It should not be surprising to investment professionals to find that the portfolios of wealthy investors ended 2020 basically the same as at year end 2019. It could be considered surprising, however, based upon the amount of volatility .....not just in the markets....but in overall cultural and historical chaos.....that occurred in 2020. It’s actually quite amazing that the markets and economy held fairly strong, at least in most sectors, after a year in which investments crashed in March and April, the entire workforce was displaced in some manner, and the political environment was overwhelmingly hostile.

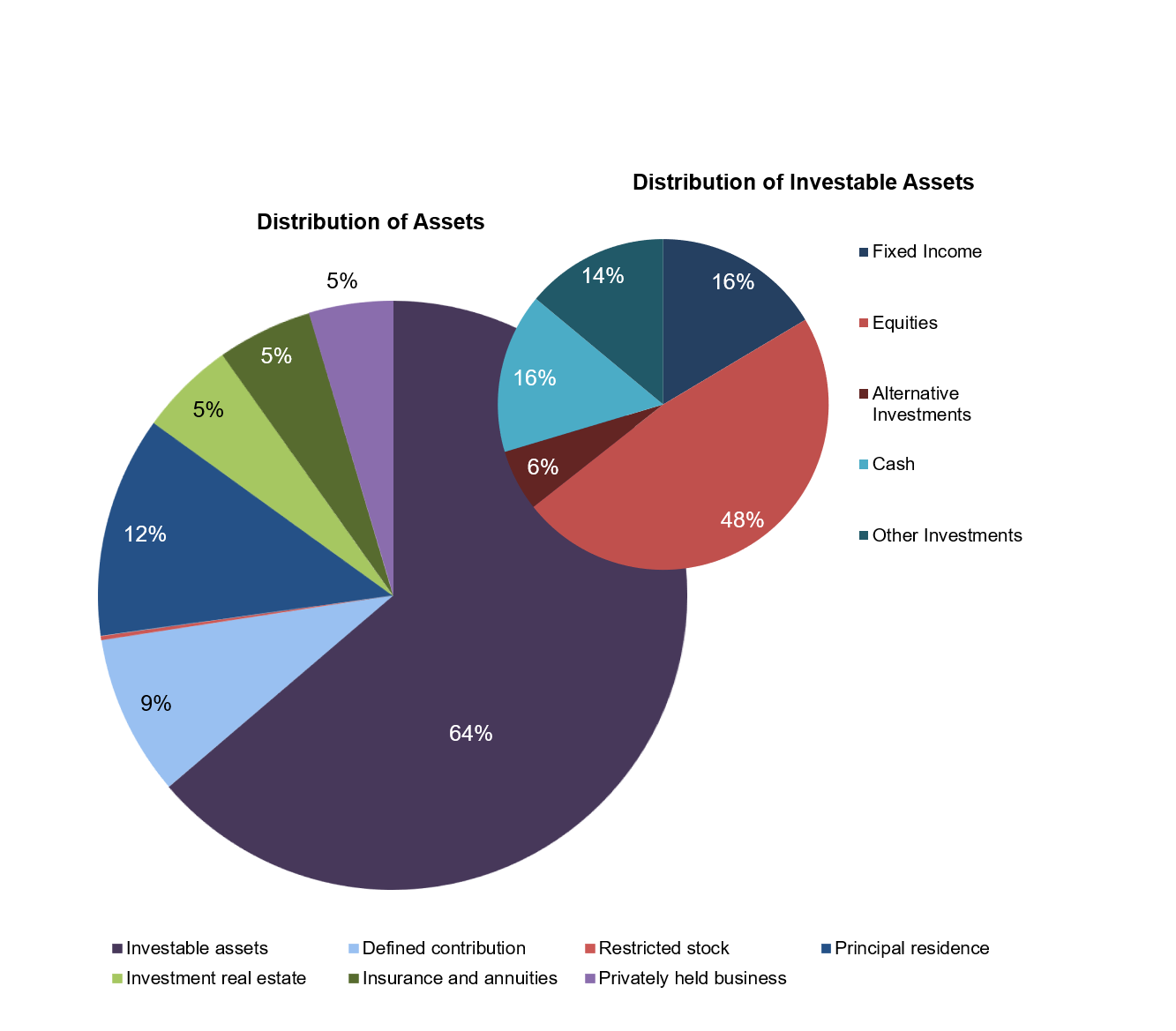

Spectrem’s ongoing research with affluent investors - those with $100,000 to $25 million of net worth (not including the value of the primary residence) - indicates that overall portfolios and asset allocation between 2019 and 2020 was virtually identical. This information is currently available in Spectrem’s new report , Portfolio Trends and Expenditures, part of our Wealthy Investor Series. In 2020, 64% of total assets of wealthy households was represented by investable assets while 12 percent of the overall value of one’s total portfolio was represented by the primary residence. In 2019, investable assets represented a slightly larger percentage of the overall portfolio at 67%. The amount represented by the primary residence was also 12% in 2019.

