“Are stocks cheap yet?”

A friend asked me that the other day.

It’s an important question because when the stock market is truly cheap, investors can load up on stocks with high confidence they’ll rise and generate big returns.

That’s what happened in 2009 and 2020 for investors wise enough to recognize the opportunity… and brave enough to act on it.

“Are stocks cheap?” is the type of question that should carry a simple “yes” or “no” answer.

But it doesn’t. Today, we’ll peel back the layers to get to the bottom of it.

By the end of the essay, you’ll know whether the stock market as a whole is cheap, which individual stocks are cheap, and what to do about it.

What does “cheap” mean?

Many folks think stocks trading for less than $5/share are cheap.

In other words, they focus on the price per share.

Let me make something clear…

How much one share of stock costs has nothing to do with whether that stock is cheap or expensive.

Compare Google with Tesla, for example.

Google trades around $2,250/share. Tesla’s stock sells for roughly $700/share. This doesn’t mean Google is three times more expensive than Tesla.

This might be obvious to you. But there are millions of novice investors who think this way.

In fact, it’s the opposite. Google trades at 20X earnings. Tesla sells for 55X earnings. In other words, Tesla is nearly 3X more expensive than Google.

A stock’s raw price per share tells you nothing about how cheap it is. To get a meaningful measure, you have to compare its price to how much earnings and profits it generates.

That’s where valuation metrics like price-to-earnings (P/E) or price-to-sales (P/S) ratios come in.

Are stocks cheap today based on P/E ratios?

The S&P 500 traded at an average P/E of 16X over the past 25 years. In other words, investors have been willing to pay $16 for every $1 of earnings.

Today, the S&P 500 trades at… 16X earnings. Based on this metric, stocks are averagely priced right now.

This will likely shock a few investors.

The S&P 500 dropped 20% over the past few months. Yet, stocks are “only” back to their long-term average valuation.

This is because US stocks are falling from a great height. They reached their most expensive levels since the dot-com bust late last year.

Should I buy cheap stocks?

It’s a GREAT question.

Most investors assume if they buy the market when it’s cheap, they’ll make the most money.

And they’re right.

For example, the S&P 500 traded at 9X earnings during the 2008 meltdown. It was the cheapest US stocks have been since the early 1990s.

The brave investors who bought when everyone else was panicking made 85% gains over the next two years.

The opposite is also true. Buying stocks when they’re expensive usually leads to lower returns.

US stocks sold for a nosebleed 26X earnings in 2000. It’s a record that still stands today. Folks who bought the top waited seven years just to break even.

Wall Street powerhouse JPMorgan ran the numbers on the S&P’s returns when it’s on sale versus when it’s pricey.

When the S&P 500 traded at a low P/E ratio, it handed out 18% over the next year, on average. That return dropped to an average of just 3% when earnings multiples were higher.

In other words, it pays to buy stocks when they’re on sale.

But what’s true for the stock market isn’t true for individual stocks…

Cheap stocks aren’t always good investments.

When a stock is cheap, there’s usually a good reason for it. Its business may be getting disrupted. Its revenues could be shrinking.

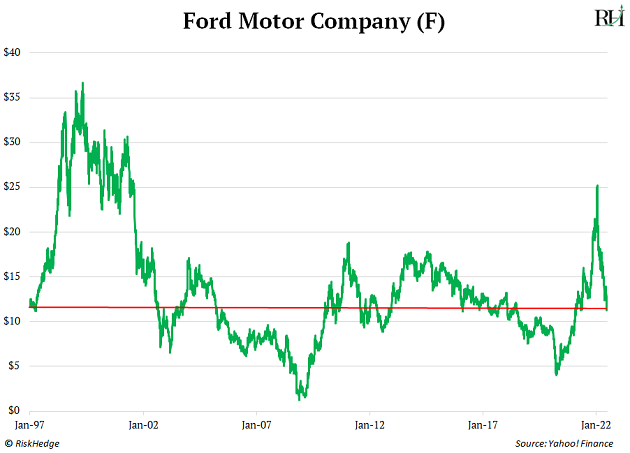

Take automaker Ford (F), for example. It trades at around 4X earnings today. In fact, the stock has traded at a rock bottom valuation for years.

Yet, Ford stock has gone nowhere since 1997!

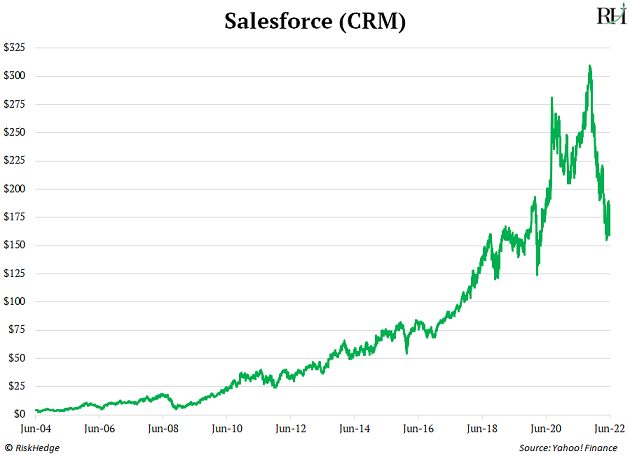

Contrast Ford to cloud computing powerhouse Salesforce (CRM), which sells at around 140X earnings today. It’s been among the most highly valued stocks for years.

