Written by: Jean-Sébastien Nadeau, MBA, CFA® |AGF

Source: Bloomberg LP as of November 9, 2023. Past performance is not indicative of future results. One cannot invest directly in an index.

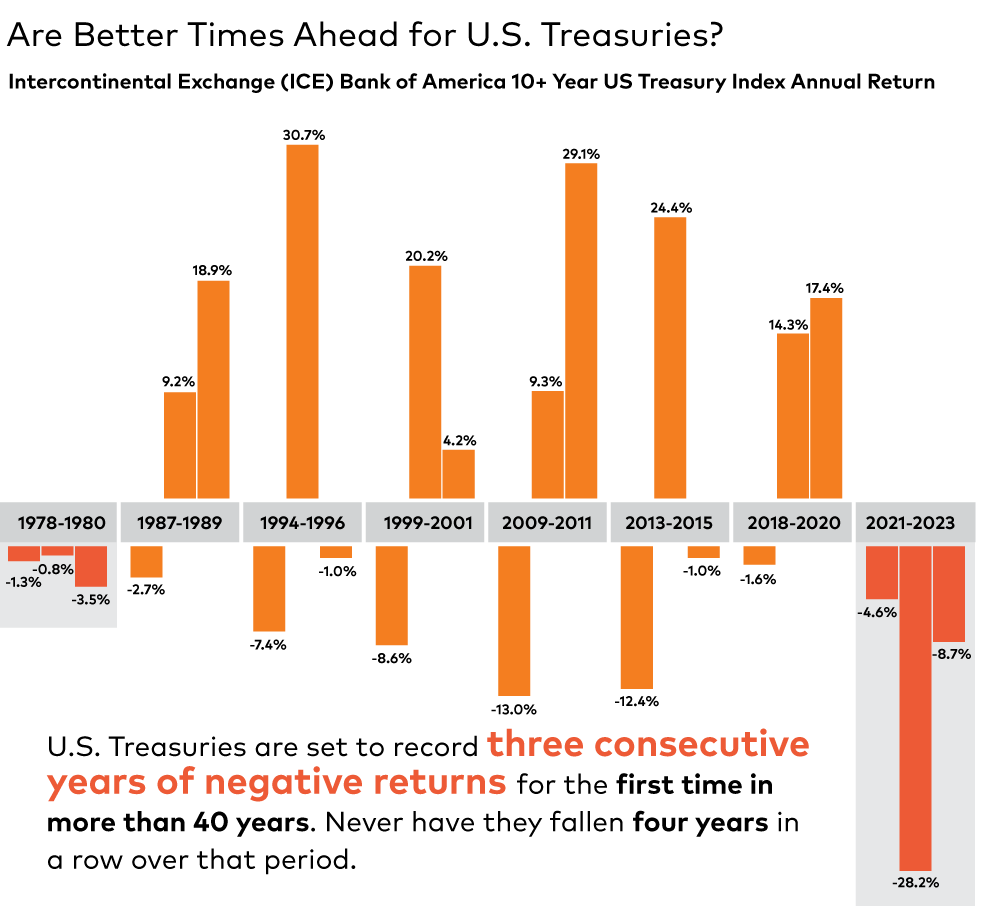

Unless something drastically changes over the next six weeks, U.S. Treasuries on the longer end of the yield curve are set to record the rare feat of having three consecutive years of negative returns (see chart). How rare? The only other time it’s happened in the past 45 years was in the late 1970s and into 1980 when Jimmy Carter was the U.S. President and interest rates rose to 20%.

Of course, most fixed income investors are hoping the current losing streak ends at three – just like it did back then. Yet whether it pans out that way may very well hinge on the strength of the U.S. economy and central bank policy moving forward. In fact, the best-case scenario for Treasuries could be a recession accompanied by rate cuts from the U.S. Federal Reserve (Fed), but it is possible a more resilient economy and less accommodative Fed than expected could end up limiting the extent to which they rebound.

Related: Equities Have Typically Peaked Months Before a Recession, but Can Bounce Back Quickly