Placing assets into the legal structure of a trust is something that wealthy investors chose to do for a variety of reasons. The ability to very specifically dictate how assets are to be distributed as well as estate and inheritance tax savings are often common reasons. Other wealthy investors create a trust in order to avoid probate or even to account for a beneficiary with special needs. Many other reasons for trust creation exist however there is a common element of trust development that most investors who utilize a trust encounter: who is going to be the trustee on the trust.

Two major types of trustees are either a corporate trustee or an individual trustee. Corporate trustees can be a bank trust department, an attorney, an independent trust company or a private bank, to name a few. According to research from Spectrem Group, less than 10 percent of investors utilize a corporate trustee. That percentage increases significantly when looking at investors with at least $25 million in net worth, not including their primary residence. These investors are likely to have at least 3 trusts that they use to manage their assets. That allows for a larger variety of corporate trustees to be used. Among those investors with $25 million plus in net worth, 21 percent have an attorney that acts as a trustee, 18 percent have a financial institution that acts as a trustee, and nine percent use an Accountant as a trustee. Investors below $25 million in net worth are most likely to use an attorney or bank trust department if they decide to utilize a corporate trustee.

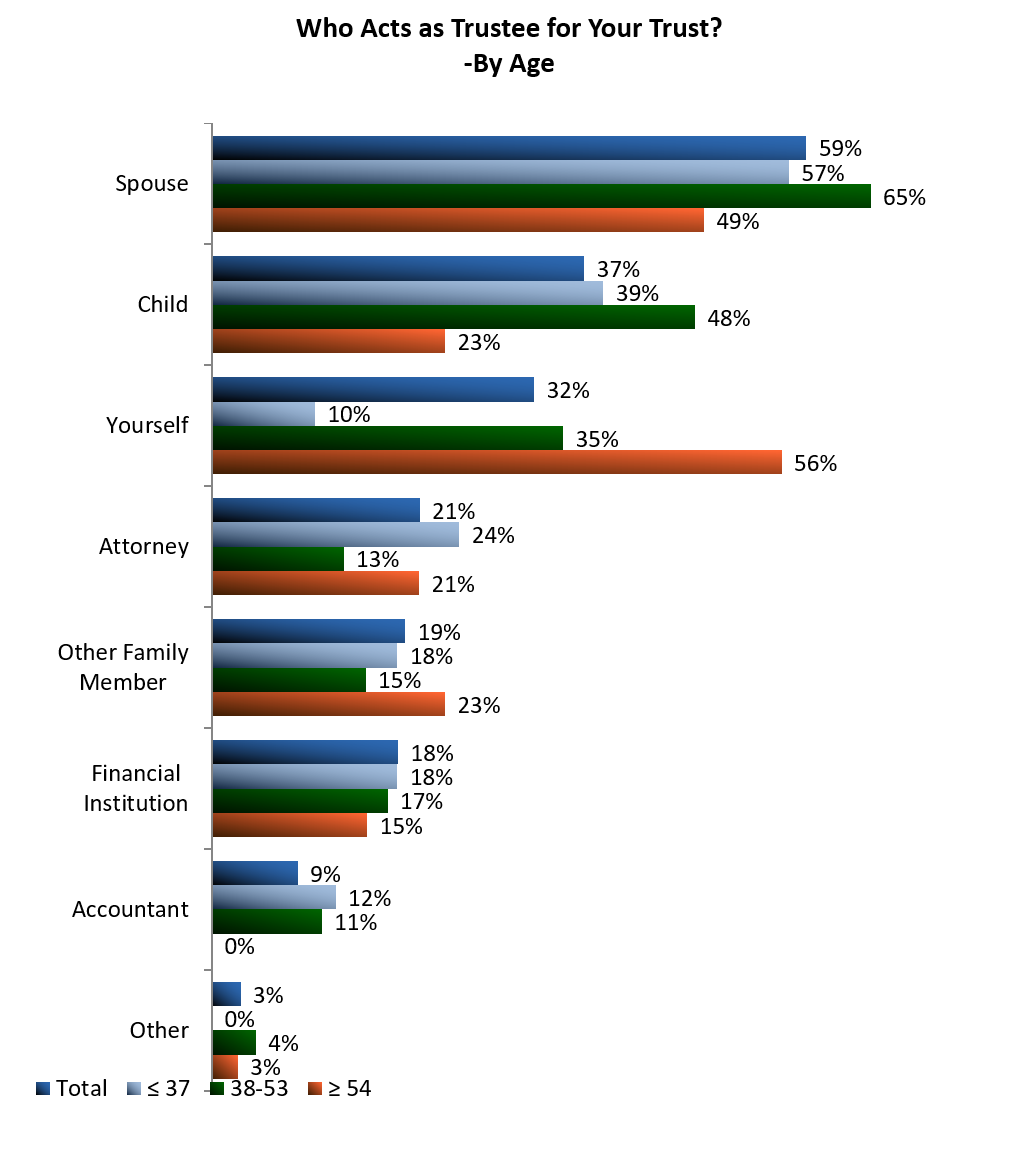

Far more common of a selection for a trustee is themselves, a spouse, or family member. Among investors with over $25 million in net worth, a spouse or a child is the most common trustee. Younger $25 million plus investors are more likely to use an Accountant or attorney, and the same holds true for investors with a net worth in excess of $125 million. Successor trustees are most commonly a spouse or child. Another successor trustee type that 16 percent of $25 million plus investors utilize is another family member.

Why do wealthy investors decide to not use a corporate trustee? Twenty-seven percent of UHNW investors, those investors with a net worth between $5 million-$25 million feel that a corporate trustee is too expensive. Thirty-one percent of those same investors indicate that their primary advisor suggested that the investor self-trustee. Individuals at lower levels of wealth are more likely to have chosen to self-trustee because they do not know where to start with a corporate trustee, or they felt they were not wealthy enough to use a corporate trustee. In fact, these investors are less likely to even have their assets held in the legal structure of a trust, with only 24 percent of investors with $25 million in net worth or less having assets in the legal structure of a trust. Among $25 million plus investors, 71 percent have over half of their assets held within the legal structure of a trust.

Trust utilization can be a very effective method of avoiding taxes, probate, and ensuring assets are distributed according to an investor’s wishes. These trusts are fully effective only if the trustee knows what needs to be done and properly executes the trust, making the selection of a trustee a decision that should not be taken lightly.