Investors who have in excess of $25 million in net worth could afford to help their children with a wide variety of expenses as they are growing up, but just because they can doesn’t mean that they do. These children can often have lifestyles that are very comfortable and they are accustomed to a certain quality of life. Do these wealthiest Americans feel that they should pay for their children’s first car, first home, college or graduate school?

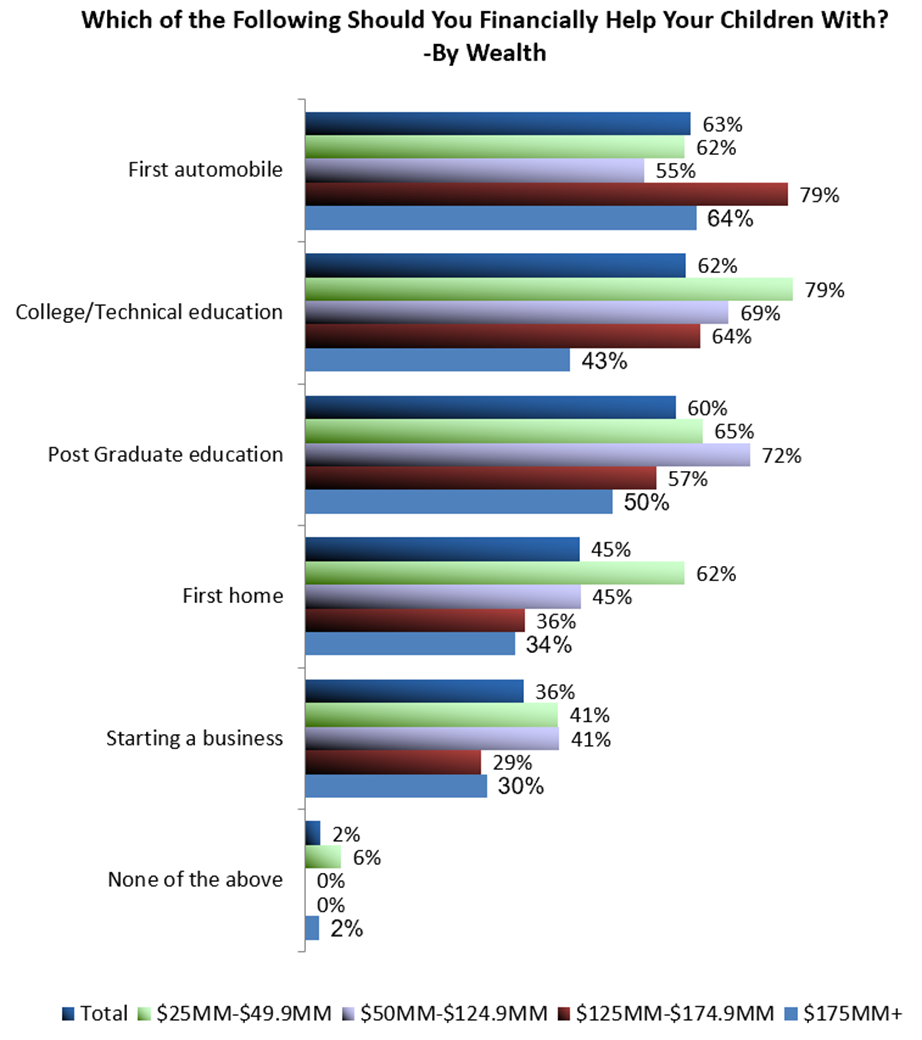

Despite the likely ability of these wealthy investors being able to afford these expenses, only 63 percent believe they should financially help their children with their first car. Slightly less, 62 percent, feel they should provide help to their children with college or technical education. Forty-five percent of the wealthiest Americans feel they should help their children with their first home. Younger investors with over $25 million in net worth are more likely to feel they should help their kids with their first car, but far less likely to feel they should help with college, graduate school, a first home, or starting a business.

Looking at the very highest levels of wealth, those investors with a net worth above $175 million, only 64 percent believe you should help your children with their first automobile. Fifty percent feel they should help their children with post graduate education while only 43 percent believe their children should have help with college or technical education costs.

Why could these wealthiest Americans choose to have their children pay for things themselves? Seventy-two percent of investors with over $25 million in net worth are concerned about the next generation being wasteful with the money that they pass on. That percentage increases to 85 percent for those investors with a net worth above $175 million. Concern regarding wasteful habits can be a strong motivator for these investors to ensure their children are financially grounded and fiscally responsible. A financial professional can be an excellent resource for education on financial topics.

These wealthiest Americans feel that it is important their children should meet their financial advisors, and they want that introduction to occur when their children are young. Fifty-nine percent of investors with over $25 million in net worth want their children to be introduced to their financial advisor by the time their children are 25 years old. During these introductions and subsequent meetings, it is beneficial for a financial advisor to provide education, both general financial education as well as education about their financial situation.

The wealthiest Americans feel that the best method for an advisor to use to educate their children or grandchildren on their financial situation is through a meeting one-on-one with the advisor. The advisor providing them with materials to study on their own and simply meeting them to ascertain how best to help them are the second and third most preferred method of educating children or grandchildren of the wealthiest Americans. The advisor meeting with them and educating them has the potential to help these potential inheritors of wealth from being wasteful with their inheritance.

Related: How Young is Too Young to Have a Financial Advisor?