The investable assets were allocated the same in 2019 and 2020 with 48% of those assets being invested in Equities. The only difference between 2019 and 2020 was a decrease in Fixed Income from 19% to 16% and an increase in Alternative/Collectibles/Commodities from 4% to 6%.

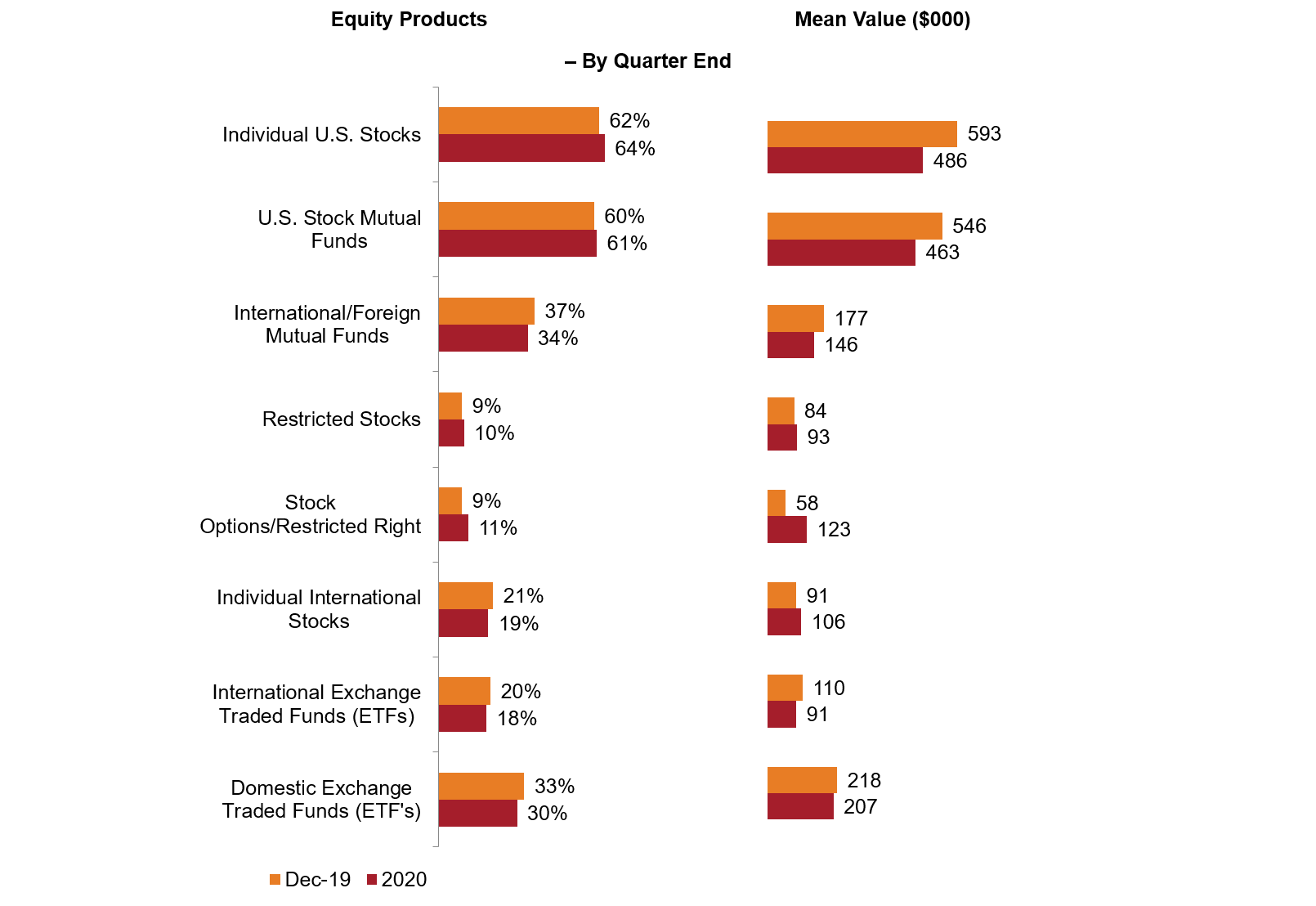

The value of Equities in the portfolios did decline somewhat with the mean value of U.S. stocks in 2019 at $593,000 compared to $486,000 in 2020 and the value of Stock Mutual Funds moving from $546,000 in 2019 to $463,000 in 2020.

Although portfolios look virtually the same despite a dramatic year, the values are slightly lower. It will be interesting to track during 2021 whether changes in primary residence and other real estate properties will be impacting the portfolios at the end of this year.

Related: Wealthier Investors More Dependent on Investment Income Than Others