It has been a rocky year so far, in 2022, with worries about inflation competing with hopes about recovery for the market's attention. In the midst of all the action, to no one's surprise, have been six stocks (Facebook, Amazon, Netflix, Google, Apple and Microsoft or FANGAM) that have largely driven US equities for the last decade, roiling the market with their most recent earnings reports. Netflix and Facebook saw drops of 20% or more in market capitalization, following negative earnings reports, but Amazon and Google beat market expectations. In this post, I will be valuing each of these companies, both to assess whether to invest in them individually, and to examine whether there are lessons for the market in their price entrails.

My September 2020 Valuations

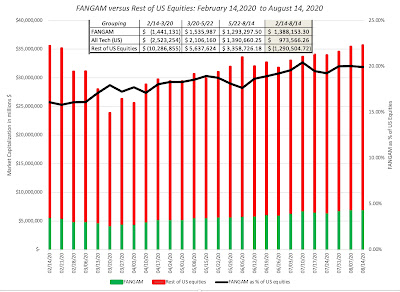

If you tally the winners and losers in the stock market sweepstakes between 2010 and 2019, it is undeniable that the decade belonged to the FANGAM stocks, as can be seen in the graph, where I chart the collective market cap of these six companies against the collective market cap of all US equities, and report on their percentage share:

Over the course of the decade (2010-2019), the FANGAM stocks increased in collective market capitalization from $719 billion from $5.07 trillion, and their share of the overall equity value of all US stocks also surged from 6.5% to 14.9%. It is not hyperbole that without these stocks, the last decade would not have been a great one for US equities. Coming into 2020 in a position of strength, these companies got stronger, as COVID rocked economies and markets in 2020, which became the headline for one of my posts on COVID:

Between February 14, 2020 and August 14, 2020, as markets first collapsed and then recovered just as strongly, the FANGAM companies collectively added $1.39 trillion in market cap, accounting for all of the recovery in US stocks during that period. I have valued each of FANGAM multiple times in the past, but my most recent attempt to value each of them was in September 2020, as one of a series of posts highlighting how COVID was playing out in markets. I wanted to see if that surge, added on to the trillions in the market cap of US equities between 2010 and 2019, had left them in nosebleed territory, in terms of value. I must admit I was surprised by my own valuations, since, given the low riskfree rates prevailing at the time, only one stock (Apple) looked significant over valued. Of the rest, Microsoft and Amazon were over valued, albeit by modest most amounts, and Facebook was the most undervalued, and Netflix and Google were close to fairly valued.

|

| Read post, with links to valuations, from September 2020 |

At the end of that post, I disclosed that I owned Facebook, Microsoft and Apple, and that I would continue to hold the first two, and would sell my Apple shares. Clearly, much has happened since these valuations. The market has continued its march upwards, these companies have had multiple earnings reports and each of them has had newsworthy events occur.

Updating the Numbers

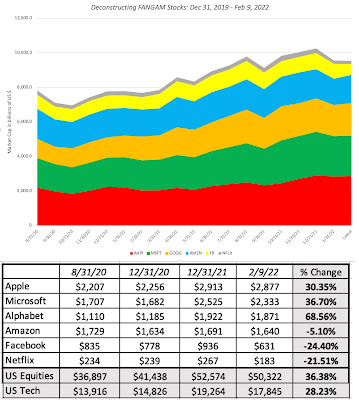

In the eighteen months since I valued these companies, much has happened, to the economy, to US equities collectively, and to these six companies, in specific. In the graph below, I report on the collective market capitalization of US equities, broken down into three groupings, the FANGAM stocks, all other US tech companies and the rest of the US equity market, from August 31, 2020 to February 9, 2022:

During the period, the collective market capitalization of FANGAM stocks increased by 21.9%, but they lagged the rest of the US tech sector (up 37%) and non-tech US equities (41.1%). For the first time in more than a decade, the FANGAM stocks are running behind the rest of the market. Breaking the FANGAM stocks into their constituent parts and charting their performance between August 31, 2020 and February 2022, here is what I get:

During this period (8/31/20-2/9/22), three of the FANGAM stocks (Apple, Microsoft and Alphabet) were up strongly, and three (Amazon, Facebook, Netflix) were down. In summary, the FANGAM stocks were up collectively between August 31, 2020, and February 9, 2022, but they lagged the rest of the US equity market, with that underperformance isolated to Amazon, Facebook and Netflix.

The Numbers

Since I last valued the FANGAM stocks in September 2020, there have been six quarterly earnings reports from each of these companies, and I report on two key operating measures, revenues and operating income, in the table below, for the last three fiscal years for each of the companies. (Note that four of these companies have calendar year-ends, and two have fiscal years that end mid-year. For the latter, I am reporting on the trailing 12-month numbers, to ensure that I have the calendar year numbers.)

