The first 3/4 of the year show the good and bad of market cycles

I don’t know if I am the first to offer this suggestion. But I think that after the mess that 2020 has been on so many levels, we might want to re-think how we refer to “20/20 vision” as being “normal.”

As investors, there has been nothing normal about calendar year 2020.

However, we can put a sharp eye on performance patterns in the stock and bond market, and use that to help us going forward.

4 stock/bond allocations, similar 2020 returns

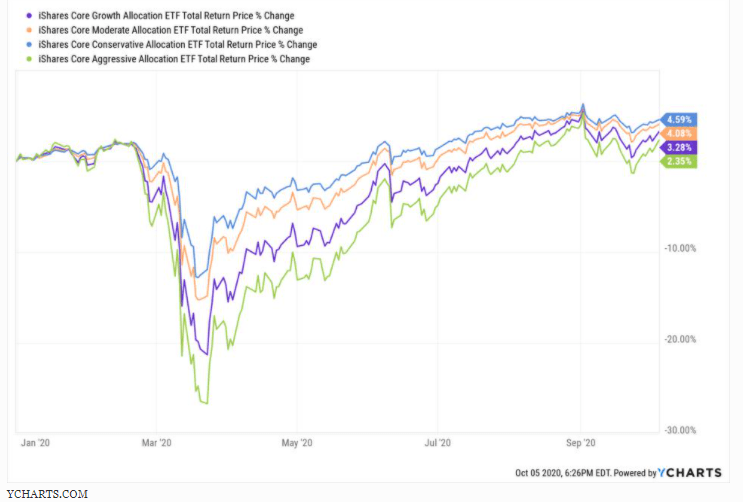

Here is a chart showing the 2020 return path for 4 different versions of the same thing. These 4 ETFs allocate to a “classic” stock/bond mix. The difference between them is in how much they are allocated to stocks versus bonds.

As the names would imply, the Aggressive ETF has the highest equity allocation, Growth is second highest, then Moderate. The Conservative Allocation has more bonds and a lower stock allocation than the rest.

Their performance in 2020 is pretty tightly bunched. The Conservative portfolio performed the best, thanks to a crash in U.S. Treasury yields. The Aggressive portfolio was the worst performer. If you are wondering how that can be, with the stock market having come back so quickly, that’s part of the point.

The (selective) stock market rally

The “stock market” has not recovered as much as the S&P 500, Nasdaq NDAQ -1% and Large Cap Growth Stock Indexes have. Large swaths of the market are still lagging. That may reflect more of what consumers and workers see, than what S&P 500-centric investors do.

This also shows us something about how the math of investment loss works. If you look at where these 4 asset mixes were at the market bottom in late March, there is a pretty wide gap between the more aggressive portfolios and the more conservative ones. The more you lose in bad times, the more you have to make up during the good times. This year, aggressive portfolios have rallied more, but still trail the more conservative ones.

MATH

The math lessons here are probably nothing new to you as an investor. What IS new is that we just had a “do-over” for those who have been counting on the classic stock/bond mixes to bail them out. Rates are so low now, it would take them turning negative to reproduce the comeback we just saw.

This should prompt the question, “what can I do to confront the next major stock market decline, since bonds won’t help as much?” Frankly, that’s what hedged investing is all about.

Specifically, it’s about building something different around your main equity portfolio. This is necessary because what worked in the past cannot work in the future. The simple laws of math, like investment gravity, are the culprit.

This is a time to get educated about what else is out there

2020 started as a calamity for investors. The bounce since March converted that calamity into merely a warning shot. With an election, a pandemic, a recession and a lopsided equity market, thinking out of the box is a timely step.