Written by: Jordan Jackson

For investors, should fundamentals remain solid we would expect the Fed to begin gradually reducing rates by the middle of this year and for long-term rates to stabilize at current levels, before grinding lower over the balance of the year.

After a powerful fourth-quarter rally in both stocks and bonds to close out 2023, January’s start has been less than stellar. As the Federal Reserve shifted from rate hikes to signaling rate cuts, markets cheered the prospects for lower rates and less restrictive monetary policy this year. However, while inflation data continue to suggest easing price pressures, and growth momentum is slowing but solid, markets may be overly optimistic on how soon, and how quickly, the Fed will ease policy this year.

Given the worst of inflation is largely behind us, investors’ focus has shifted to the impact higher rates will have on growth and labor markets. Even after two years of aggressive tightening, the overall job market looks strong with evidence of gradual slowing:

- The December employment report showed that the US economy added a strong 216k jobs and the unemployment rate held steady at 3.7%. The unemployment rate has now been below 4% for 25 consecutive months. That said, downward revisions to job gains in October and November bring the 3-month moving average to 165k, its slowest pace since early 2021.

- The ADP employment report showed private payrolls rose a similarly strong 164k in December. Moreover, initial jobless claims fell 18k to 202k in the last week of the year, the lowest weekly reading since October.

- Demand for labor continues to cool with the number of job openings in November declining to 8.79 million – the lowest since March 2021. This brings the ratio of job openings per unemployed worker to 1.4 – down from a peak of 2.0 in March 2022, in line with a cooling of tight labor market conditions.

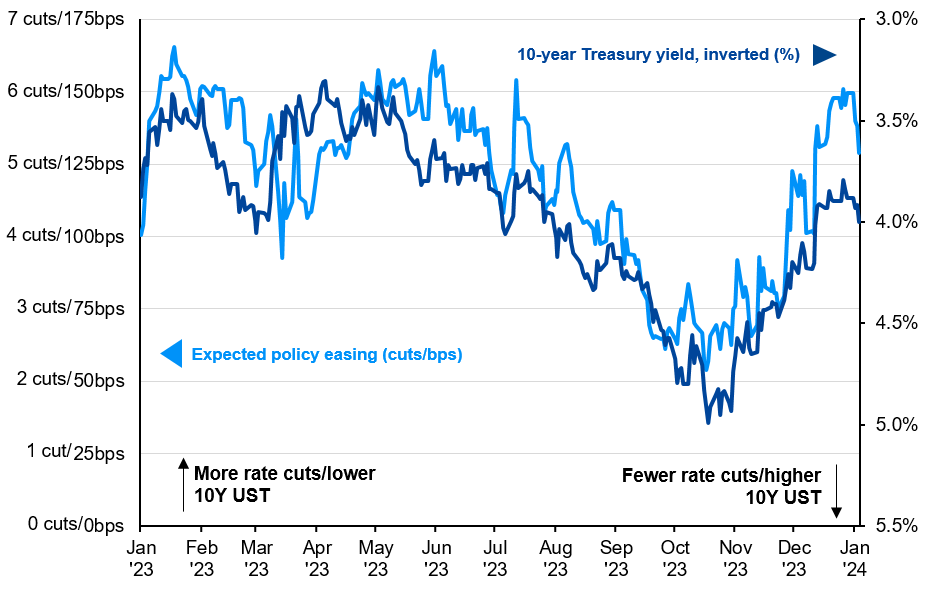

Importantly, the job market continues to become more in balance, but a still strong labor market suggests the Fed doesn’t need to be in a rush to cut interest rates. As highlighted, the markets have gone from expecting just 50 basis points of cuts in 2024 in mid-October, to close to 6 cuts at the beginning of the year even as growth and payrolls have remained solid. Unsurprisingly, markets paired back some of this expected easing and now see roughly 5 rate cuts this year following the employment release.

Notably, since the start of 2023, long term interest rates have moved almost in lock step with shifting rate expectations and following the December report, the U.S. 10-year moved back above 4% as another rate cut was priced out. For investors, should fundamentals remain solid we would expect the Fed to begin gradually reducing rates by the middle of this year and for long-term rates to stabilize at current levels, before grinding lower over the balance of the year.

Market expectations for policy easing in 2024

Federal funds futures, 10-year treasury yield (inverted)

Source: Bloomberg, CME, J.P. Morgan Asset Management. Market expectations for policy easing are derived from federal funds futures contracts for December 2023 and 2024. Data are as of January 4, 2024.

Related: How Sectors Perform Under Republicans vs. Democrats?