Ouch.

Global markets are in freefall in response to President Donald Trump’s universal 10% tariff on all goods being imported into the U.S., with as many as 60 countries facing “reciprocal” tariffs on top of that.

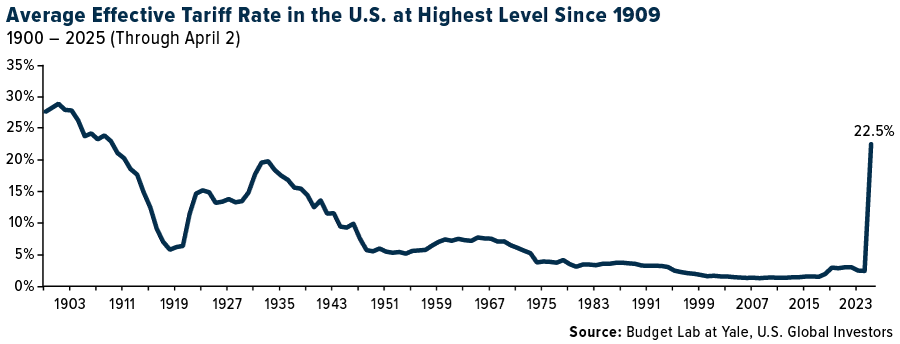

When we combine all new tariffs in 2025 so far, including the raft of reciprocal tariffs announced on Wednesday, we’re looking at an average effective rate of 22.5%, according to Yale’s Budget Lab. That’s the highest such rate since 1909—the same year that President Howard Taft proposed the idea of an income tax to Congress.

History Shows Tariffs Often Backfire

As I pointed out to you last month, tariffs are a type of tax paid for by domestic import-export companies, who often pass the additional cost on to consumers. This can turbocharge domestic inflation.

Tariffs can also lead to full-blown trade wars, as we saw in the federal government’s previous attempts to raise revenue through the taxation of imported goods.

The Smoot-Hawley Tariff Act, enacted in 1930, is widely believed to have exacerbated the effects of the Great Depression, as global trade tanked a whopping 65%. A few decades prior, then-Representative William McKinley’s tariff act triggered retaliation from other nations, leading to higher prices for U.S. consumers. (If you need to brush up on your Smoot-Hawley history, I recommend the famous “Anyone? Anyone?” scene in 1986’s Ferris Bueller’s Day Off, which you can watch here.)

As was the case then, we’re already seeing retaliatory tariffs. China announced today that it will impose a 34% duty on all goods imported from the U.S.

Tesla Could Benefit from Its Domestic Supply Chain Advantage

If this weren’t enough, automobile imports face a steep 25% tariff. Trump claims he “couldn’t care less” if foreign manufacturers raise prices for U.S. consumers, and from the looks of it, they may need to—and significantly so, in some cases. Mitsubishi, for instance, will need to increase the price of its vehicles by more than 20% here in the U.S. to offset the new levy, according to estimates by CLSA.

The manufacturer expected to fare the best is Tesla, whose supply chain is well-integrated in the U.S.

More than 62% of the company’s facilities are located domestically, with approximately a quarter of its suppliers also based in the U.S. By comparison, fewer than half of Ford’s facilities worldwide are located in America.

This could be constructive for Tesla, whose stock has fallen by half since its peak in mid-December, making it one of the worst performers of the year so far. Due to political backlash against CEO Elon Musk, Tesla’s quarterly sales fell a significant 13% in the first quarter compared to the same period last year.

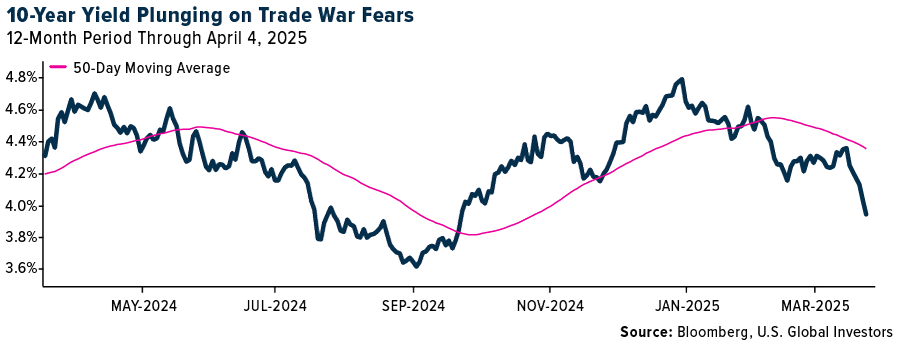

Why Falling Yields Could Help Homebuyers

When it comes to new home purchases, bad economic news could be good news. Mortgage rates generally track the yield on the 10-year Treasury, which has sharply dropped below 4% due to trade war fears. Bond yields generally fall when prices rise.

