In the investment world, a fact - in and of itself - has little relevance without context and historical reference. When placed in time and amongst shifting trends, valuable insights can be gained above the nominal perception. An investment manager’s perspective, and how they think about and process the facts that everyone can see, can become their competitive differentiator and an alpha generator.

This came to mind in a recent discussion with Kevin Rendino and Daniel Wolfe, Portfolio Managers at 180 Degree Capital Corp – a microcap investment firm utilizing a “constructive activism” investment approach and manager of a publicly traded closed-end fund (NASDAQ: TURN). We were reviewing their recent market research paper Normalized Rate Environments and Small Caps.

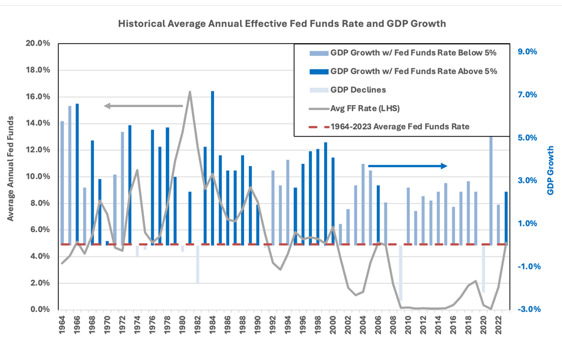

In their white paper, they argue with charts and history that 5% Fed funds rates are not the cataclysmic event that some analysts and economists are suggesting. In fact, the way they see it using a longer-term lens, these rate levels are normal and conducive to a continued period of strong economic growth, along with strong returns for small and microcap companies. I asked them questions to further discuss and explore how the firm developed their perspective, market outlook, and what the implications are for investors.

Hortz: How did you come about this viewpoint? What lines of thinking or elements of the economy and markets were you reacting to?

Rendino: We were reacting to the near-constant drumbeat that higher interest rates would drive the economy into recession. The collective wisdom of Wall Street, economists, and the financial soothsayers around us focused on the question of how could the economy grow after the Federal Reserve brought the Fed funds rate to a targeted 5.25-5.50% versus near zero rates only 18months ago? At that rate range, recession became a foregone consensus conclusion, with most of these people resolved only to figuring out how painful and enduring it would be. That only got us thinking, let us take a look and see if historical data supports that conclusion.

As experienced money management participants investing through many market cycles and students of market history, it became apparent to us that this question ignores over 60 years of history during which Fed funds rates were at or above 5%. While many on Wall Street began their careers post-2008 and, therefore, have never experienced an interest rate market other than zero or near zero, my tenure significantly pre-dates that time frame making me personally familiar with markets in higher rate environments. Of course, we knew that higher rates had and would continue to slow portions of the economy that are more interest rate sensitive, particularly given the speed at which the Fed funds rate was increased. However, we did not believe rates at these levels would lead to the end of the US economy, a catastrophic collapse in any major economic indicators, or the destruction of the small and micro-capitalization companies in which we invest.

Hortz: What process did you follow to explore and determine the validity of your perspective?

Wolfe: We set out to answer a number of key questions:

Does a 5% Fed funds rate actually equate to a historically high level and, if not, how does it compare to historical levels?

Has the economy and earnings of perceived “risk” assets ever grown with a Fed Funds rate at 5%?

Have small capitalization stocks performed well with Fed funds rates at 5%?

Hortz: What key elements of your research did you find that you feel most substantiated your viewpoint?

Wolfe: In reality, the average fed funds rate for the entirety of the last 60 years is 4.9%, if one excluded 2009 to 2023 when rates were historically low, the average Fed funds rate is 6.3%. Over the past 60 years, there have been 31 years (or half the time), in which the Fed funds rate was 4.9% or greater. The economy grew in 26 out of these 31 instances, or 84%. Interestingly, in the years where the Fed funds rate was greater than 4.9%, the economy grew an average of 3.3%. In the years where the Fed funds rate was less than 4.9%, the economy grew 2.9%.

