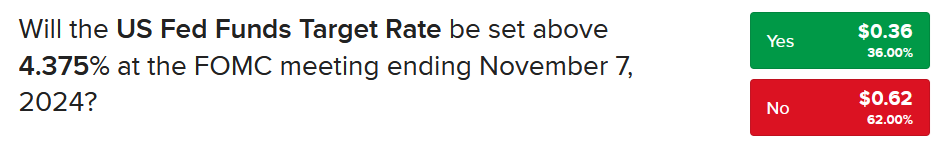

A fortunate series of events helped stocks reach fresh all-time highs this weel, but the AI enthusiasm was disrupted by news from the Wall Street Journal of the Department of Justice opening an investigation against Super Micro Computer Inc. Initially, the semiconductor trade was bolstered by strong results from Micron Technology as well as another fresh round of stimulus measures from Beijing, but it has lost steam as a result of the regulatory headwind. Turning to the stateside economic calendar, it featured an upward revision to second quarter GDP which coincided with stronger-than-expected durable goods orders and pending home sales. Contained unemployment claims also added to confidence that the Fed could engineer a soft landing, helping equities but sending yields north. Despite the solid figures, however, investors in our IBKR Forecast Trader are favoring a 50-bp reduction from the central bank at its November meeting, while fed funds futures carry similar odds at the moment.

Source: ForecastEx

Stimulus from Beijing, Again

West of the Pacific in Beijing, government leaders assured market participants that they will not just help the economy via the monetary system, but with fiscal support as well. The 24-member Politburo also seeks to cushion the struggling real estate sector by limiting new construction projects and stabilizing prices with aggressive interest rate and regulatory maneuvering. The group is also planning to motivate investments in the stock market and propel corporate buybacks through financing easements. Lowering unemployment amongst the younger generations is also a policy goal of the committee.

