The reasons why an investor would NOT have an advisor are just as varied as the reasons why investors use an advisor. For investors who are not certain if they want to use an advisor or not it can be helpful to know why other investors have decided to avoid hiring an advisor. Spectrem Group sought out this information in our most recent research.

The most cited reasons wealthy investors do not have a primary financial advisor is because they believe they can do a better job of investing than a professional and they feel a financial advisor would not be looking out for their best interests. The financial industry has attempted to resolve some of the concerns about a financial advisor looking out for a client's best interest in various ways throughout the years, most recently with Regulation Best Interest (Reg BI). Despite having this and other regulations in place to protect the best interests of the investor, this concern remains a top reason for not having a primary financial advisor.

There has been progress made however, as this reason for not having a primary financial advisor was identified by 43 percent of investors in 2016, compared to the 39 percent in 2021. Another area of progress is the belief that the investor can do a better job of investing. That percentage declined to 38 percent in 2021 from 43 percent in 2016. Five years also cut in half the percentage of investors who don’t know how to find an advisor and those investors who feel they cannot afford a financial advisor.

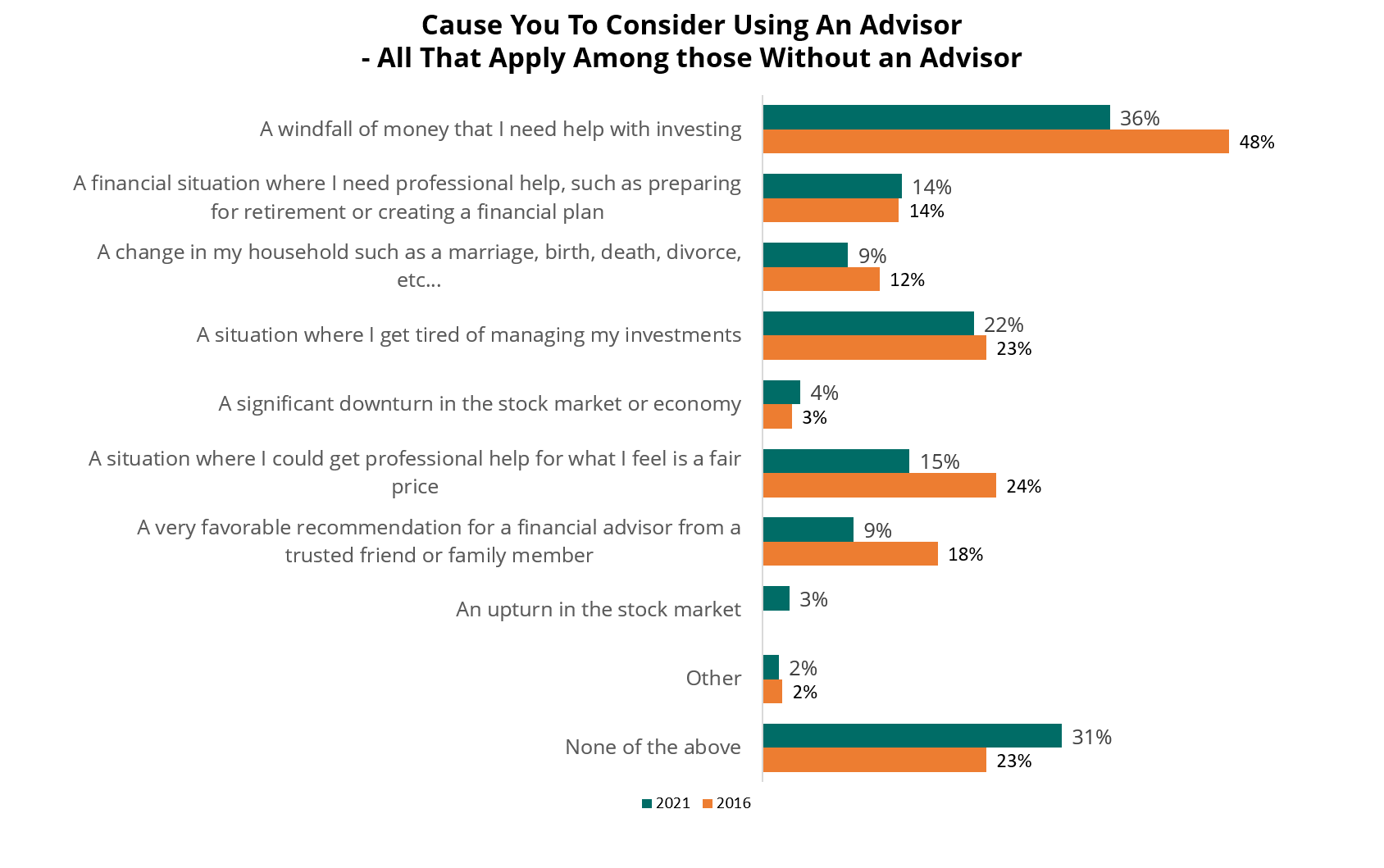

With the decreases in those investors who don’t know how to find an advisor, and those who don’t feel they have enough assets, when would these investors consider using an advisor? Among those investors who do not use an advisor over a third would consider using one if they received a windfall of money that they needed help with investing. Nearly a quarter (22 percent) would also consider using a primary financial advisor if they got tired of managing their own investments. Fifteen percent of investors would consider using an advisor if they felt they could get professional help for what they feel is a fair price, however the percentage of investors who would consider using an advisor for this reason has decreased from 24 percent five years ago.

The good news of the decline in reasons why someone does not use an advisor is tempered by the decline in reasons that would cause an investor to consider using an advisor. This poses a challenge to advisors, as fewer investors have reasons for not using an advisor, but the situations that would cause them to take action and hire an advisor are also fewer. Investors that do not currently use an advisor, what is your reason?