No one has a crystal ball to know where the markets are headed. There are educated guesses and projections based on an immense amount of research, but no one could be certain where the markets are going to move by the end of 2021, especially after the tumultuous year we had in 2020. Investor attitudes can often drive the stock market, with optimism and desire to invest driving increases in the market. Investor fear and selling can also have the opposite effect and drop stock prices.

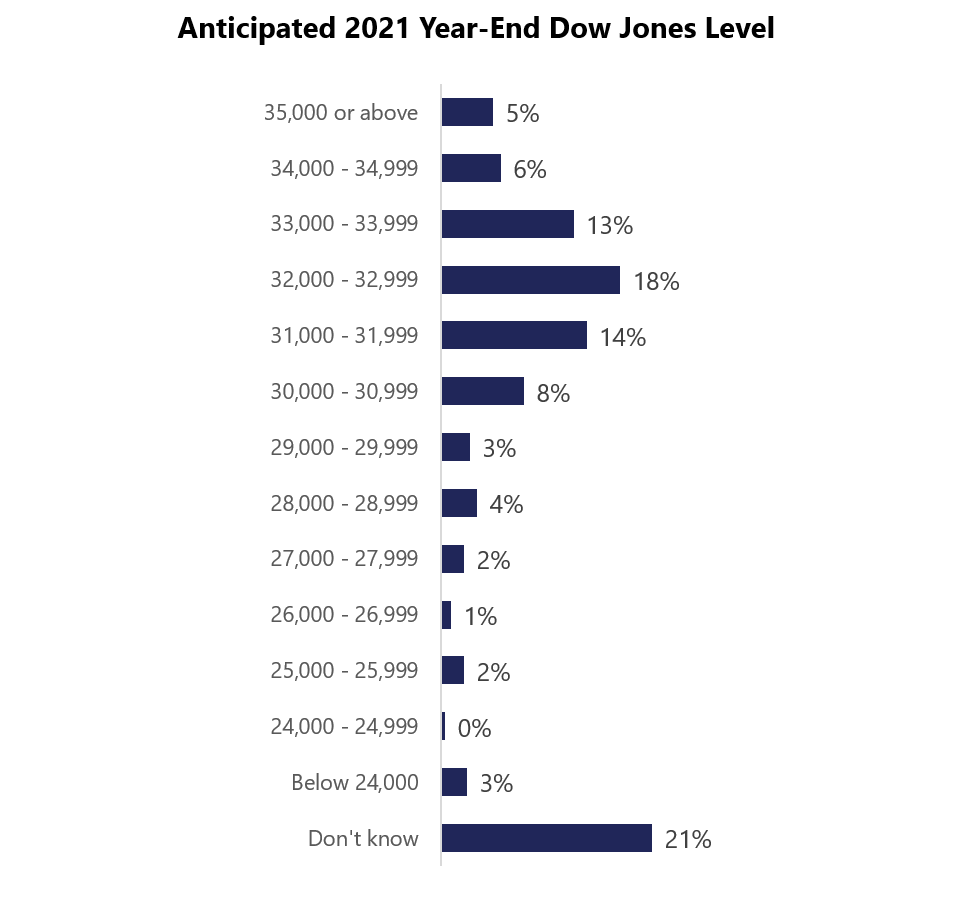

When Spectrem Group asked wealthy investors where the DOW will be at the end of 2021 the results were very mixed. Twenty-one percent of investors did not even want to take a guess and simply indicated that they don’t know. Eleven percent of investors believe the DOW will be at 34,000 or more at the end of 2021. A similar percentage, 12 percent, believe the DOW will end the year below 29,000. Another 11 percent think the end of 2021 will bring a DOW value between 29,000-31,000.

The most popular answer among wealthy investors for where the DOW will end 2021 is between 32,000-32,999. This is very interesting considering the DOW has been over 33,000 since April 1st, 2021. Of course it is possible for the market to decline and end up below 33,000 or even lower, but it is also possible that it could end up somewhere between 33,000-33,999, which is where 13 percent of wealthy investors felt the DOW would end the year.