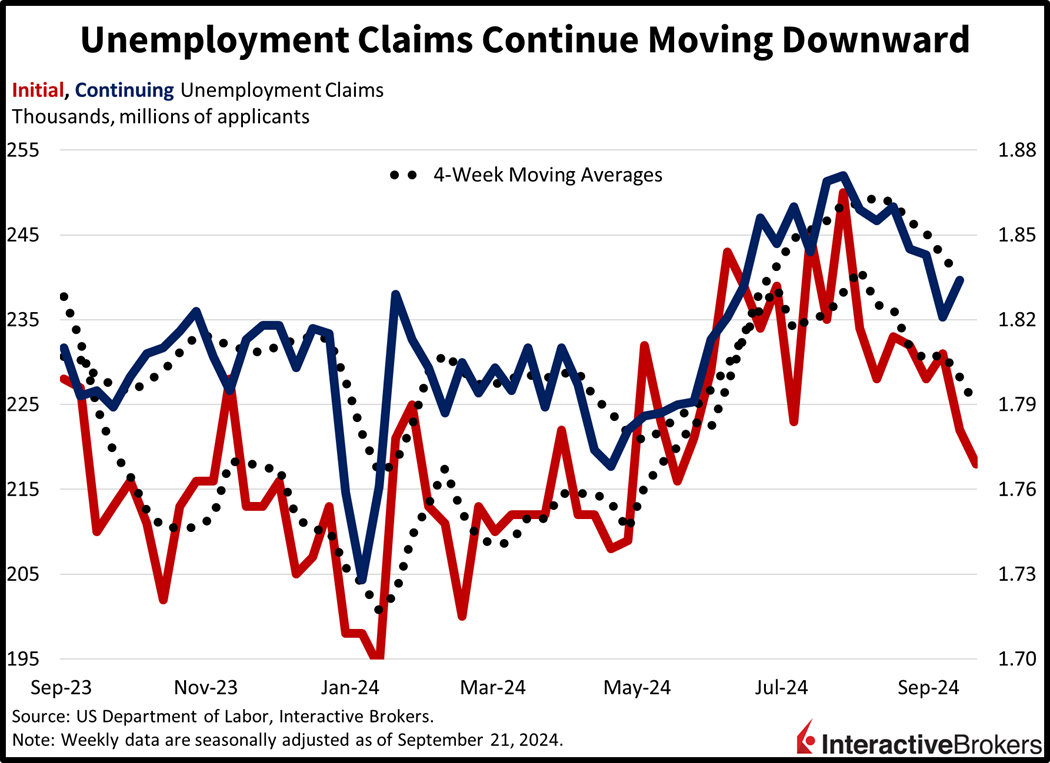

Layoffs Remain Contained

The weekly unemployment claims report has gained importance as all eyes are on labor market health to see if the Fed can side-step recession after hiking rates 525 basis points (bps). So far, so good. Initial claims fell to 218,000 for the week ended September 21, below the prior period's 222,000 and the median estimate of 225,000. Continuing claims for the seven-day interval ending September 14 inched up slightly to 1.834 million, above the previous span's 1.821 million and projections of 1.828 million. Four-week moving averages dwindled on both fronts, however, from 228,250 and 1.842 million to 224,750 and 1.836 million.

Mortgages Too Costly Above 6

Another look at the real estate market offered little reason for optimism, with home contract signings remaining near year-to-date troughs. Pending home sales did increase slightly in August though, posting a 0.6% month-over-month (m/m) gain, better than the 0.3% projected and the 5.5% decline from July. On a year-over-year basis, though, the headline figure dropped 3%, a smaller slip than the preceding period’s 8.5% contraction. Contract signings serve as a lead to closings, as financing agreements, inspection visits, and other considerations occur in between the two pivotal dates.

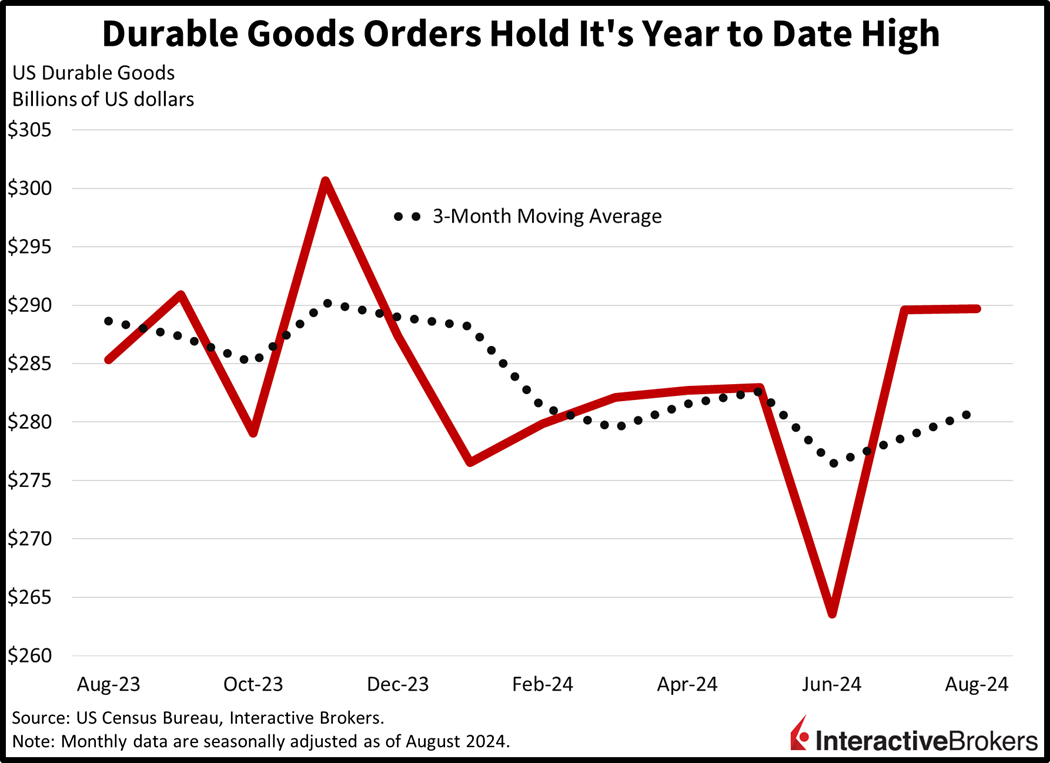

Durable Goods Stay Afloat

In the manufacturing sector, durable goods orders came in unchanged last month, holding on to July's sharp recovery. The outcome was better than the median estimate which called for a decline of 2.6% m/m, while the previous month's gain sported a sizable 9.8%. Hampering the progress was the passenger aircraft category, which saw purchases decline 7.5% m/m. Communications equipment and computers saw modest m/m declines of 0.7% and 0.3%. Defending July's recuperation were transactions for defense airplanes, electrical equipment, fabricated metal products, machinery, primary metals, automobiles and parts, and the other segment which saw m/m increases of 8.4%, 1.9%, 0.6%, 0.5%, 0.2%, 0.2% and 0.2%. A proxy for business investment, nondefense capital goods excluding aircraft, rose 0.2% m/m, offsetting the 0.2% decline in July.