Over the past decade, Salesforce handed investors 5X their money.

Buying the whole market while it’s cheap is a winning strategy.

Buying individual stocks while they’re cheap might be a winning strategy if you pick the right stocks. But it also may leave you with a portfolio of mediocre stocks.

To know if stocks are truly cheap, you must understand how two powerful forces influence the stock market…

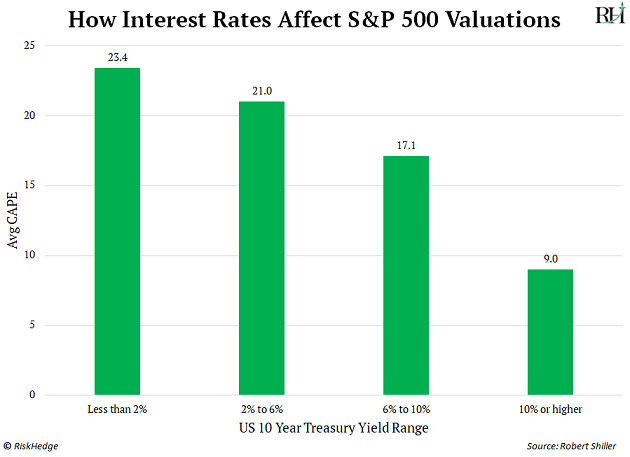

The first powerful force is interest rates.

Superinvestor Warren Buffett called interest rates “the most important item” for stock prices.

He’s compared them to gravity, saying: “Interest rates are to asset prices… like gravity is to [matter].”

In short, when rates are low, stock valuations can go to the moon. But rising rates pull valuations back down to earth.

When my friend asked if stocks were cheap, I told him it depends on where interest rates go from here.

Take a look at this table. It shows the 10-year average P/E ratio for US stocks (called the CAPE ratio) based on the US 10-year Treasury yield.

As you can see, the higher the yield, the lower the CAPE ratio:

The CAPE ratio is a longer-term measure that doesn’t drop quickly when the stock market drops. Today it’s about 28. Based on today’s 10-year Treasury yield of around 3%, US stocks are still a bit overvalued.

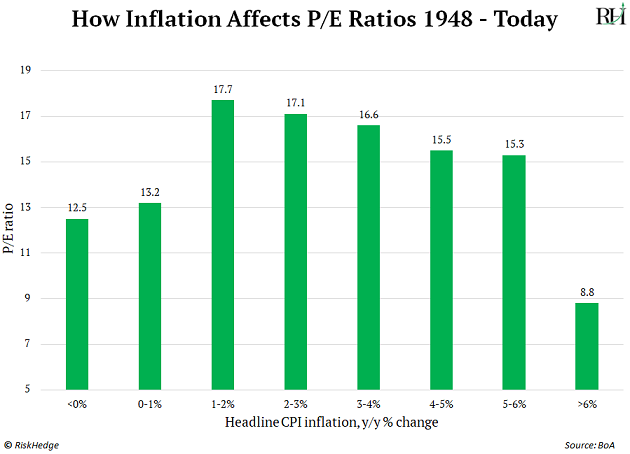

The second powerful force is inflation.

Without getting too into the weeds… stocks hate high inflation.

Stocks tend to perform well when inflation is 1%–3%. They perform okay when inflation is up to about 6%. After that, performance falls off a cliff.

You can see this relationship in the chart below.

In short, when inflation runs hot, stocks get cheap.

Going by last month’s annual inflation rate of 8.6%, stocks are overvalued today.

“Okay, Stephen… what does all this mean for my money?”

Stocks as a whole have gotten cheaper over the last few months… but they’re not a screaming “buy” yet.

But remember: what’s true for the stock market isn’t necessarily true for individual stocks.

Some great companies are trading at their cheapest levels in decades and, in some cases, ever.

Take Amazon, for example. It’s in the midst of its sharpest dip since 2006. The stock is trading where it was in September 2018, despite Amazon’s business being twice as large. Amazon recently traded at its lowest P/E ratio since the depths of the financial crisis.

Meta (Facebook) and Google are selling for their cheapest valuations in history. In fact, when measured by free cash flow, they’re now trading at lower valuations than Coca-Cola, a 120-year-old soda maker that barely grows.

That’s never happened before…

Computer chip stocks—my slam-dunk investment of the decade—are now as cheap as most of them have ever been.

These are the kind of investment opportunities I’m scaling into today. You should take a hard look at some of these stocks too.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.