Optimism is contagious. And in a world dominated by doom and gloom, it’s more important than ever to spread it.

Being a prudent optimist is also the best way to become a successful investor. I’ll elaborate on this in another essay soon.

We have LOTS of market stuff to talk about.

First: You probably saw all the hullabaloo and confusion about the impending approval of the first bitcoin (BTC) ETF, which will open up easy access to bitcoin for the trillions of dollars in Americans’ retirement accounts.

I’m hearing the ETF could be officially approved as early as today, with trading starting tomorrow.

No matter—this is short-term noise. Bitcoin’s incoming halving event is the real driver I believe will push its price to $150,000.

Let’s get after it…

1. The January effect is in play for stocks…

There’s an old saying on Wall Street, “As January goes, so goes the rest of the year.”

Many Wall Street adages are little more than old wives’ tales. But this one is true.

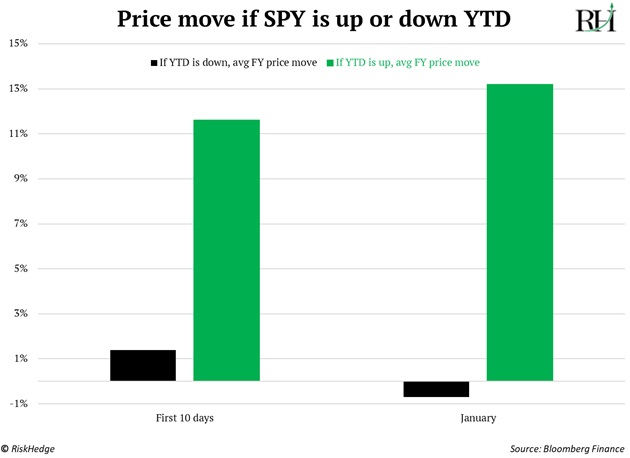

Take a look: When stocks rise in the first 10 trading days, markets perform dramatically better the rest of the year than if stocks had fallen:

We’re 10 days into 2024, and the S&P 500 is in the green. That’s good news for bulls.

But you should never hang your hat on a single detail.

The more important trend I’m watching is what type of stocks are going up.

Big tech stocks carried the market higher in 2023. And while artificial intelligence (AI) chip giant Nvidia (NVDA) hit a new all-time high yesterday, tech is among the worst-performing sectors so far this year.

Sectors like healthcare and financials are picking up the slack. This is what the pros call “rotation.” It’s the sign of a healthy market.

We’re watching the leaders in Disruption Investor, looking for opportunities…

2. New Year’s resolutions are dumb, but here’s one for you anyway.

True, lasting change rarely erupts like fireworks at the stroke of midnight on December 31.

That’s why New Year’s resolutions are broken all the time. Don’t wait until some arbitrary point in the year to make a needed change. Do it today.

I realized phones were a mind virus for kids last April. So, I immediately stopped using my iPhone around my kids.

But since it’s that time of year, I’ve made a new resolution: DON’T WATCH THE NEWS.

The news is a never-ending feed of the worst things happening on a given day. And it’s likely to be especially toxic leading up to November’s election.

Wasting valuable time reading the news is a surefire way to kill brain cells. Don’t get sucked into the political vortex.

Get a news jar for your kitchen. Insert $5 each time you watch ABC, click on The New York Times, or scroll through Facebook’s news feed. You’ll either avoid the poisonous rhetoric or have enough money to buy a very nice bottle of Barolo come year-end. Win-win.

I’m not saying politics isn’t important. But we’re investors around here. And to quote Warren Buffett, “If you mix politics and investing, you’re making a big mistake.”

For perspective, stocks typically go up in election years. Since 1928, US stocks were positive 90% of the time—gaining 11.7%, on average.

And there’s a good reason for that. Any politician who wants to get re-elected must hand out goodies to the people.

Don’t be surprised if Uncle Sam turns the money printer back on before November.

3. Are you brave enough to bet against Wall Street (again)?

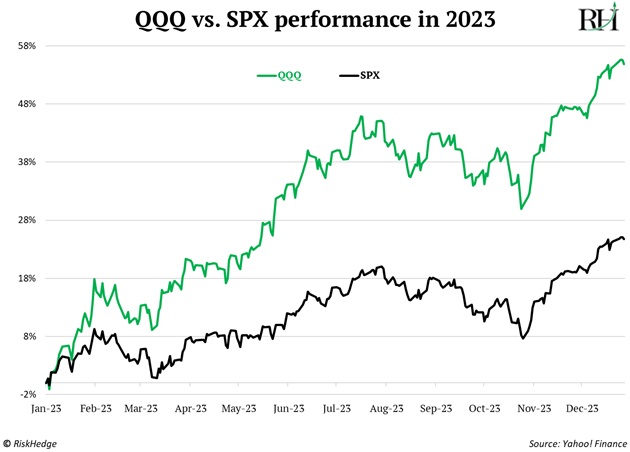

Wall Street strategists predicted a down year for stocks in 2023. I’m glad we took the other side of that bet and made a lot of money.

The S&P 500 climbed 24%, and the tech-heavy Nasdaq just had its best year since the dot-com boom:

The strategists are out with their 2024 predictions. And they’re still sour on stocks.

Their average year-end price target for the S&P is 4,800… just 1% above where it’s trading today.

Given strategists’ targets have historically been +6%, this is their roundabout way of calling for another down year.

I’ll let you in on a little secret about Wall Street: Nobody ever predicts a big up year or a big down year.

They make safe, middle-of-the-road forecasts that won’t get anyone fired, which is why they’re mostly useless—and why we should ignore them.

Trying to predict the stock market is a waste of time anyway. These guys have access to every high-powered investing tool imaginable, plus armies of Ivy League grads… and they still get it wrong most of the time.

Instead of playing this fool’s game, invest in great businesses profiting from disruption—which can add to our wealth no matter which way the market winds blow.

That’s what Chris Wood and I do in Disruption Investor.

-

Today’s dose of optimism…

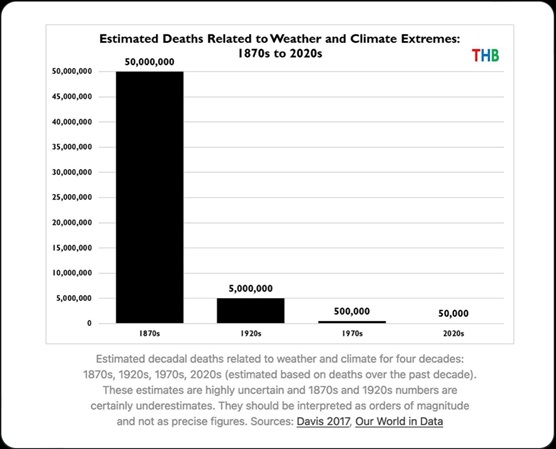

The number of people dying from extreme weather-related events has plunged 99.9% over the past 150 years, according to estimates from Our World in Data:

Source: Our World in Data

We have technology to thank for that.

Air conditioning to keep us cool during scalding-hot summers. Insulation to keep us warm during freezing winters. Early warning systems to get us out of harm’s way. And clever inventions to stop events like droughts.

Arizona uses 3% less water than it did in 1957, despite having a population that’s mushroomed 555%.

Show this chart to your favorite climate activist; it might just trigger them.

Related: Five Industries That Are Reviving American Innovation