Granted, home prices in the U.S. are still hovering near record highs, but current homeowners may be able to refinance sooner than expected.

Gold Has Historically Shined When Real Yields Turn Negative

Lower yields are also good for gold. Because it’s a non-interest-bearing asset, gold starts to look more attractive as yields fall, especially when inflation remains historically elevated, as it is now. The 10-year yield is nominally 3.9% right now, but when you factor in the 2.8% headline inflation rate from February, the real yield is closer to 1%.

If yields fall further or if inflation jumps higher due to tariffs, we may end up with negative real yields, which have historically been bullish for gold prices.

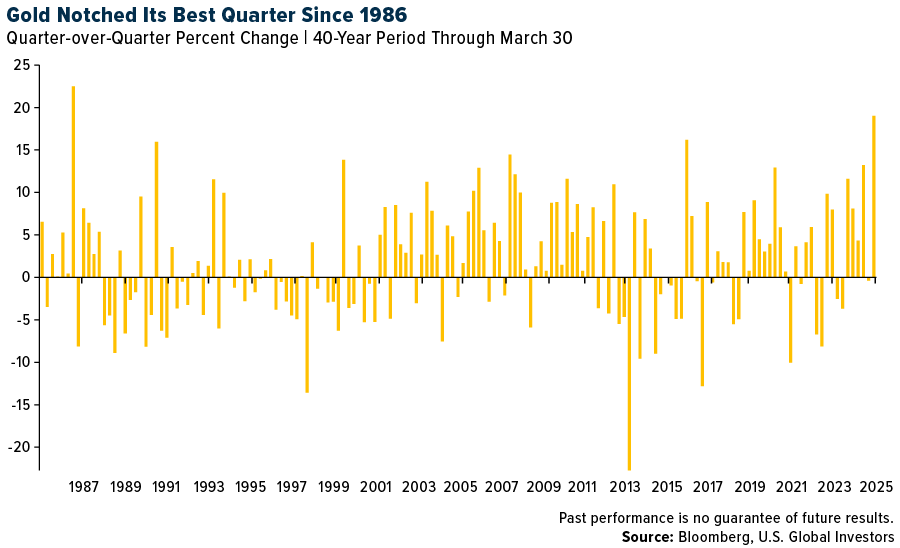

The yellow metal is off its highs today, trading down more than 2% as it’s swept up in the broader selloff. I believe investors should strongly consider buying these dips. Gold just notched its best quarter since 1986, ending the March quarter at $3,123 per ounce, and there could be further upside momentum.

Insights from the Oxford Club’s Investment U Conference

I believe the number one thing investors can do at this moment is to remain calm and not panic.

This week, I attended and spoke at the Oxford Club’s Investment U conference in Florida, where many presenters offered their own advice to those who may be worried right now, especially those nearing retirement age. Dr. Nomi Prins, founder of Prinsights Global, told the audience that now may not be the time to obsess over your 401(k). No need to look at it every minute.

My favorite piece of advice came from my friend Alexander Green, the chief investment strategist of the Oxford Club. Alex reminded the audience of America’s exceptionalism, which is no less true today than it was before markets started crashing. “If we’re no different from other Western democracies,” Alex said, “why were transformative companies like Apple, Alphabet, Facebook, Amazon, Microsoft, Twitter, Netflix, Snapchat, Instagram, Tesla, Uber, Crispr and NVIDIA—to name just a few—all found here?”

Alex is currently working on a book on America’s exceptionalism, which I’ll be sure to pick up once it’s released. You can read my two-part interview with him from 2017 here and here.

Warren Buffett, the perennial optimist, has always urged investors to look beyond the current crisis and to follow the trendlines, not the headlines. In his 2017 letter to Berkshire Hathaway shareholders, he wrote that “major declines” can “offer extraordinary opportunities to those who are not handicapped by debt.” He also paraphrased lines from the British poet Rudyard Kipling’s famous poem “If,” which I’ll end with today:

If you can keep your head when all about you are losing theirs…

If you can wait and not be tired by waiting…

If you can think—and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.

You can listen to Oscar-winning actor Sir Michael Caine read Kipling’s poem by clicking here.

Related: The Tariff Impact in One Graph