After a three decade-long sideways market, Japanese equity returns have been strong recently. Over the past year, Japanese equities are up 37% in local currency (outperforming the U.S. by 225bps) and 25% in U.S. dollar terms. This year, the Nikkei 225 index hit an all-time high for the first time since 1989. Now, the big discussion is about when the Bank of Japan will finally exit negative interest rates and how much Japanese Yen strength this may cause. Will Yen strength derail the Japanese equity rally? Unlike in years past, this rebound in Japanese equities is about much more than just currency weakness helping exporters. Despite causing some short-term profit taking, gradual Yen strength can be digested by equities. Japan finally deserves to retake its place as a strategic allocation in global equity portfolios.

This year the Bank of Japan (BoJ) may finally end negative interest rates. Introduced back in 2016 (together with aggressive quantitative easing), the goal was to end deflation and bring inflation back to the 2% target. For years success was limited, but the post-pandemic global inflation surge impacted Japan as well, with its headline CPI increasing 4.3% in early 2023. Since then, it has eased some, but core inflation (excluding energy and fresh food) has remained stickier at 2.7% in January. For Japan, this is a welcomed development from the perspective of its central bank and its companies. Recent BoJ commentary suggests an openness to ending its negative interest rate policy and raising rates very slowly from there. When will depend on spring wage negotiations between labor unions and large companies to see whether last year’s strong wage growth can continue. This would be a sign that a positive wage-price dynamic is finally taking hold in Japan.

Consensus is that the BoJ raising rates implies a stronger Yen. Indeed, the Yen is very cheap at two standard deviations below its 10-year average. However, the policy outlook is already reflected in futures market, with investors expecting the policy rate to hit 0.25% by the end of 2024 (from the current -0.1%). For the U.S. and Japan interest rate differential to narrow further and the Yen to strengthen meaningfully, the BoJ would need to be particularly hawkish or the Fed to be particularly dovish.

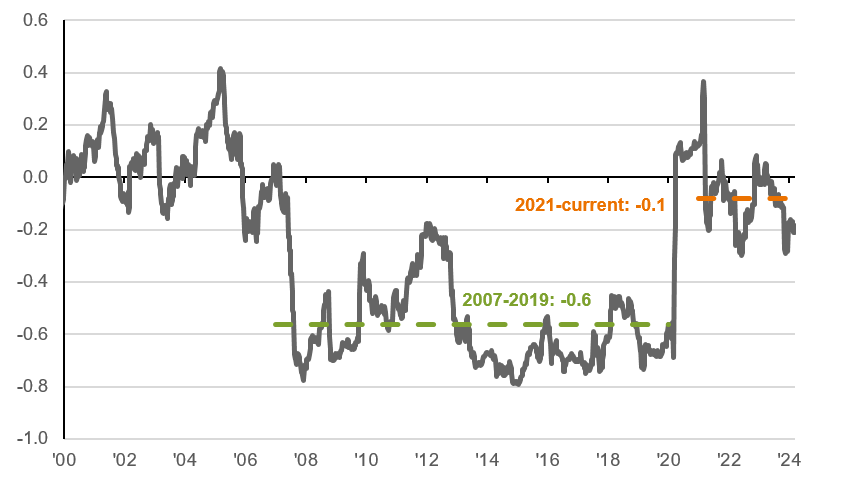

Importantly, a gradual strengthening of the Yen does not necessarily derail the uptrend in equities. The concern is that Yen strength would weaken Japanese exporters’ competitive position and undermine its earnings. The currency does impact those companies’ earnings, but it’s key to realize that the correlation between Japanese equities and the Yen has weakened substantially. From 2007-2019, the negative correlation between the Yen and the Nikkei 225 index was significant at -0.6 on average. This meant that when the Yen weakened, equities rose and vice versa. However, since 2021 this relationship has remained substantially weaker at -0.1

As we argued last year, enthusiasm about Japanese equities has been about much more than the usual Yen weakness helping exporters’ earnings. The positive change in Japan’s nominal growth, combined with governance reforms and shifts in capital flows, justified this enthusiasm. Japanese earnings are set to grow 10% this year, with the price-to-earnings ratio at 15x (in line with its 15-year average). As investors question the concentration risk in U.S. equities, Japan provides a good source of diversification in developed market equities.

Impact of the Yen on Japanese equities has weakened

Rolling 1-year correlation between weekly change in JPY vs. USD and the Nikkei 225 index

Source: FactSet, Nikkei, Reuters, J.P. Morgan Asset Management. Nikkei 225 performance calculated using local currency index. Data is as of March 13, 2024.

Related: The Federal Reserve's Actions During Election Years