This morning, Halloween is bringing tricks, not treats to many investors. The S&P 500 (SPX) seemed set to extend its monthly winning streak to six, but it seems to be choking – just like my Yankees did last night. Yes, I’m tired and cranky after a lousy night in the Bronx, but even though I can’t be objective about my team’s ability to snatch defeat from the jaws of victory, I’ll do my best to keep my sour mood out of today’s analysis.

While last night’s baseball game hinged upon a series of silly mistakes, today’s drop seems to be much more rooted in cogent thinking. Microsoft (MSFT) and Meta Platforms (META) are leading a broad selloff. Both companies handily beat their EPS estimates – MSFT $3.30 vs. $3.11 exp, and META $6.03 vs $5.52 exp – but their commentary seems to have spooked investors, nonetheless. MSFT offered tepid guidance for its Azure cloud division, noting that they fell short of data center capacity and thus will need to spend more to catch up. META reaffirmed its commitment to spend heavily on artificial intelligence and other forward-looking technologies. META investors have heard this before, perhaps recalling the stock’s swoon in 2022 when its heavy spending on the metaverse failed to improve the bottom line.

That combination has led to some rethinking about the promise of AI. At some point, all this spending has to improve the bottom lines of its users – not just the chipmakers.

The market’s mindset seems to be switching from one where anything AI-related was a reason for enthusiasm towards one where investors are looking for some returns on their massive spending. That’s definitely what’s hitting META and MSFT today. If I’m investing in a company that is spending billions on AI chips, servers, and developers, I’d eventually like to see that resulting in some ROI. And I think an increasing number of investors agree, though not all.

Ultimately, we need to see a wide range of companies see bottom-line results from their AI activities. So far, it’s been a huge boon to the chipmakers, the picks and shovels of the AI gold rush, and there is a giant halo on the “miners”, the software providers like MSFT, GOOGL, META, AMZN, etc. But think about the early days of the internet. It did indeed prove to be a huge productivity boost for a wide range of companies, but it took a while to achieve it. I would not be surprised if we start to see some more skepticism about AI spending until we start to see some real productivity as a result – not just a lot of capital spending. Let’s see what AAPL and AMZN have to say on the topic today. (And will the potential accounting issues at NVDA’s 3rd largest customer (SMCI) have any effect on its bottom line?)

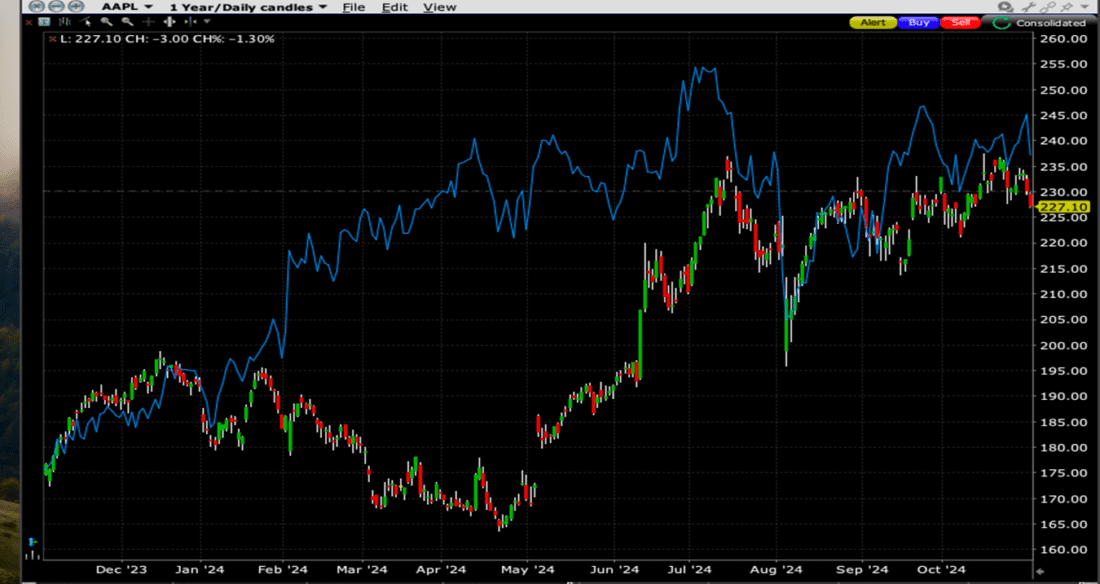

So now it’s Apple’s (AAPL) and Amazon’s (AMZN) turns at bat. On a one-year basis, both have offered double-digit returns, and on a year-to-date basis they have performed roughly in line with SPX and the Nasdaq 100 (NDX):

