What a difference a week makes. A blue undertow (Biden won, but the Senate appeared likely to remain with a Republican majority) swept into the sea of red and turned the market green. Volatility vanished and FOMOTINATE (Fear Of Missing Out There Is No Alternative To Equities) poked the bull out of its pen. The S&P 500 surged 7.32% led by a double-digit gain in the Technology sector accompanied by strong performance by Basic Materials, Health Care, Industrials, and Consumer Services. It was the best election week for the stock market since 1932. Gold gained 3.9%, the dollar dropped 1.9%, and the yield on the Ten-Year Treasury ticked down 4 basis points to 0.82%.

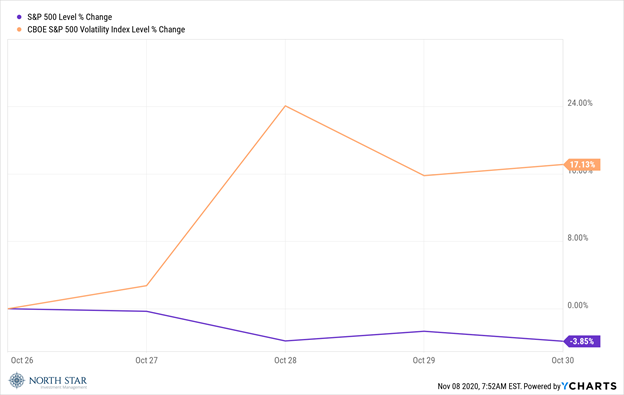

By way of reminder, the previous week saw a steep sell-off and a spike in volatility:

Putting the two weeks together the S&P 500 is 3.19% higher and the VIX 23.41% lower.

Stimulus:

The stimulus topic was pretty much out of the headlines as the focus was on the election. The odds of a major stimulus bill in 2020 seem increasingly remote.

Economy:

The data continued to show surprising strength with the highest manufacturing index report since 2018 including the biggest jump in new orders in 17 years. The October jobs report also surprised to the upside with the unemployment rate falling to 6.9%, although it worth noting that there are still approximately 10 million less jobs than before the pandemic, and more than 4 million people less are in the labor force than one year ago.

Earnings:

The magnitude of the earnings beats continued at a record pace. At the end of the third quarter the decline in composite earnings was forecasted be 21.2%. As of the end of last week, with 89% of the companies having reported results, the actual decline has been just 7.5%.

COVID-19:

The number of new cases and deaths globally are at record levels. In the U.S. daily cases are double the previous peaks with a record 126,742 cases recorded on Saturday. New restrictions are likely in the near-term to contain the spread of COVID-19. Winter is coming.

This Week:

Monday morning Pfizer announced that early data from its coronavirus vaccine shows it is more than 90% effective with no serious side effects. The study should be concluded by the end of the month with the likelihood of emergency FDA approval to follow post haste. This development changes the landscape. Spring will follow winter.

Investors will continue to process the implications of the election following the relief rally last week. Legal challenges might be noisy but seem unlikely to unnerve the market. Earnings season will come to a close with just 15 S&P 500 companies reporting results. Inflation will be in focus on the economic calendar with October CPI on Thursday and PPI on Friday. Consumer sentiment could also be of interest with the University of Michigan Index of Consumer Sentiment for November on Friday expected to show a reading unchanged from October.

Stocks on the Move: Twenty-three double digit gainers!

AMD +14.1%: Advanced Micro Devices designs and produces microprocessors for the computer and consumer electronics industries. The majority of the firm’s sales are in the computer market via CPUs and GPUs. This week, AMD announced the acquisition of Xilinx and provided better than expected 3Q results and 4Q guidance. AMD is a 3.66% holding in the North Star Opportunity Fund and AMD corporate bonds are a 2.27% holding in the North Star Bond Fund.

BGSF +15%: BG Staffing Inc. is engaged in providing temporary staffing services. The business activities are carried out through three segments: Real Estate, Professional, and Light Industrial segments. This week, BGSF released third quarter results that beat on revenue and EPS. The company also declared their 24th consecutive quarterly dividend, doubling it to $0.10 per share. BGSF is a 1.80% holding the North Star Dividend Fund and a 1.91% holding in the North Star Opportunity Fund.

