Financial professionals work very hard to develop a meaningful relationship with their clients. It is critical to gain trust and respect from their clients in order to effectively help them with their financial lives. That is often achieved over time, through a strong referral from a friend or family member, the advisor providing services or expertise the client doesn’t have, as well as a variety of other methods. After this trust has been developed, many financial professionals think that they are the source of investment information for their clients, however this isn’t always the case. There are many other sources, and people, that investors are listening to, and advisors who are aware of the other sources their clients could be seeking will be able to address any questions or concerns raised as a result of getting information from sources other than themselves.

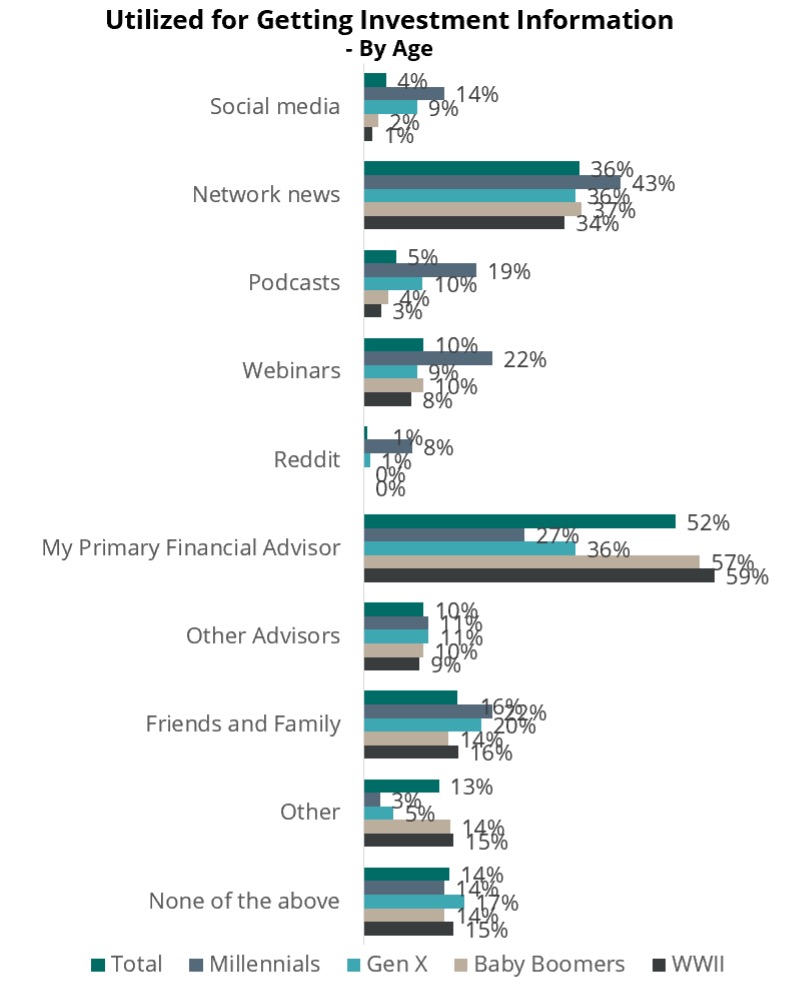

According to recent research from Spectrem Group, just over half of investors use their primary financial advisor for investment information. This is the most commonly identified source of information for investors. While this may be having advisors breath a sigh of relief that they are the trusted source, they need to not get too comfortable. Among Millennial investors the percentage that use their financial advisor for investment information drops to only 27 percent, and 36 percent among Gen X investors. That means that these investors could be using other sources for investment information.

One source that is identified by 43 percent of Millennials as a source for investment information is network news. This source is also identified by over a third of all age segments. Webinars and friends and family are sources for investment information for 22 percent of Millennials. Millennials also identify Podcasts and social media as a source of investment information 19 percent and 14 percent utilize, respectively.

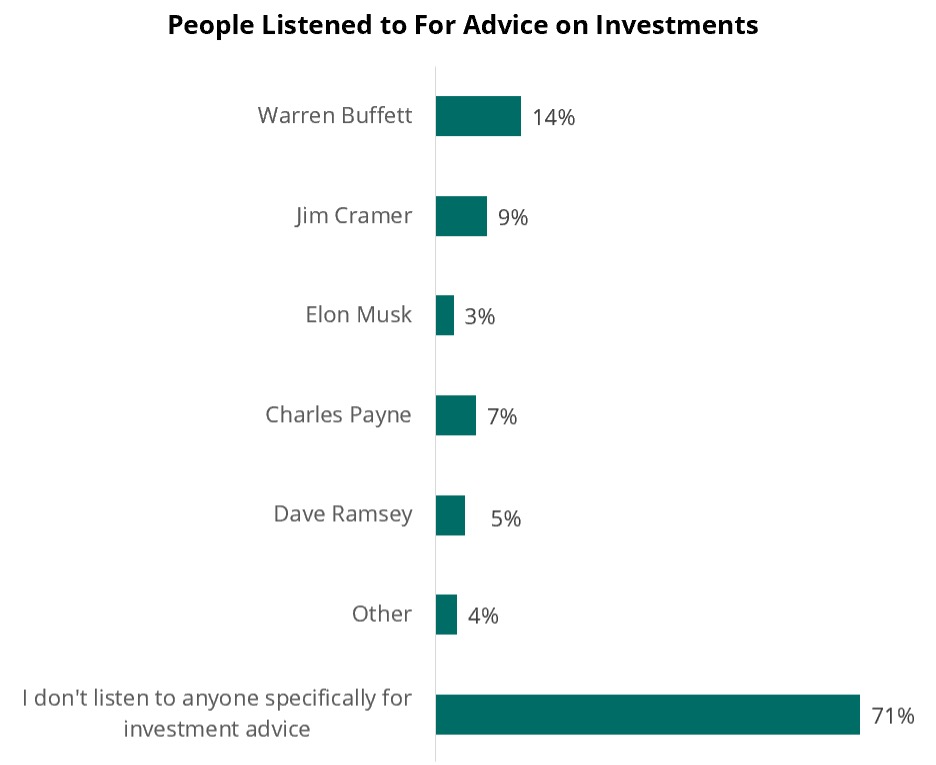

Knowing that network news is used by Millennials as an investment information source more than a financial advisor, along with the fact that over a third regardless of age watch network news for investment information, it is wise to know what individual people are listening to. It is important to note that 71 percent of wealthy investors do not listen to one specific person when they are tuning into network news. Fourteen percent are listening to Warren Buffett, while nine percent listen to Jim Cramer. Charles Payne gets seven percent of viewers, while Dave Ramsey gets five percent.

Financial professionals need to be aware of what these other individuals are saying because that could impact how their client perceives investments and their overall financial picture. Knowing what has been discussed from a big picture perspective on network news recently could allow financial advisors the opportunity to address something that could be front of mind for their clients before the client even mentions it, which will serve to further solidify the relationship and position the advisor as the must trusted source of investment and financial information.