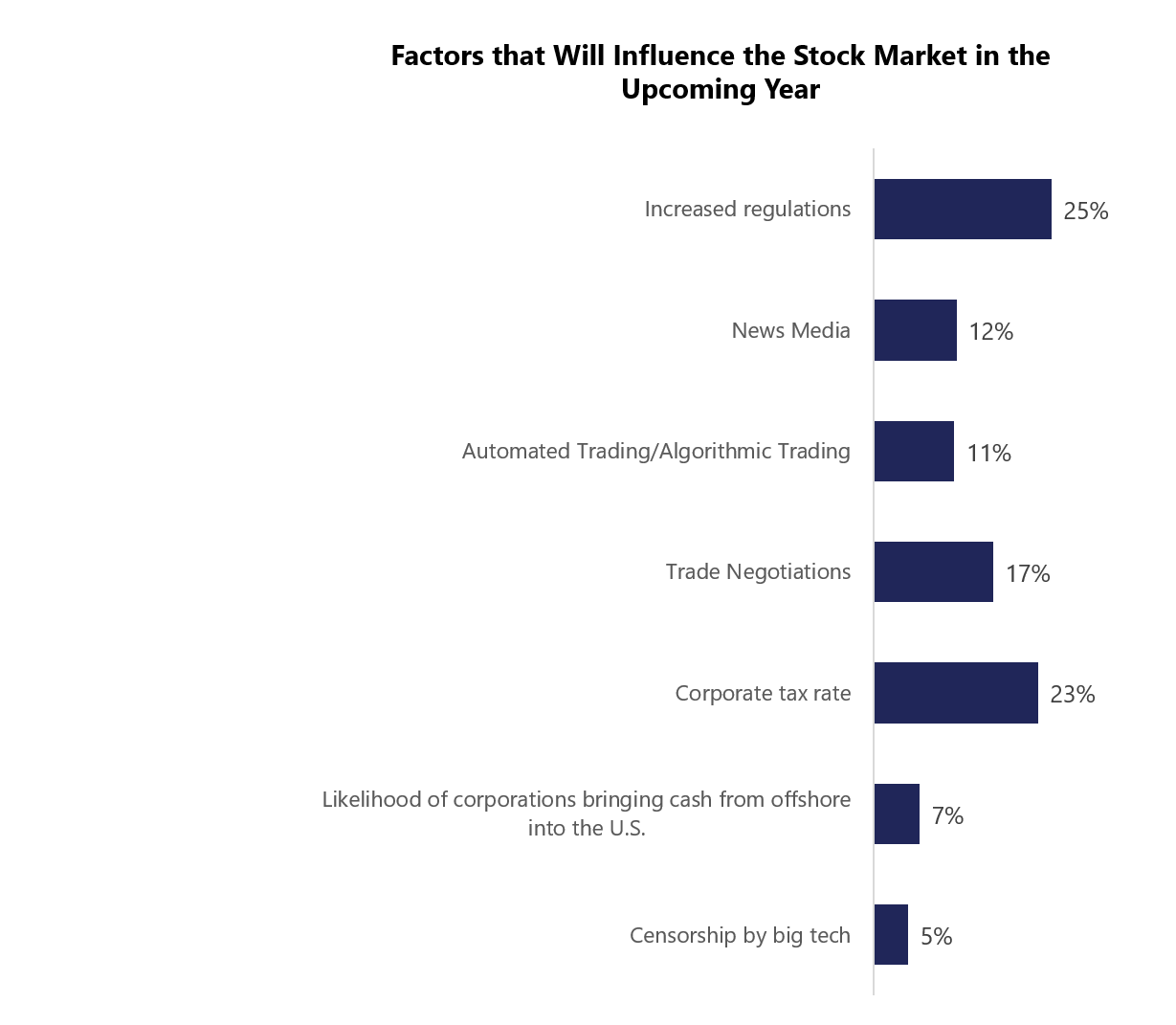

What are some of the factors that can determine where the DOW will end up? Beyond corporate earnings and other typically followed stock market indicators there are several other factors that can move the stock market. Twenty-five percent of investors feel that increased regulations will influence the stock market in 2021. Twenty-three percent feel that corporate tax rates will be a factor that influences the market in 2021. Trade negotiations are viewed as a factor influencing the stock market for 17 percent of wealthy investors.

It is impossible to ignore two factors that are seen often, news media and automated trading/algorithmic trading. Twelve percent of wealthy investors feel that the news media will influence the market, while 11 percent believe automated trading/algorithmic trading will influence the stock market throughout 2021.

Much of what could be driving investors predictions about where the DOW will end 2021 could be based on how they feel about stock market results. Investors were asked to rate the rationality of stock market results on a 0-100 scale, with 0 being irrational and 100 being rational. In 2020 they gave a rating of 53.76, but in 2021 they dipped just below 50 with a rating of 49.81. Investors have also become more pessimistic about stock market returns. In 2019, 38 percent of investors felt the stock market returns will be better in 2019 than 2018. That percentage decreased to 32 percent who felt the returns would be better in 2020 than 2019. It dropped even lower in 2021 to 30 percent who felt the stock market returns will be better this year than last.

Only time will tell what predictions will be correct at the end of 2021.