BX +10.5%: Blackstone Group Inc. is an alternative asset manager with more than $350 billion in assets under management. Its alternative asset management businesses include investment vehicles focused on real estate, private equity, hedge fund solutions, credit, secondary funds of funds, and multi-asset class strategies. There was no significant company news this week. BX is a 2.96% holding in the North Star Opportunity Fund.

CAH +15%: Cardinal Health Inc. is the third largest global logistics provider engaged in wholesale pharmaceutical and medical products. The company services hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices. This week, Cardinal Health announced FQ1 earnings that beat estimates resulting in an adjusted, optimistic outlook for FY2021. CAH is a 1.06% holding in the North Star Opportunity Fund.

PRTS +10.2%: CarParts.com Inc. is an online provider of automotive aftermarket parts and repair information. The company principally sells its products to individual consumers through its network of websites and online marketplaces. The company’s products consist of collision parts serving the body repair market, engine parts to serve the replacement parts market, and performance parts and accessories. There was no significant company news this week. PRTS is a 6.88% holding in the North Star Micro Cap Fund and a 2.88% holding in the North Star Opportunity Fund.

CVS +15.8%: CVS Health now provides an even more integrated healthcare-services offering for its members. Legacy CVS combined both the largest pharmacy benefit manager, processing about 2 billion adjusted claimed annually, and a sizable pharmacy operation, including nearly 10,000 retail pharmacy locations primarily in the U.S. This week, CVS announced Q3 results that generally beat expectations. Additionally, the company named Karen Lynch, a veteran executive, as its next president and CEO. CVS is a 2.53% holding in the North Star Opportunity Fund.

KKR +11.8%: KKR & Co Inc. is a leading investment firm. It manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, and credit, with strategic partners that manage hedge funds. There was no significant company news this week. KKR is a 2.32% holding in the North Star Opportunity Fund and KKR/PfdA is a 1.06% holding in the North Star Bond Fund.

OESX +13.9%: Orion Energy Systems Inc. is a developer, manufacturer, and seller of lighting and energy management systems. Its activities are carried out through three segments: Orion U.S. Markets segment, Orion Engineered Systems segment, and Orion Distribution Services segment. The company serves energy service companies, electrical contractors, national accounts, and electrical distributors. This week, Orion released FQ2 earnings that beat previous estimates. OESX is a 4.98% holding in the North Star Micro Cap Fund and a 5.07% holding in the North Star Opportunity Fund.

CRM +11.3%: Salesforce.com provides enterprise cloud-computing solutions, including Sales Cloud, the company’s main customer relationship management software-as-a-service product. There was no significant company news this week. CRM is a 0.78% holding in the North Star Opportunity Fund.

HEAR +15.3%: Turtle Beach Corp. is a gaming audio and accessory brand offering a broad selection of gaming headsets for Xbox, PlayStation, and Nintendo consoles, as well as for PC, Mac, and mobile, tablet devices. Its products are sold at thousands of storefronts including retailers such as Amazon, Argos, Best Buy, GAME, GameStop, EB Games, Media Markt, Saturn, Target and Walmart. This week, Turtle Beach released fantastic earnings with GAAP EPS of $1.04 (beat by $0.78) and revenues of $112.49 million (beat by around $25 million). HEAR is a 5.62% holding in the North Star Micro Cap Fund and a 1.69% holding in the North Star Opportunity Fund.

CLCT +30.3%: Collectors Universe Inc. provides authentication and grading services to dealers and collectors of coins, trading cards, event tickets, autographs and historical and sports memorabilia. The company generates revenues principally from the fees paid for its authentication and grading services. This week, the company reports outstanding Q1 results as well as announced it would be expanding its operation and doubling its physical footprint to accommodate for increased demand. CLCT is a 3.94% holding in the North Star Dividend Fund and a 3.76% holding in the North Star Micro Cap Fund.

