Written by: Dev Chakrabarti and James T. Tierney, Jr.

When seven giant stocks dominate returns, it’s hard for active managers to outperform the market. But we think the pendulum will eventually swing back and more companies with real earnings power will begin to attract the attention they deserve.

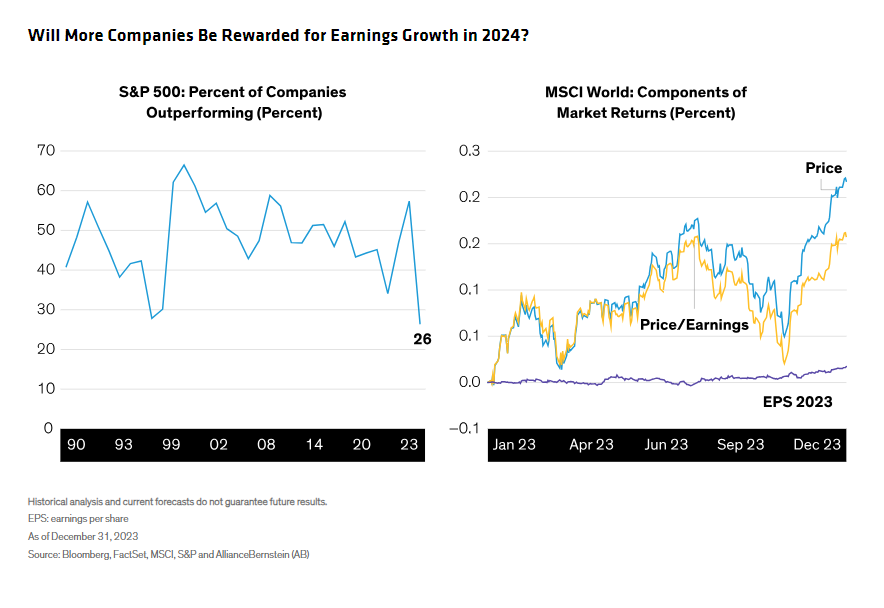

Market returns were extreme by many measures in 2023. The Magnificent Seven stocks, a group of giant companies seen to be big winners from artificial intelligence (AI), accounted for 58% of the S&P 500’s returns last year. Only 26% of S&P 500 companies beat the benchmark in 2023—the lowest in more than 30 years (Display). The equal-weighted S&P 500 and MSCI World, which give every index member an identical weighting to better represent what the broader market is returning, underperformed their cap-weighted counterparts by 12.7% and 7.1% respectively in one of the narrowest years on record. Earnings were not the drivers of stock market returns in 2023–instead, it was largely price-to-earnings multiple expansion.

AI excitement wasn’t just hype. Investors were drawn to the Magnificent Seven stocks’ potential to monetize the revolutionary technology—an especially attractive proposition in an uncertain macroeconomic environment. These were harsh conditions for active equity managers who aim to diversify holdings, even in concentrated portfolios with relatively small numbers of stocks. While the Magnificent Seven stocks include excellent companies with strong businesses, many active managers are wary of holding the entire group of highly correlated stocks, which comprise about 29% of the S&P 500.

Earnings, Earnings, Anywhere?

While the consensus is optimistic entering 2024, we don’t expect a sudden surge in profits across the board. Earnings will face continued headwinds due to sticky wage inflation, slowing GDP growth and more limited pricing ability as inflation declines. Meanwhile, elevated geopolitical risk could prompt volatility, as the Russia-Ukraine war grinds on, while the Israel-Hamas conflict destabilizes the Middle East, and the US enters a polarized election campaign.

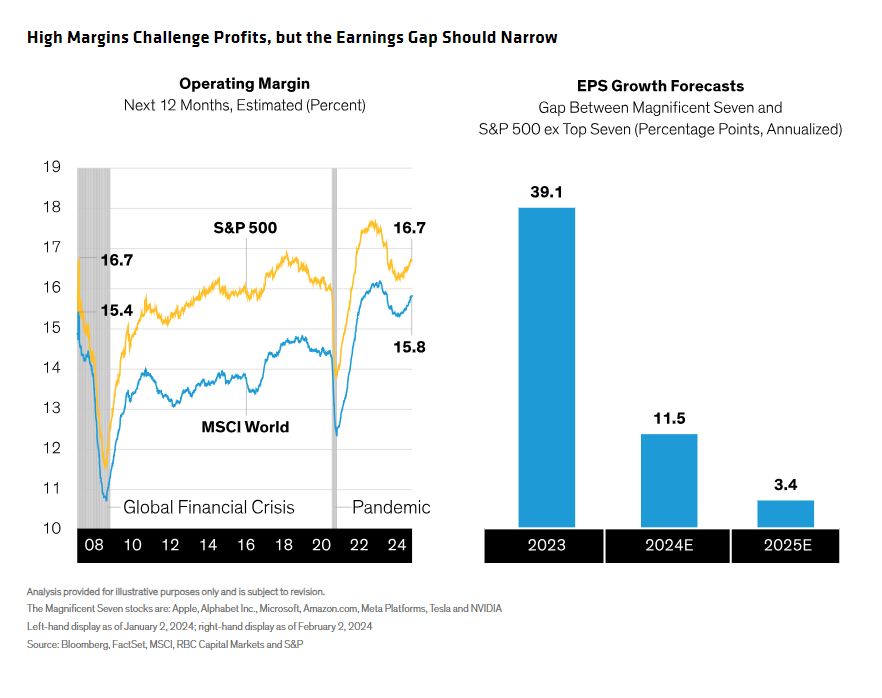

Persistent uncertainty may continue to support positive short-term sentiment for the US mega-caps. And with operating margins near record highs in the US and globally, we think companies across the broader market will struggle to meet consensus earnings forecasts of about 13.4% in the US and 8.5% globally. However, over time, we believe the relative earnings advantage of the Magnificent Seven stocks will narrow (Display).