GDP Gets Upgraded

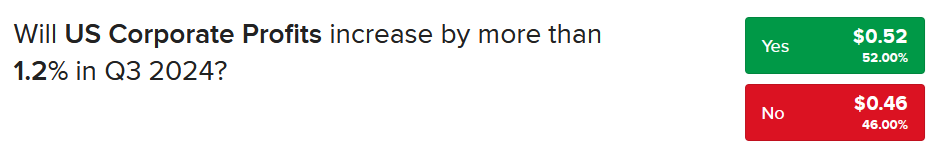

In other economic news, second quarter US economic growth was bumped up to 3% from 2.9%, primarily reflecting stronger inventory investment and federal spending. Consumption, business investment and exports were revised lower, but imports higher, weighing on the amount of the upgrade. Meanwhile, the pace of corporate profits beat expectations, rising 3.5% quarter over quarter and recovering from the 2.1% decline in the first quarter. The IBKR Forecast Trader offers near coin-flip odds for a reading of 1.2% in the third quarter, for those that think profitability momentum remains positive.

Source: ForecastEx

Bumpy Rise in Markets

Firm economic data and adversarial artificial intelligence news are sending yields north, while major equity indices are paring sharp gains, but hanging in there. We’re seeing some bear-flattening action across the yield curve, with the 2- and 10-year Treasury maturities moving up 6 and 2 bps to 3.62% and 3.81%. Major stateside equity benchmarks remain in the green and are led by the Russell 2000, which is up 0.7%. The Dow Jones Industrial, Nasdaq 100, and S&P 500 indices are higher by 0.6%, 0.4%, and 0.2%, as the adversarial news from the Justice Department passed the daily leadership baton from growth to value. Sectoral breadth is positive with 7 out of 11 segments trading north as materials, technology, and industrials add 2%, 0.7%, and 0.6%. The laggards are comprised of energy, real estate and utilities which are off by 1.8%, 0.8% and 0.2%.Commodities are mostly bullish as easy-money sentiments bolster prices for copper, silver, lumber, and gold; they’re higher by 3.2%, 1%, 0.6%, and 0.5%. But crude oil can’t catch a break, folks; this time it’s the market reacting to Riyadh ready to abandon its mission for loftier prices in order to chase greater market share. Tripoli is also looking to add supply, which is contributing to lower prices. WTI is trading at $67.50 per barrel, a 3.3% decline. The dollar is depreciating relative to all its major counterparts including the euro, pound sterling, franc, yen, yuan, and Aussie and Canadian dollars.

Is Beijing Desperate?

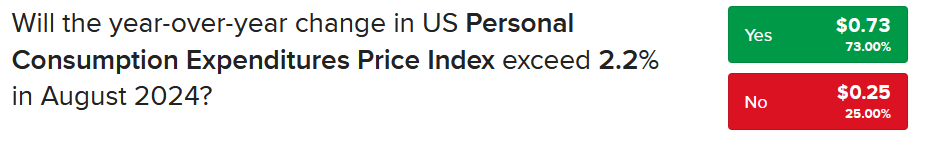

Recent efforts by Beijing to shore up its markets are increasingly suspicious in regard to the economic prospects of the nation. The benefits of this week’s earlier effort were short-lived, with the market not responding well yesterday. Today’s development, meanwhile, could point to deteriorating conditions domestically and a state of panic, which could have ripple effects globally. Much of this year’s disinflation was imported from China; the question on some people’s minds, especially with rising commodity prices, is whether Beijing can import inflation as it stimulates fiscally and monetarily. Finally, tomorrow’s economic calendar carries the Fed’s preferred inflation gauge, as well as consumer spending numbers for services. The Wall Street consensus for headline and core price pressures is at 2.3% and 2.7%, while the IBKR Forecast Trader prices the Yes contract of a headline number above 2.2% at $0.73.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Related: Why Rate Cuts Won’t Rescue the Real Estate Market — Yet