Robinhood Markets (HOOD) has been a case of giving to and taking away from investors. The stock quadrupled from August 2024 to February 2025, but it shed nearly 31% for the month ending March 12 and now resides at its lowest levels since December. Despite that vicious pullback – one that’s put the once the high-flying stock in bear market territory – Wall Street remains bullish on the shares.

Even when accounting for the recent retrenchment, the stock has quadrupled since May 2022, indicating that it has rewarded investors that are able to remain patient through intense pullbacks. While Robinhood isn’t for the faint of heart, it’s clear sell-side analysts see opportunity ahead.

(Image: TipRanks)

The current market climate, one marred by trade wars, declining cryptocurrency prices and retreating mega-cap growth stocks, acts as a headwind to stocks such as Robinhood. To be sure, those are credible reasons to be tepid on the stock over the near-term, but the medium- to long-term outlook is bright.

Robinhood Product Expansion Justifies Bullish View

Robinhood rose to prominence during the early days of the coronavirus pandemic as one of the platforms of choice for a new generation of investors. The company leveraged that popularity, selling shares to the public for the first time in July 2021. To its credit, Robinhood’s product suite has not remained static in the years since its initial public offering (IPO).

Rather, it’s expanded, making the brokerage firm an increasingly viable rival to the likes of Charles Schwab (SCHW), Fidelity and Morgan Stanley’s (MS) E*TRADE. Robinhood Gold is a prime example of the broker’s customer acquisition and retention strategy. That offering lures customers with a 4% interest rate on cash sweeps and a 3% IRA match, but it’s relevant to shareholders because it operates on a subscription model. Translation: Robinhood Gold is an added revenue stream and one that can facilitate top-line growth.

Robinhood Gold is paying off on another front. It’s spawned the creation of a namesake credit card – one that has aura of exclusivity to it because only members of this tier are eligible to apply. In fact, there’s a waitlist. That stands to reason because it features 3% cash back on most purchases and 5% cash back on travel booked through the broker’s portal – perks craved by investors and devoted travelers alike.

Demographic Trends Bode Well for Robinhood

It’s worth noting that Robinhood possesses demographic advantages over some of its old guard rivals. Alone, the fact that retail participation in financial markets has surged from 49% in 2013 to 58% in 2022 augurs well for firms like Robinhood, but there’s more to the story.

At the end of 2024, the financial services provider had $193 billion in assets under custody by way of 25.2 million funded customers. The median age of a Robinhood customer is 35 and $161 billion of those assets are held by millennial and Gen X clients.

Those data points are all the more relevant as the great wealth transfer accelerates. By 2048, an estimated $124 trillion in wealth will be moved from baby boomers and older generations to their heirs with Gen X and millennials slated to garner the bulk of those benefits. That tidal wave of shifting wealth, which is already occurring, could position Robinhood for more earnings per share (EPS) growth.

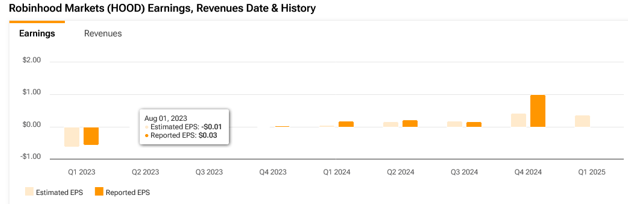

(Image: TipRanks)

Over the past five quarters and in six of the past seven, Robinhood has delivered at least triple-digit EPS growth, indicating that its price-to-earnings ratio of 22.8x is undemanding. A case can be made that at that multiple and with a market capitalization of $32.20 billion, the brokerage firm isn’t getting adequate credit for its $4.33 billion in cash. Undoubtedly, that outlook is optimistic, but upside to EPS estimates is possible if equity and crypto prices rebound, prompting renewal of animal spirits among Robinhood’s core client base.

Sentiment Remains Biggest Near-Term Headwind

The biggest near-term challenge to the Robinhood bull thesis is how investors are feeling about markets and the economy at large. Currently, those feelings are dour – sentiment borne out in the broker’s February update.

As a result of weak equity markets, assets under custody declined and quarter-to-date crypto notional volumes, described by some analysts as a “volatile” revenue source, followed bitcoin prices lower. Equity and options notional volumes were also lower last month, reflecting apprehension among market participants.

On the brighter side of the ledger, funded accounts grew month-over- and year-over-year, standing at 25.6 million at the end of February. Additionally, Robinhood’s February operational results don’t reflect the acquisition of TradePMR, which closed at the end of the month. As of the end of January, TradePMR had $43 billion in assets under administration. The buyer said the addition of TradePMR will be immediately accretive to earnings.

Wall Street Broadly Bullish on Robinhood

Eighteen analysts cover Robinhood and there are no sell ratings on the stock with the consensus equating to a moderate buy. The average price target of $71 implies upside of 82.43% from the March 12 close.

That might be overly rosy for some on the sell-side, but even those that recently trimmed price targets view Robinhood as having the potential for significant upside, noting the recent slide could be the pullback some have been waiting for to get involved with the once high-flying shares.

“We reduce our PT to $61 from $75 previously on lower estimates and a modestly lower valuation assessment, we note the 42% drop in the stock from its recent high just after 4Q earnings in mid-February, represents an excellent buying opportunity and we see ~60% upside over the next 12 months to our revised price target,” wrote Deutsche Bank’s Brian Bedell in a March 12 note. “We reiterate our Buy rating.”

(Image: TipRanks)

Fintech Stocks Cooling Off, But Smart Investors Spot Opportunity

Robinhood was a beneficiary of post-election ebullience and hope that 2025 would be a turning point for cryptocurrency, but the air has come out of trades. That’s a reminder that securities don’t move up in straight line fashion. Nor do the fundamentally sound names slide into perpetuity.

Robinhood checks the fundamentally sturdy box while offering impressive growth rates with somewhat of a value feel. There’s no denying near-term challenges linger, but risk-tolerant investors could see their patience rewarded.

Related: Most Institutional Investors Will Increase Crypto Exposure in 2025