1. Year Chart, AAPL (red/green daily candles), AMZN (blue line)

Source: Interactive Brokers

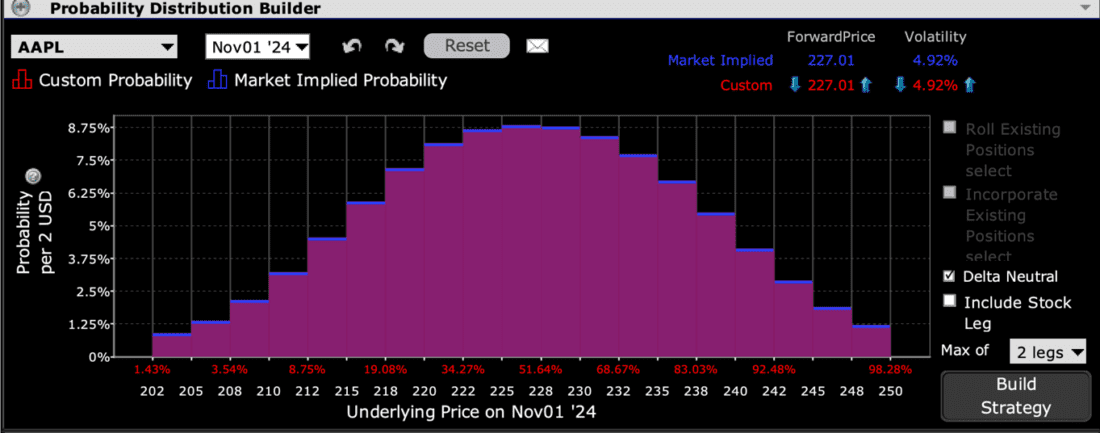

Looking at AAPL, the IBKR Probability Lab reveals little. We have a symmetrical probability distribution with a peak in at-money options:

IBKR Probability Lab for AAPL Options Expiring November 1st, 2024

Source: Interactive Brokers

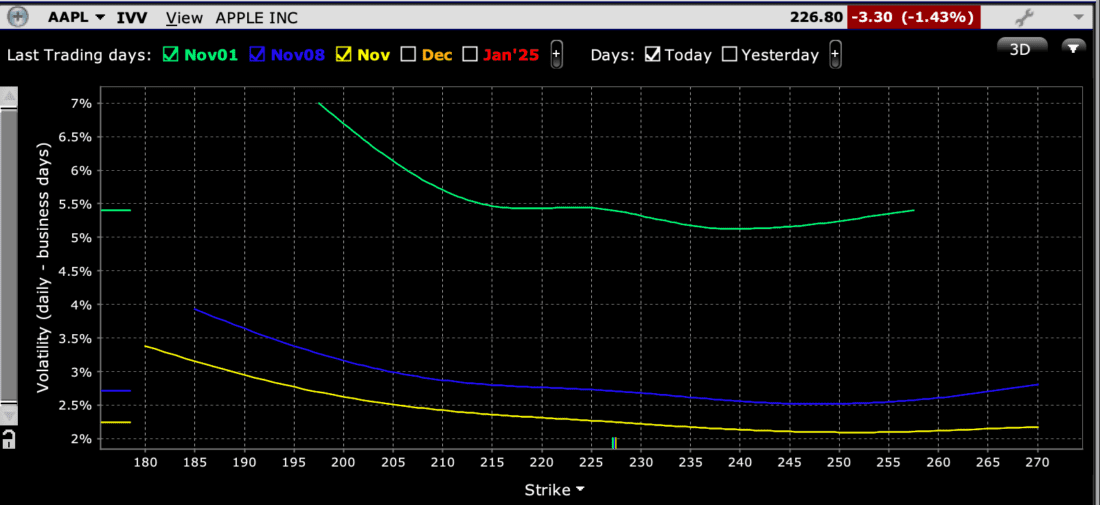

Skew charts reveal a bit more risk aversion. Once again, we see a bit of a “W” shape, but there is a pronounced bias to the downside. Today’s drop seems to have traders a bit more concerned about the potential for another megacap dip. The at-money, near-term options have a daily volatility just shy of 5.5%. That is well above the average for the past six post-earnings moves of 2.87% (+0.69%, +5.98%, -0.54%, -0.52%,-4.8%, +4.69%)

Skews for AAPL Options Expiring November 1st (dark blue), November 8th (light blue), November 15th (yellow)

