Written by: Nick Petrucelli and David Chang | New York Life Investments

Inflation has become a top-of-mind topic for clients in recent months, with many exploring ways to position for potentially higher inflation in the period ahead. However, after a decade of “disinflation,” we believe the investment community continues to anchor to the prior regime and to some stubborn misconceptions around inflation hedging. Here are five that could prove costly if, in fact, inflation does rise.

Misconception #1: You can wait to allocate to inflation hedges until we have higher inflation.

Reality: Timing when to buy inflation-related assets is just as difficult as trying to “market time” any other type of investment. That’s why investors are advised to hold strategically diversifying assets like stocks and bonds and, in our view, should also own inflation-sensitive assets as a long-term, strategic portfolio allocation. As with any asset, the fundamentals are already priced in ahead of time, making waiting for the “right time” challenging at best and futile at worst.

Misconception #2: Commodities earn next to nothing, so why even bother with them?

Reality: Given that commodity spot prices roughly kept pace with (or even outpaced) the Consumer Price Index over the long term, their yield should be thought of as a “real” (inflation-adjusted) yield.

Commodities’ yield comprises both the collateral yield (effectively zero for the foreseeable future) and the roll yield. The latter was a major headwind during the recent disinflationary cycle, which many investors have extrapolated into the future. During inflationary cycles, however, the roll yield can be persistently positive, which (when compounded with rising spot prices) has led to strong commodity returns.

Misconception #3: Equities are all you really need as an inflation hedge.

Reality: Despite their many potential benefits, equities have historically proven to be poor inflation hedges. That’s because rising inflation has historically created tighter monetary policy, greater economic uncertainty, and higher input costs, all of which tend to be headwinds for corporate earnings and equity valuations. While equities have struggled with inflation shocks, the myth that equities are an effective inflation hedge stems from their historically positive long-term real returns during high-inflation periods. However, returns during these periods have been much lower than in “non-inflation” periods.

Additionally, today’s lofty equity market valuations are at least partly due to subdued inflation, allowing interest rates to stay low and government policy accommodative. As a result, rising inflation would pose a clear risk for core equities.

Misconception #4: Real assets and inflation hedges are the same thing.

Reality: From here, some real assets will likely be better inflation hedges than others. For example, longer-duration real assets with stable cash flows may be susceptible to underperformance if higher inflation causes interest rates to rise, while others may offer significant operating leverage to rising prices. The real assets that performed well over the last disinflationary decade typically exhibit low sensitivity to inflation, raising the risk that they may not function as inflation hedges when needed.

Misconception #5: Commodities aren’t particularly relevant to today’s economy.

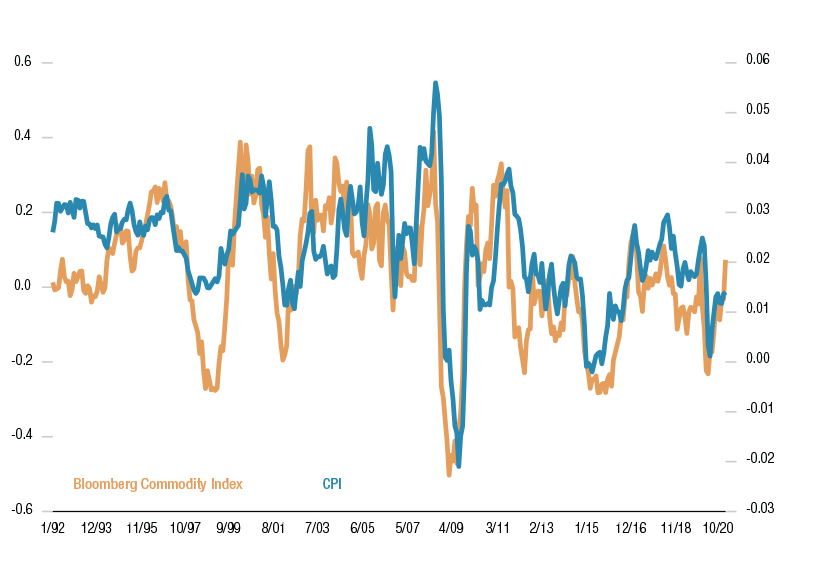

Reality: Figure 1 (historical inflation versus commodity returns) shows that commodities remain highly relevant for economy-wide prices. Even amid excitement over the upcoming spending wave on “green” energy, new drivers of commodity demand are emerging, as batteries require nickel, electric-vehicle charging stations utilize copper, and wind turbines need iron ore. The scale of this demand is amplified by inadequate production potential after a decade of underinvestment in the mining and energy sectors. What appears to be a cyclical rebound in commodity prices could be more structural in nature.

The Bloomberg Commodity Indices (BCOM) are a family of financial benchmarks designed to provide liquid and diversified exposure to physical commodities via futures contracts. The principal potential benefits of including commodities in a diversified financial portfolio include positive returns over time and low correlation with equities and fixed income

Final thoughts

Investors may be surprised how “inflation-exposed” their portfolios have become following a decade of disinflation. Now may be an opportune time to revisit traditional inflation hedges.

Related: ESG Investing is No Longer Optional. Are You Up To Speed?