Looking at the percentage changes in revenues and operating income between 2019 and 2021 gives us a measure of how well each of these companies have navigated the currents of the last two years, and they seem to have turned the troubles to their advantage, posting strong compounded annual growth rates in revenues and operating income. These consolidated growth numbers, though, don't reflect the trend lines over the three years at these companies. Facebook and Netflix stumbled in their most recent earnings releases, losing more than a fifth of their market capitalization. With both companies, the user numbers were the basis for the negative surprises, with Facebook reporting its first drop in user number on a quarter-to-quarter basis as a public company and Netflix reporting underwhelming subscriber growth. Amazon and Google reported stronger than expected growth in both revenues and operating income, in the most recent quarter, and Microsoft and Apple delivered close to expected numbers.

The News

The FANGAM six, by virtue of their market capitalizations and their presence in our daily lives, have been also among the newsworthy of companies, and a significant portion of the news stories have are only mildly connected to current operating numbers. If I were to summarize the news about these companies in the last eighteen months:

- Facebook and Google found themselves in the midst of both the data privacy and political partisanship debates, as politicians and regulators argued about how best to restrict the social media platforms of these companies. Google, notwithstanding a few storms around YouTube, escaped relatively unscathed, but Facebook continued to draw fire from all directions. It is worth noting, though, that Facebook's loss of half a million users in the most recent quarter may have been more attributable to Apple tightening privacy protections on its devices than government action. The most revealing news story about Facebook, though, was its decision to rename itself "Meta", in late October, and it framed the decision as readying itself for business in the Metaverse. I argued then that the name change was a reflection of management at Facebook coming to the conclusion that its name had become too toxic, from a business perspective, and I did sell my shares in the aftermath. In hindsight, of course, this was a fortuitous decision, since it allowed me to evade the post-earnings collapse in the stock price, but it was definitely more luck than skill.

- The big stories affecting Netflix were less about the company and more about its competitors, and one of them, in particular, Disney. During this two-year period, Disney doubled down on Disney Plus, its streaming platform, and on content production, spending more than $25 billion on content in 2021. Netflix continued its traditional path of spending immense amounts on content, with content costs reaching $17.7 billion in 2021, but its cost of acquiring users climbed, as the US and European markets matured, and new subscribers in Asia and Latin America, the two geographical areas with the most user growth potential, delivered less revenues per subscriber.

- Apple and Microsoft, ancient companies by tech standards, continued for the most part to keep their heads down, and stay out of public controversies. In fact, Apple managed to reframe itself as a protector of privacy, putting itself on the right side of that debate, while also inflicting pain on its competitors (see Facebook above). Its new iPhone models rolled out smoothly and to generally positive reviews, a source of immense relief to a company that lives on the revenues from that product. Microsoft continued its long term path of consolidating its core product franchises (Windows and Office) and converting them to subscription businesses (with Office 365), while increasing its cloud business exposure. In the last month, the company made a splash with its announcement of the acquisition of Activision Blizzard for $68.7 billion, in an all-cash deal. While I am not a fan of acquisitions, especially big ones of publicly traded companies, there are some reasons to believe that this deal has a better chance than most of succeeding. First, at close to $70 billion, the deal looks big in absolute terms, but relative to Microsoft's market cap (of $ 2.2 trillion), it is a small deal. Second, I have to weigh in the fact that Microsoft has not been trigger-happy, when it comes to deals, and Satya Nadella has not struck me as an ego-driven CEO, at least in his public interactions. Third, I think that this deal plays into a much bigger end game, for Microsoft, than getting market share in the conventional game platform business. Finally, Activision own internal troubles had led to marking down of its stock price in the months leading into this deal, effectively reducing the actual premium paid. I know that there are some who see this acquisition as an attempt by Microsoft to squeeze Sony and Nintendo, but while that may be a side-product of this deal, I think that Microsoft has a much bigger gaming market, in mind, with much of it online, where it is competing against the other social media giants (Facebook and Google) and online game platform companies (Roblox).

- Of the six companies in the group, Amazon is most used to being targeted, for political and social reasons, over its entire lifetime. In addition to the stories about worker exploitation, with anecdotes about drivers not able to take bathroom breaks and overworked warehouse workers, there were questions about its competitive practices, albeit often planted by competitors whose only hope of stopping Amazon has become the government. While Jeff Bezos officially stepped down as CEO of the company in 2021, his status as one of the richest men in the world, his messy divorce and newfound standing as a globe-trotting celebrity all became news stories about Amazon. It is a testimonial to the succession team that Bezos built at Amazon that the company continued its march towards global dominance, notwithstanding all these distractions.

Valuing these FANGAM stocks reinforces the truth that valuing companies can never just be based upon the financials, since all of this news will play out eventually in the valuation stories (and valuations) of these companies.