Source: Interactive Brokers

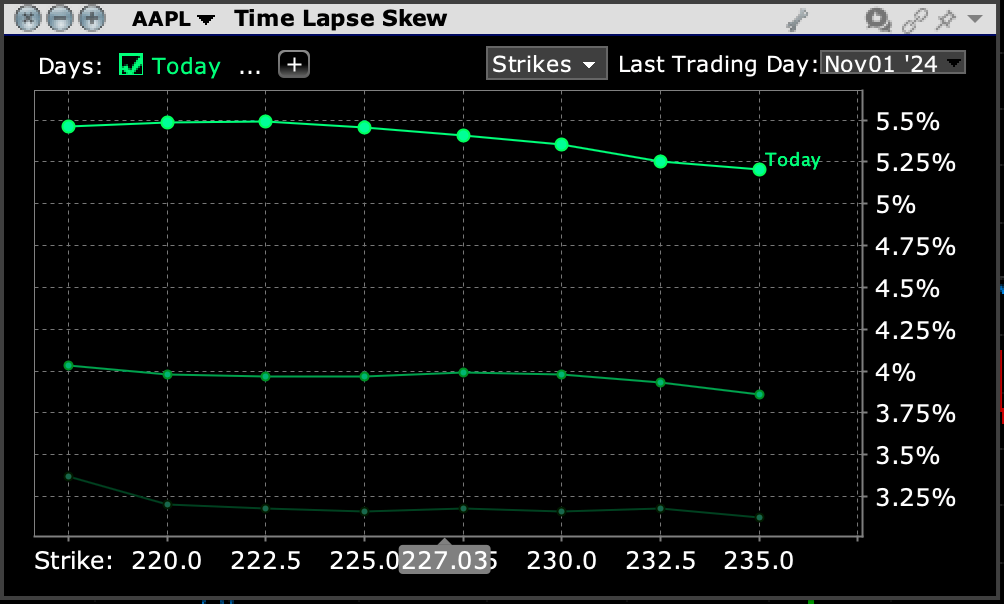

It is normal for implied volatilities to rise as an earnings date approaches, but the one-day change in AAPL is indeed quite pronounced. A down day will do that:

Skew for AAPL Options Expiring November 1, 2024, Today (dark green), Yesterday (light green)

Source: Interactive Brokers

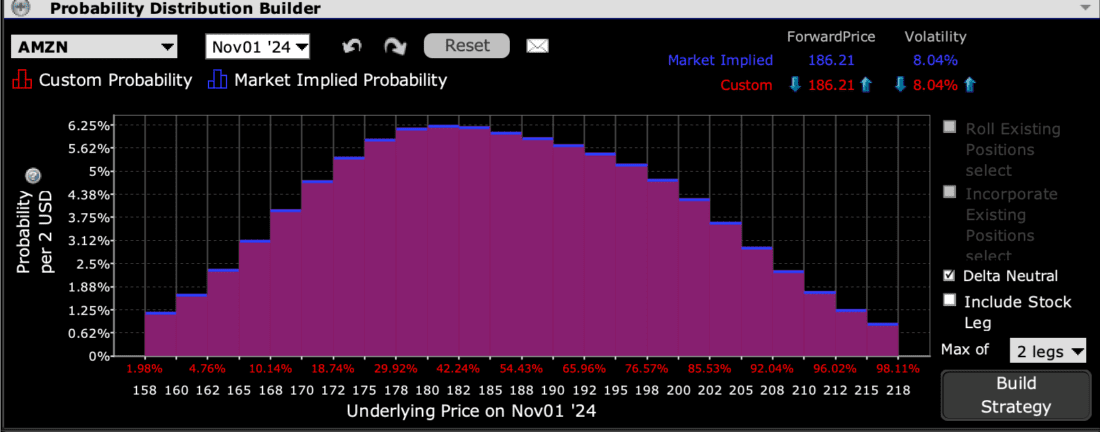

Interestingly, AMZN options tell a different story from AAPL’s. In AMZN’s case, the Probability Lab shows a peak below the current $186.21 in the $180-$182 range:

IBKR Probability Lab for AMZN Options Expiring November 1st, 2024

Source: Interactive Brokers

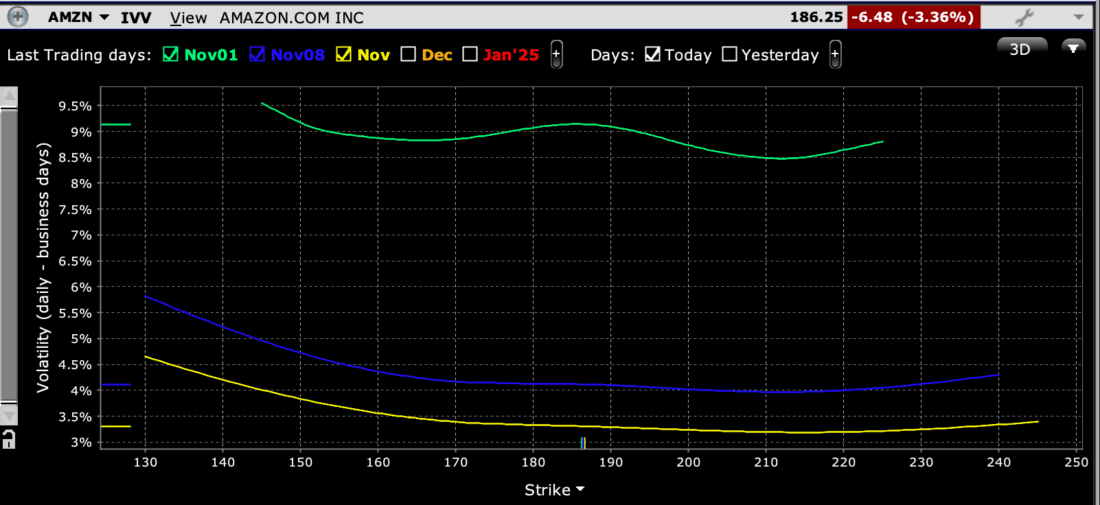

Skews, however, are largely flattish, with only a slight tilt towards the downside. Those too reflect a daily at-money implied volatility well above the 6.34% average of the past six post-earnings moves (-8.78%, +2.29%, +7.87%, +6.83%, +8.27%, -3.98%). The flat skew might be the result of four rises after the last five earnings.

Skews for AMZN Options Expiring November 1st (dark blue), November 8th (light blue), November 15th (yellow)

Source: Interactive Brokers

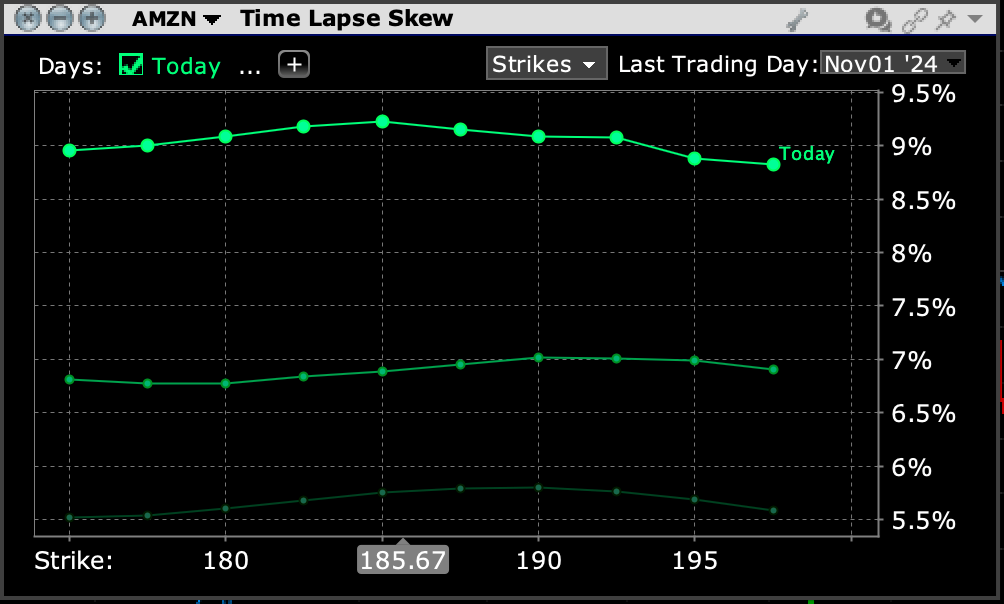

As with AAPL, the front week’s volatilities expanded dramatically today:

Skew for AMZN Options Expiring November 1, 2024, Today (dark green), Yesterday (light green)

Source: Interactive Brokers

Today’s reports will hopefully offer some clarity into whether AI is benefitting two important tech giants. AMZN has noted that AI has improved the company by simplifying many programming tasks, though it’s not clear if those benefits have been quantified. AAPL’s latest iPhones have highlighted their improved AI ability. We hope to learn if that is engaging buyers, leading to greater revenues and profits. For today, at least, that seems to be what investors want.

Related: Will Halloween Fear Bring November Cheer for Bondholders?