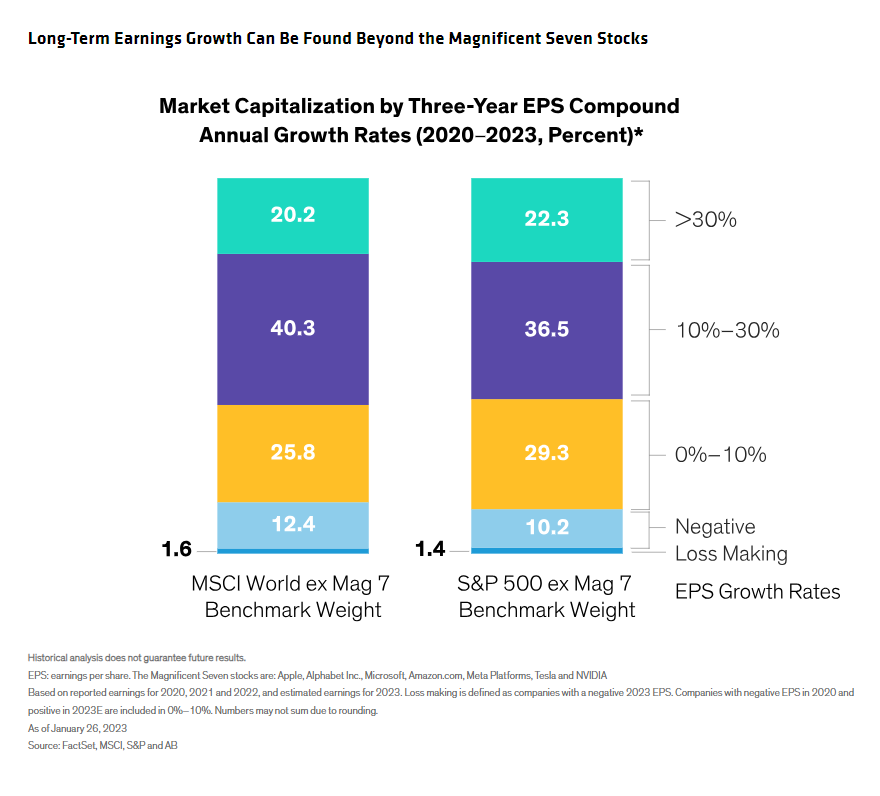

That’s because there is more earnings growth potential in the market than meets the eye. While last year’s headline earnings were weak, a large number of companies outside the Magnificent Seven stocks have attractive earnings growth profiles over the last three-years. In fact, about 40% of the S&P 500’s weight beyond the seven largest companies is in companies growing earnings by between 10% and 30% from 2020 to 2023 (Display). More than 20% of the benchmark weight is in companies growing by at least 30% a year. The MSCI World shows similar EPS growth characteristics.

To be sure, this three-year period wasn’t a normal environment. It included the bust-and-boom cycle during COVID-19, when many companies experienced a sharp earnings decline followed by a rapid recovery. Investors also grappled with a spike in inflation, rising interest rates and the prospects for normalization. Still, we think the long view suggests that companies with diverse sources of earnings growth potential can be found.

Quality Is Still the North Star

It’s easy to lose faith in the longer-term outlook when companies with real growth aren’t getting rewarded. And it’s even harder to stay the course when a small group of giants are running away with all the returns.

But we think investors with a long-term horizon should stay focused on companies that have high-quality businesses to support consistent earnings growth for the next three to five years. Companies with competitive moats, pricing power, innovative products and top-notch management possess the business traits needed to go the distance—even if they aren’t winning the short-term returns race because of unusual market conditions.

Real Growth Will Be Rewarded

AI isn’t the only growth game in town. In the healthcare industry, new products targeting worldwide health crises, including diabetes and obesity, can capture enormous potential for unmet medical needs. Software companies with strategic solutions for the ongoing migration to the cloud should benefit from structural growth of a global technology trend. More digital payments and open banking services will create opportunities for fintech companies.

Finding companies like these isn’t easy. Even in the best of times, very few can translate compelling business drivers into consistent earnings growth year after year. But our research suggests that companies that do produce strong earnings growth for at least three consecutive years tend to beat the market over time.

Markets haven’t consistently rewarded companies like these lately. Enthusiasm for the Magnificent Seven stocks has been so unrestrained that the share prices of some AI darlings continued rising even when their earnings revisions were negative. In our view, such exuberance can’t continue indefinitely. Now’s the time for investors to identify firms that have been left behind, with relatively attractive valuations and resilient earnings potential. Shares of companies like these are prime candidates for a rerating if more signs of a soft landing accumulate and bolster confidence in a broader corporate recovery.

Related: Unlocking the Potential of Anchoring: An Intriguing Avenue for Financial Advisors