Source: Bloomberg

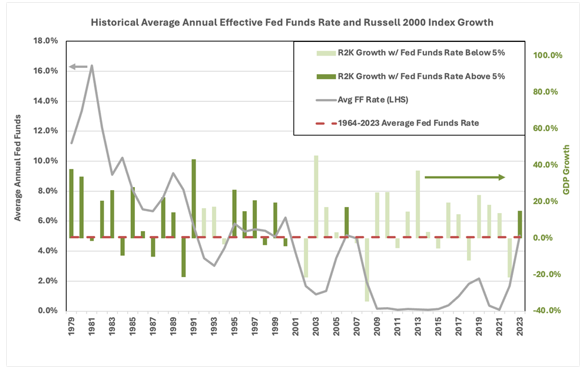

GDP growth does not tell the whole story, however, since it incorporates all parts of the country. As microcap value managers we are more interested in looking at the performance of small and micro-capitalization public companies during these years versus Fed funds rates. One of the best proxies for this universe of companies is the Russell 2000 Index. The Russell 2000 Index was down 14 years out of the last 45. In 8 of those 14 years, the Fed funds rate was less than 5%, while in 6 years the Fed funds rate was 4.9% or higher. The number of times the Russell 2000 Index was up in each interest rate environment is approximately equal with 15 years of increases when Fed funds rates were greater than 4.9% and 16 times when it was less than 4.9%.

Source: Bloomberg

As a follow on to this research into small-cap and micro-capitalization stocks, we further compiled a deeper dive series of charts and facts in a report entitled A Picture is Worth 1,000 Words that argues that the small and microcap markets are incredibly undervalued. Not only does the current 5% Fed funds rate not signal devastation for this area of the market, but the research points to it now being one of the better buying opportunities for the small-cap and microcap markets.

If history is a guide to potential future outcomes, then the data presented above supports our view that the current interest rate environment of 5.25-5.50%, should not be viewed as the end of the world. Rather it is a reversion to more normalized levels that historically have supported both strong economic growth and value creation in small and micro-capitalization stocks.

Hortz: What investor misconceptions or biases have been in play and how do you recommend addressing them with clients?

Rendino: Recent history convinced investors that near-zero interest rates are required for economic prosperity, particularly for “risk” assets. Given that many investors have known nothing other than periods of zero to low interest rates, it is hard for them to fathom that there is economic life outside of that policy for any company other than the ones that are the largest and most well-capitalized.

Additionally, another aspect that could be affecting investors’ market opinions is what cognitive and social scientists call “recency bias” which is the mind’s natural tendency to overemphasize the importance of recent experience or latest information in estimating future events.

Only by analyzing historical data like the charts and information mentioned above can you address these misconceptions and biases that could not be further from the truth based on facts.

Hortz: How can your research help advisors and investors to adjust their portfolios in response to this prevailing concern over higher Fed funds rates?

Rendino: We believe that long-term market and economic history demonstrates that the current normalized interest rate environment is not likely to lead to a devastating recession by itself. Reversion to normal is not bad news for the economy or stocks. The resiliency the economy showed in 2023 is more than capable of continuing into 2024.

Therein lies what we believe to be the opportunity for investors, who like us, feel history will repeat itself and lead to a continued period of strong economic growth and meaningful value creation in this more normal environment, particularly for small and micro-capitalization companies.

Related: Perspectives on Large-Cap Value Investing

Disclaimer: This interview is for informational purposes. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions. Nothing contained herein constitutes investment advice or the recommendation of or the offer to sell or the solicitation of an offer to buy or invest in any specific investment product or service. Before investing you should carefully consider the investment’s objectives, risks, charges, and expenses. This and other information can be obtained through https://ir.180degreecapital.com/. Please read the prospectus carefully before you invest. Investing involves risk including the possible loss of principal.