Written by: Meera Pandit

Profit growth is set to be robust in 2025 across the market cap spectrum, but no number catches the eye more than small cap’s estimated 39% earnings growth (GTM Page 13). Although it appears that small cap is set to be the standout this year, typically small cap earnings are revised down significantly.

- Historical revisions are steep: From 2011-2023, large cap and mid cap annual earnings estimates were revised down on average 3.7% and 5.8%, respectively, from September 30 of the prior year through actual results at the end of February the year after. Small cap earnings were revised down nearly 24%.

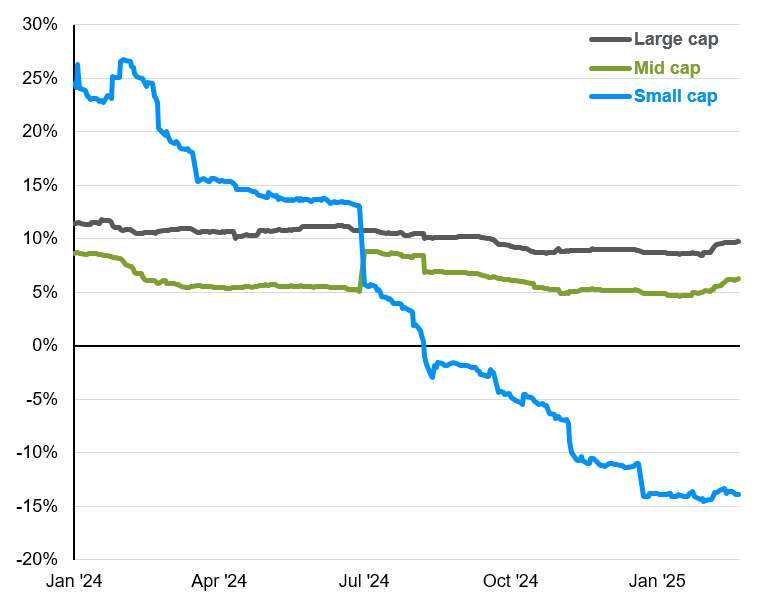

- Expectations have not matched reality: Earnings prospects looked bright in 2023. Russell 2000 earnings were expected to grow 13%. Instead, they contracted 12%. Then 2024 was supposed to garner 24% y/y profit growth. Instead, profits are tracking a 14% decline, shown in the chart below. A fall of the same magnitude in 2025 would wipe out estimated profit growth this year. In contrast, mid cap earnings grew 10% relative to 12% expectations at the beginning of 2023 and are tracking for 6% growth vs. 9% initial expectations for 2024. Similarly, large cap earnings were flat in 2023 relative to expectations of 4.5%, and in 2024 are expected to come in at 10% vs. estimates of 12% to start the year.

- Estimates have already begun to decay: Small cap earnings for 2025 have already been revised down 5%-points since the start of the year, compared to large cap down 2%-points and mid cap down 3%-points. For 1Q25, earnings have already turned negative for small caps, falling 13%-points to -8%.

After suffering back-to-back years of contracting earnings, a rebound in small cap earnings would not be surprising; however, investors should temper their expectations as small caps still face headwinds. About 43% of the index is unprofitable, despite a healthy economic backdrop. Moreover, economic growth is unlikely to accelerate further. The Fed is likely to leave rates rate high for longer, keeping debt service costs high, particularly given the high share of floating rate debt of small cap companies. Although tariffs may favor small caps over large due to their domestic orientation and less sensitivity to the dollar, it does not create explicit tailwinds. In addition, valuations are not necessarily cheap relative to history.

For investors looking to diversify from heavily concentrated and high valued large cap equities, mid cap equities may provide high quality, cyclical exposure with solid earnings prospects, while small caps could disappoint due to weaker fundamentals.

2024 consensus earnings growth estimates by size

Pro forma, year-over-year, start date 1/1/2024

Source: Factset, FTSE Russell, Standard and Poor's, J.P. Morgan Asset Management. Large cap = S&P 500, mid cap = Russell Mid Cap, small cap = Russell 2000. Sharp drop in small cap estimates and sharp rise in midcap estimates on July 1, 2024 reflect index reconstitution. Data are as of February 24, 2025.