Receiving the phone call that alerts you to the fact that your financial advisor has left their firm often creates uncertainty among investors. If the financial advisor decided to move to another firm, you have decisions to make. Do you stay with the firm or go with your advisor? Why do investors who choose to stay with the firm make that choice? Thinking about what you may do in the event of your financial advisor switching firms can help prepare you in the event that this happens.

Spectrem Group recently researched what investors would do in the event of their financial advisor leaving their firm, as well as the reasons behind why they would stay with the firm if that was their choice. Responses to this potential situation varies greatly depending upon the advisor type. An investor’s occupation, age, gender, and understandably advisor dependency all impact what actions an investor would take when posed with this situation.

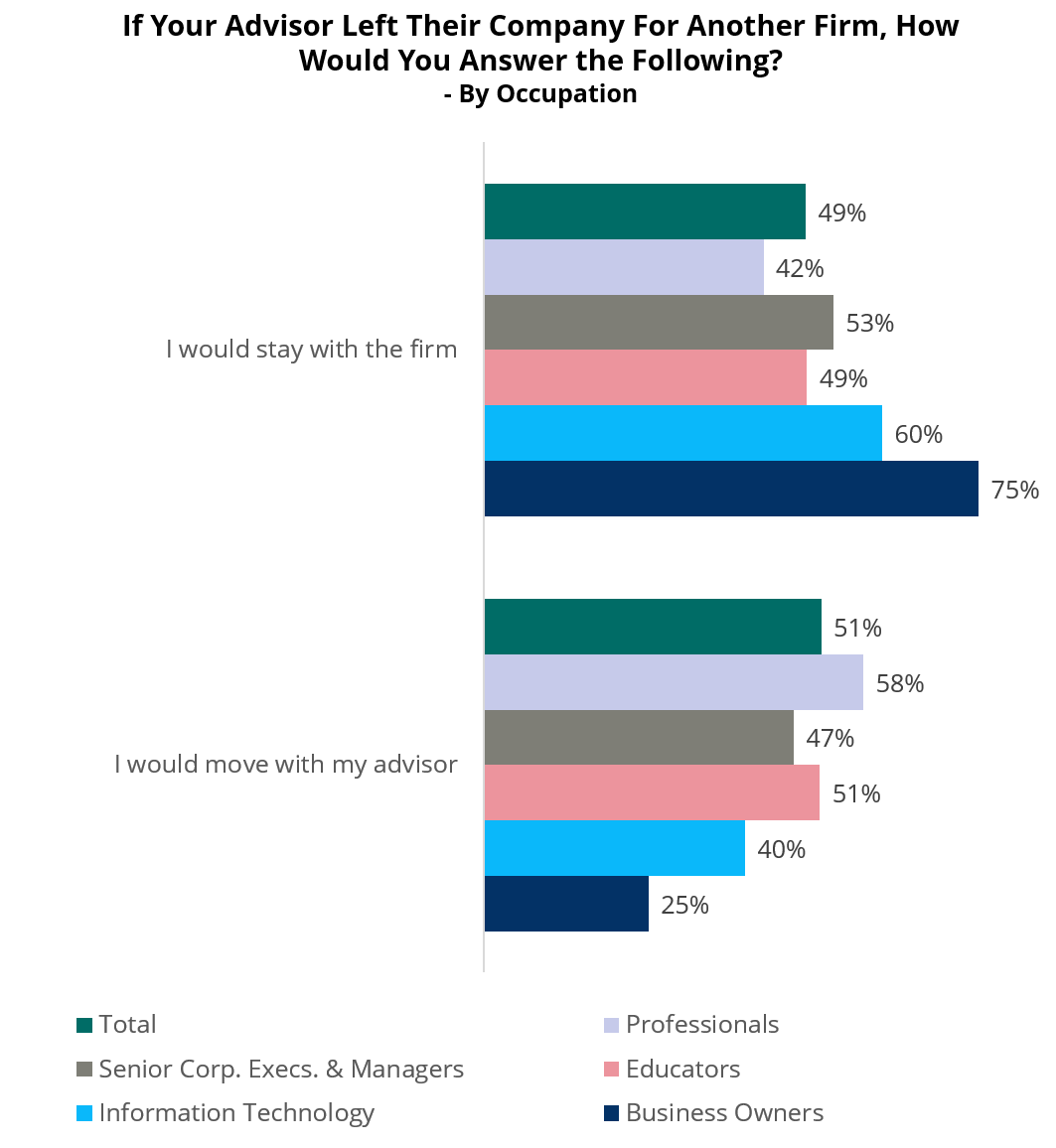

Overall investors are quite split when confronted with the question of what to do if their advisor left their firm for another firm, with 49 percent indicating they would stay with the firm, and 51 percent indicating they would go with the financial advisor. Professionals are the occupational segment that is most likely to move with their advisor, with 58 percent of professionals feeling that way, while Business Owners are at the other end of the spectrum, with 75 percent preferring to stay with their firm. Men and women differ on this topic as well, with men slightly more likely to stay with the firm, and women more likely to move with the financial advisor.