ESCA +17.5%: Escalade Inc. manufactures and distributes sporting goods for a varied range of activities. These sports include archery, table tennis, basketball goals, trampolines, play systems, fitness, game tables like hockey and soccer, billiards, darting, and other outdoor games. This week, the company declared an in-line dividend of $0.14 per share. ESCA is a 5.71% holding in the North Star Dividend Fund and a 6.14% holding in the North Star Micro Cap Fund.

FLXS +12.2%: Flexsteel Industries Inc. is a United States-based company that manufactures, imports, and markets residential and commercial upholstered wood furniture products. The product offering includes sofas, loveseats, chairs, rockers, desks, tables, convertible bedding units, and bedroom furniture. There was no significant company news this week. FLXS is a 2.93% holding in the North Star Dividend Fund.

VVV +10.6%: Valvoline produces, markets, and sells automotive maintenance products, particularly lubricants, to retail outlets and installers customers by selling products to auto-parts stores and leading mass-merchandisers via direct sales and distributors. Valvoline also operates and franchises quick-lube oil change centers. This week, there was no significant company news. VVV is a 0.60% holding in the North Star Dividend Fund.

IIPR +30.7%: Innovative Industrial Properties Inc. is a real estate investment trust engaged in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. This week, the company announced better-than-expected Q3 earnings. IIPR is a 3.34% holding in the North Star Dividend Fund.

ALSK +56.6%: Alaska Communications Systems Group Inc is a US-based fiber broadband and managed information technology services provider. The company is focused primarily on the business and wholesale customers in and out of Alaska. This week, the company reported in-line Q3 results and announced it would be acquired by Macquarie Capital and GCM Grosvenor for $3.00 per share. As of 11.6.20 positions of ALSK were liquidated.

BOOT +10%: Boot Barn Holdings Inc operates specialty retail stores. The company sells western and work-related footwear, apparel, and accessories in the United States. It is a single operating segment, which includes net sales generated from its retail stores and e-commerce websites. There was no significant company news this week. BOOT is a 3.38% holding in the North Star Micro Cap Fund.

CNTY +15.9%: Century Casinos Inc. is a US-based international casino entertainment company. The company principally engages in the development and operations of gaming establishments as well as related lodging, restaurant, and entertainment facilities. It also operates ship-based casinos on international and Alaskan waters. This week, the company announced Q3 results that were significantly impacted by recent acquisitions. Additionally, the company expects COVID-19 to continue to have an adverse impact on its results into 2021. CNTY is a 0.77% holding in the North Star Micro Cap Fund.

GBRK +17.2%: Green Brick Partners Inc. acquires and develops land, as well as provides land and construction financing to its controlled builders. The company is engaged in various aspects of the homebuilding process, including land acquisition and development, entitlements, design, construction, marketing, sales, and brand image creation. This week, there was no significant company news. GRBK is a 1.31% holding in the North Star Micro Cap Fund.

NSSC +16.3%: NAPCO Security Technologies Inc. manufactures security-products, encompassing access to control systems, door-locking products, intrusion, and fire alarm systems and video surveillance products. Its products are using for commercial, residential, institutional, industrial, and governmental uses. This week, the company announced underwhelming FQ1 earnings. NSSC is a 1.83% holding in the North Star Micro Cap Fund.

QEPC +15.3%: QEP Co Inc. is a provider of flooring and industrial solutions. The company is a manufacturer, marketer, and distributor of hardwood and laminate flooring, flooring installation tools, adhesives and flooring related products targeted for the professional installer as well as the do-it yourselfer. There was no significant company news this week. QEPC is a 2.57% holding in the North Star Micro Cap Fund.

SP +20.6%: SP Plus Corp. provides parking management, ground transportation, and other ancillary services to commercial, institutional, and municipal clients inn urban markets and airports across the United States, Canada, and Puerto Rico. This week, the company announced Q3 earnings that beat by $0.96, but revenues missed by about $6.5 million. SP is a 2.85% holding in the North Star Micro Cap Fund.

Related: Market Volatility Spike Three-Peat