While legislative changes are difficult to predict one of the most likely changes in the next few years will be an increase in the federal estate tax laws. These changes are seen as one of the ways to “tax the 1%” as well as one method to reduce the looming national debt. Are wealthy investors ready for these changes and are they worried about the impact of these new taxes?

In research recently conducted with investors with more than $25 million of net worth (not including the value of their primary residence), 72% of investors indicated that they are worried about potential estate tax increases. This is in addition to concerns over federal income tax increases (74%) and state income tax increases (73%). At the current time the specific legislative changes are unclear, however, current proposals would reduce the current estate tax exemption from $10 million ($11.7 million in 2021 after adjustments for inflation) to $3.5 million (not adjusted for inflation). Additionally, the transfers in excess of the exemption amount would be taxed at progressive rates rather than at the current flat rate of 40%.

https://www.jdsupra.com/legalnews/proposed-gift-and-estate-tax-changes-3117008/

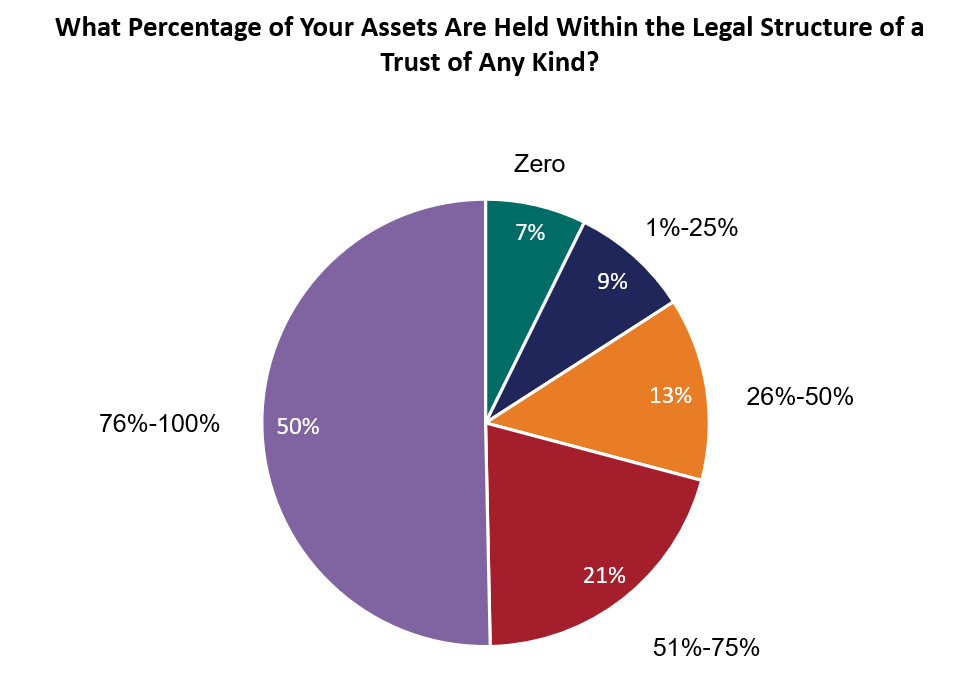

But the wealthiest of investors seem well prepared to transfer their assets to the next generation if they can rely on some of the existing estate planning tools. If the laws should change dramatically this could change the existing plans. Most investors with more than $25 million of net worth hold some or all of their assets within the legal structure of a trust. More than three-quarters of these households hold half of their assets in the structure of a trust. In fact, the average number of trusts owned by these households is 3.5.

While the wealthiest households generally have completed appropriate estate planning – at least based upon the existing rules, those with lower levels of net worth are not quite as well-prepared. Because of the current exemptions, those with lower levels of net worth have not necessarily placed their assets into trust.

How can financial advisors and providers assist their clients with estate tax changes?

Keep your clients informed regarding the changes. While many of your clients may currently have assets in trust, they need to reassess whether more of their assets need to be placed into trust. Additionally, should changes to the provisions of their trusts be required, they will be relying upon their advisors to act appropriately.

Approach clients that may not currently have assets placed in trust. With exemption levels changing dramatically many investors who did not have to worry about the estate tax in the past will now be subject to the new rules. It’s time to proactively ensure that they are protected to the extent possible.

As the new administration continues to propose legislative changes, financial advisors and providers need to stay informed and assist their clients through any potential changes.

Related: Does Wealth Equal Happiness?