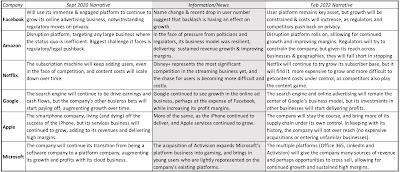

The FANGAM Valuations: February 2022

In the trading game, where pricing is driven by mood and momentum, earnings reports and news stories are scanned for incremental news, information that ultimately will have little effect on value, but can move prices substantially. That explains the fixation with earnings per share expectations, and why seemingly trivial surprises, where a company beats or falls short of earnings expectations by a few cents can cause the market capitalization of a company to increase or decrease significantly. If you have been reading my posts, it should come as no surprise to you that I believe in intrinsic value, but I also believe that intrinsic value is driven by narrative. To me, the value effect of earnings reports and news stories comes from how they change (or don't change) the core narratives for companies. In keeping with that belief, I revisited my narratives for the FANGAM stocks, with the intent of revising these narratives, based upon what we have learned about these companies in the last two years:

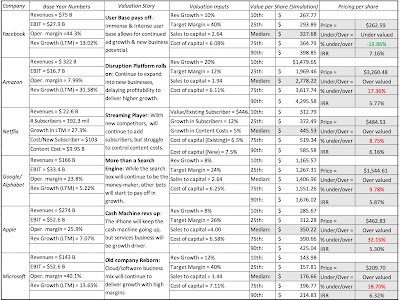

Converting these stories into numbers, I revalued the six companies. You can download the full valuations by clicking here (Facebook, Amazon, Netflix, Google, Apple, Microsoft), but the summary of my key assumptions and valuations are below:

|

| (Download full valuations of Facebook, Amazon, Netflix, Google, Apple, Microsoft) |

At the risk of repeating some of what I have said before, here is what the valuations tell me about these companies, as investments.

- Facebook looks the most under valued of the six companies, but one reason is that it seems to have lost its story script. For a decade whether you liked or hated the company, the story that drove its valuation was a simple one: a platform of billions of users, about whom Facebook knew a great deal, and they then used that knowledge to deliver focused advertising. In short, this is a company that has built its business on accessing and using private data, and the privacy backlash seems to have finally led the company to try to redefine itself, first by renaming itself (Meta), and then muddying the waters about its business model. I think that the company is still a profit-generating behemoth, with some of the highest operating margins in American business, but I think that until it finds a cohesive story line, the price recovery will be stilted.

- Netflix is the most overvalued company in the mix, even after its major price knock down, after the last earnings report. The company has upended the entertainment business and made everyone else in the business play the game their way, but it has always been on a hamster wheel, where its primary sales pitch to investors is its capacity to keep growing its subscriber base, and the only way it can keep doing this is by spending ever-increasing amounts of money of new content. The question of how the company would get off this hamster wheel has always been there, and now that user numbers are starting to slow, and new users are becoming more costly to acquire, the challenge of doing so has become larger.

- Microsoft and Apple have kept their heads low, as the rest of the FANGAM stocks have been buffeted by controversy and blowback. Apple seems to have found a way to be one of the good guys in the privacy battle, and in the process, intentionally or not, it has helped deliver punishment to others (like Facebook) in this rarefied group. For Microsoft, buying Activision advances them further towards becoming a premier platform business, and the company's diverse platforms (Office 365, LinkedIn and now Activision) offer the potential for growth and sustained high margins.

- Google surprised me the most, delivering high growth and increased margins, suggesting that Facebook’s problems are its own, and that Google continues to steamroll its online advertising competition. The other bets at Google continue to be cash-draining investments that deliver little in value, and after six years, I am not sure that they will be ever be big value creators, but that search box is the gift that keeps on giving.

- Amazon has, for much of its life, been a Field of Dreams company, offering investors a promise of revenues now, and if they wait patiently, profits in the future. For the first decades of its existence, all that investors saw was revenue growth, but margins remained slim to non-existent. In the last five years, Amazon’s margins have climbed and the company is solidifying its profit pathway, and while regulators and governments will try to rein it in, its mix of businesses and geographies will make it difficult to legislate against.

I came into the analysis holding Microsoft, and I will continue to hold it, though it is mildly over valued. If I still had Apple in my portfolio, I would also hold it, but since I don’t own it now, I have to wait for a price dip, and when it comes, I will buy it. I used to own Facebook, and while I sold it on its name-change, I will be getting back into the stock, at current prices, notwithstanding its muddled story line and near-term troubles, simply because of its cheapness. On Amazon, a stock that I have bought and sold four times over the last twenty years, I am glad to add it back to my portfolio. As for Google, I have never held it, to my regret, and don't plan to add it on, at the current stock price. Finally, I just don’t like Netflix, even at depressed prices, since I believe that scaling down content costs, key to the company's future success, has become more difficult, not less, after the entry of Disney into the streaming wars. Needless to say, there is the broader question of the overall market, and how inflation will play out this year, but the answer to that question has a bigger effect on my overall asset allocation than on my judgment on whether to buy any of these stocks.