As one would expect, investors that are Self-Directed are far more likely to stay with the firm. This could be because since they are mostly self-managed, they may not see the benefit of the financial advisor as much as the access to research and investments the firm offers. Just under a third of Advisor-Dependent investors would move with their financial advisor. Being more dependent upon the advisor makes this decision an easy one for these investors.

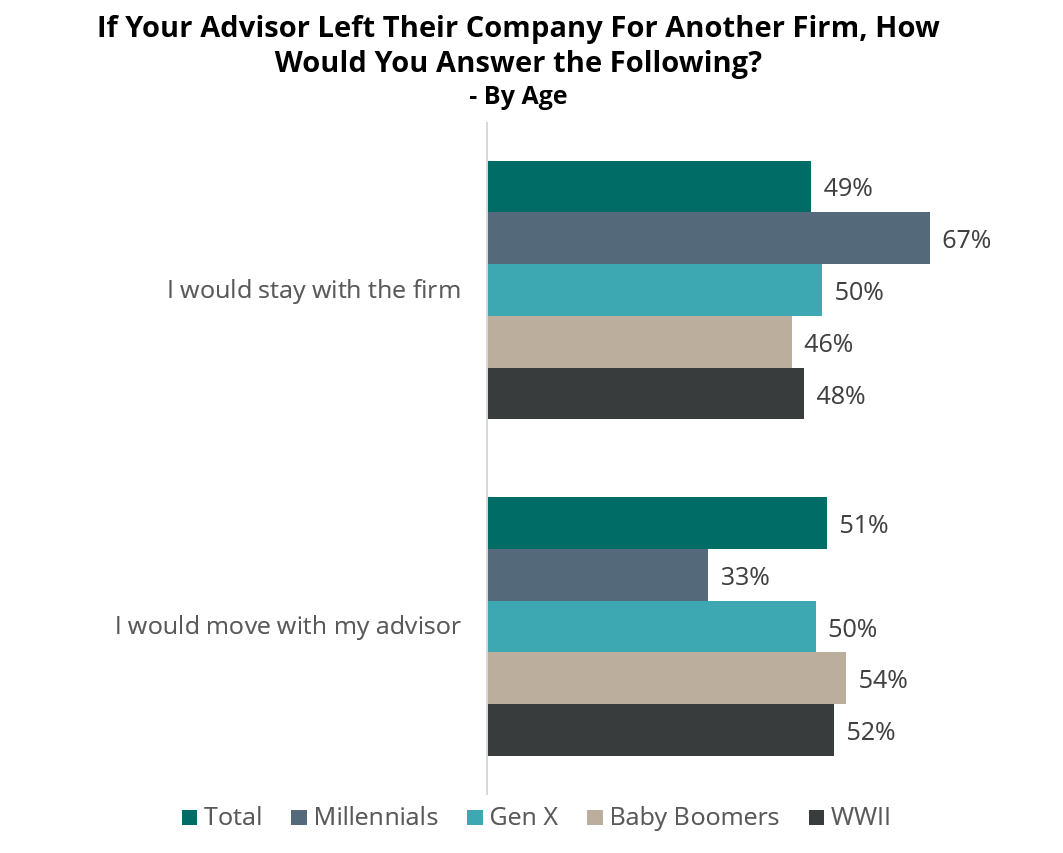

Younger investors are far more likely to stay with the firm, while Baby Boomers and WWII investors are slightly more likely to move with their financial advisor. Millennials often do not have as long of a relationship with their financial advisor as older investors, so the loyalty to that individual may not have developed yet, and Millennials are more interested in online platforms and offerings than older investors, making the firm important for these investors.

Regardless if you decide to move with your financial advisor, or stay with your firm, it is important to ensure that either location sill offers what you expect and require for your wealth management needs. If you are considering moving with your financial advisor, be certain to ask your advisor what features and offerings will be added to their services as a result of the move.