That will likely catch the eye of the dozen Fed heads making the rounds this week, including Fed Chair Powell, who speaks on Thursday. The other item central bankers probably noticed in the Flash PMI report was employment fell for the second consecutive month in September. While modest, it points to further softening in the labor market an area of increasing focus for the Fed. Other data next week will bring another take on the jobs market in September. As it’s published, we’ll want to parse central banker comments for clues as to how that data may influence the cadence of future rate cuts and mesh with its forecast for an additional 50 basis points in cuts for this year.

Homebuilding data and Micron’s earnings

In between comments from Federal Reserve Governor Michelle Bowman today at 9 AM ET and Federal Reserve Governor Adriana Kugler at 4 PM ET tomorrow, given our Homebuilding & Materials model, we’ll be digging into quarterly results from KB Home (KBH) and out tonight and tomorrow’s New Home Sales report.

August single-family housing starts moved up nicely month-over-month, but we’ll be looking to see if the recent decline in mortgage rates has started to stir housing fence-sitters. The consensus forecast for August New Home Sales is 700,000 down from 739,000 in July. With KB, we’ll be looking to see if its guidance for 2H 2024 is as strong as the delivery forecast issued by Lennar (LEN) last week which calls for a 21% increase in 2H 2024 home deliveries compared to 1H 2024.

Quarterly results after Wednesday’s market close, we expect Micron (MU)will reiterate prior comments about AI’s impact on memory demand. As it does that, we are interested in the underlying color for the data center, PC, and smartphone markets given our thematic model lineup below.